Answered step by step

Verified Expert Solution

Question

1 Approved Answer

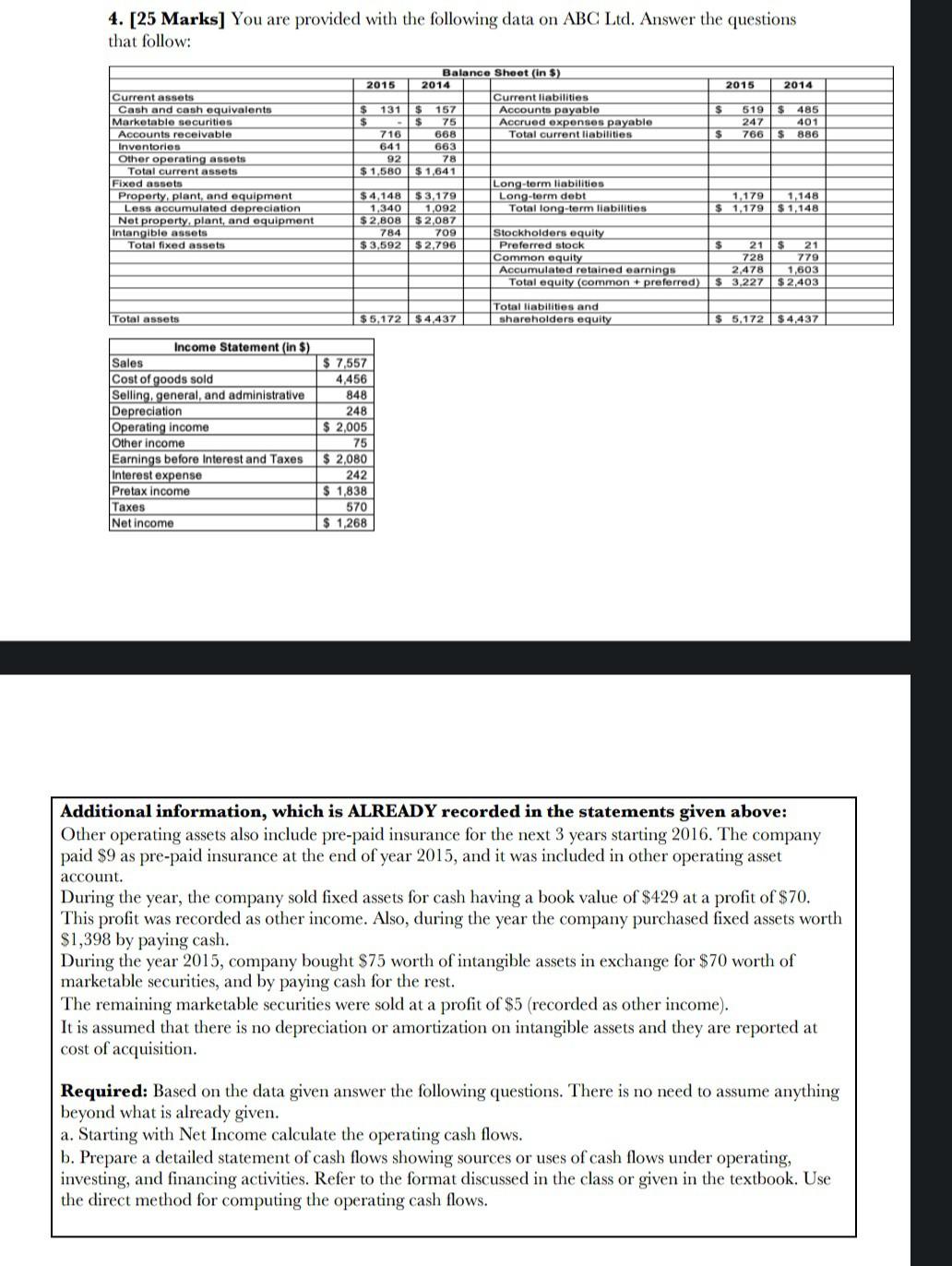

4. [25 Marks] You are provided with the following data on ABC Ltd. Answer the questions that follow: Balance Sheet (in $) 2015 2014

4. [25 Marks] You are provided with the following data on ABC Ltd. Answer the questions that follow: Balance Sheet (in $) 2015 2014 2015 2014 Current assets Current liabilities Cash and cash equivalents $ 131 $ 157 Accounts payable $ 519 $ 485 Marketable securities $ $ Accounts receivable 716 Inventories 641 Other operating assets 92 75 668 663 78 Accrued expenses payable Total current liabilities $ 247 766 401 $ 886 Total current assets $1,580 $1,641 Fixed assets Long-term liabilities Property, plant, and equipment Less accumulated depreciation $4,148 1,340 $3,179 Long-term debt Net property, plant, and equipment $2,808 1,092 $2,087 Total long-term liabilities $ 1,179 1,179 1,148 $1,148 Intangible assets 784 Total fixed assets $3,592 709 $2,796 Stockholders equity Preferred stock $ Common equity Accumulated retained earnings 21 728 2,478 $ 21 779 1,603 Total equity (common+preferred) $ 3,227 $ 2,403 Total liabilities and Total assets $5,172 $4,437 shareholders equity $ 5,172 $4,437 Income Statement (in $) Sales $ 7,557 Cost of goods sold 4,456 Selling, general, and administrative 848 Depreciation 248 Operating income $ 2,005 Other income 75 Earnings before Interest and Taxes Interest expense $ 2,080 Pretax income 242 $ 1,838 Taxes Net income 570 $1,268 Additional information, which is ALREADY recorded in the statements given above: Other operating assets also include pre-paid insurance for the next 3 years starting 2016. The company paid $9 as pre-paid insurance at the end of year 2015, and it was included in other operating asset account. During the year, the company sold fixed assets for cash having a book value of $429 at a profit of $70. This profit was recorded as other income. Also, during the year the company purchased fixed assets worth $1,398 by paying cash. During the year 2015, company bought $75 worth of intangible assets in exchange for $70 worth of marketable securities, and by paying cash for the rest. The remaining marketable securities were sold at a profit of $5 (recorded as other income). It is assumed that there is no depreciation or amortization on intangible assets and they are reported at cost of acquisition. Required: Based on the data given answer the following questions. There is no need to assume anything beyond what is already given. a. Starting with Net Income calculate the operating cash flows. b. Prepare a detailed statement of cash flows showing sources or uses of cash flows under operating, investing, and financing activities. Refer to the format discussed in the class or given in the textbook. Use the direct method for computing the operating cash flows.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Starting with Net Income calculate the operating cash flows Net Income 1268 To calculate operating cash flows using the direct method we need to adj...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started