Answered step by step

Verified Expert Solution

Question

1 Approved Answer

4. (25) One of the key provisions of the Affordable Care Act was the ensuring coverage for pre- existing conditions, which had formerly been

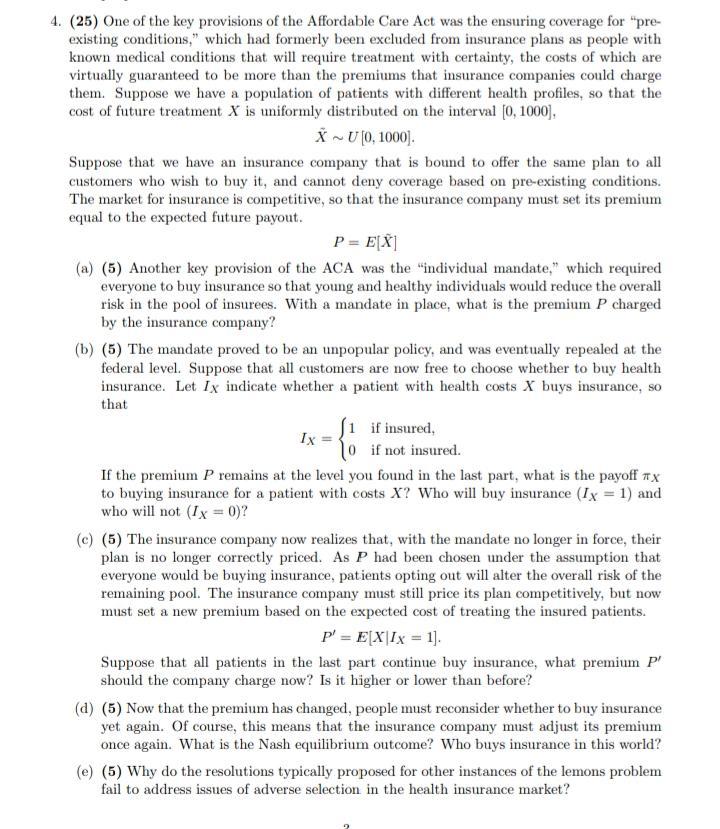

4. (25) One of the key provisions of the Affordable Care Act was the ensuring coverage for "pre- existing conditions," which had formerly been excluded from insurance plans as people with known medical conditions that will require treatment with certainty, the costs of which are virtually guaranteed to be more than the premiums that insurance companies could charge them. Suppose we have a population of patients with different health profiles, so that the cost of future treatment X is uniformly distributed on the interval [0, 1000], X~ U[0, 1000]. Suppose that we have an insurance company that is bound to offer the same plan to all customers who wish to buy it, and cannot deny coverage based on pre-existing conditions. The market for insurance is competitive, so that the insurance company must set its premium equal to the expected future payout. P = E[X] (a) (5) Another key provision of the ACA was the "individual mandate," which required everyone to buy insurance so that young and healthy individuals would reduce the overall risk in the pool of insurees. With a mandate in place, what is the premium P charged by the insurance company? (b) (5) The mandate proved to be an unpopular policy, and was eventually repealed at the federal level. Suppose that all customers are now free to choose whether to buy health insurance. Let Ix indicate whether a patient with health costs X buys insurance, so that 1 if insured, Ix = 10 if not insured. If the premium P remains at the level you found in the last part, what is the payoff #x to buying insurance for a patient with costs X? Who will buy insurance (Ix = 1) and who will not (Ix = 0)? (c) (5) The insurance company now realizes that, with the mandate no longer in force, their plan is no longer correctly priced. As P had been chosen under the assumption that everyone would be buying insurance, patients opting out will alter the overall risk of the remaining pool. The insurance company must still price its plan competitively, but now must set a new premium based on the expected cost of treating the insured patients. P' = E[X|Ix = 1]. Suppose that all patients in the last part continue buy insurance, what premium P should the company charge now? Is it higher or lower than before? (d) (5) Now that the premium has changed, people must reconsider whether to buy insurance yet again. Of course, this means that the insurance company must adjust its premium once again. What is the Nash equilibrium outcome? Who buys insurance in this world? (e) (5) Why do the resolutions typically proposed for other instances of the lemons problem fail to address issues of adverse selection in the health insurance market?

Step by Step Solution

★★★★★

3.34 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Solution 1 Individual mandate Health insurance reforms Essential health benefits Affordable ins...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started