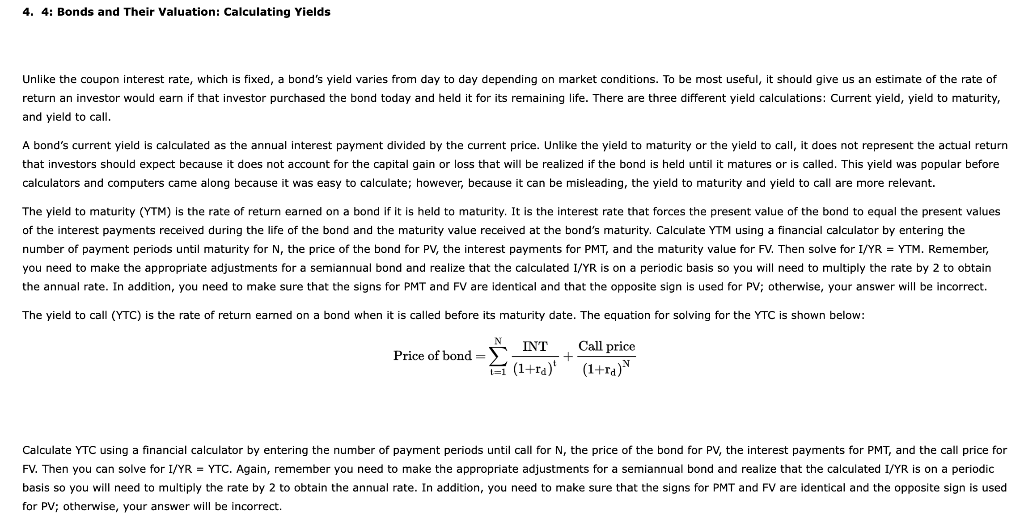

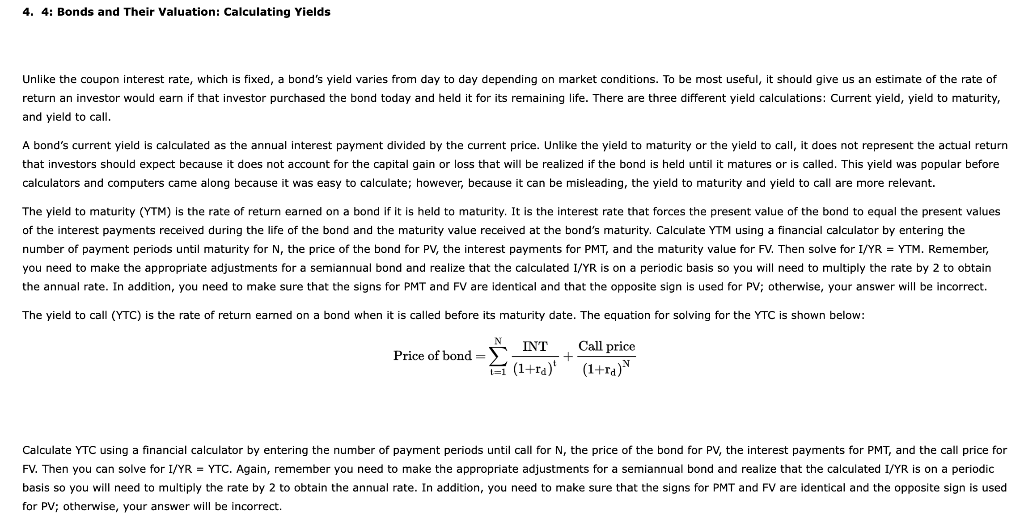

4. 4: Bonds and Their Valuation: Calculating Yields Unlike the coupon interest rate, which is fixed, a bond's yield varies from day to day depending on market conditions. To be most useful, it should give us an estimate of the rate of return an investor would earn if that investor purchased the bond today and held it for its remaining life. There are three different yield calculations: Current yield, yield to maturity, and yield to call. A bond's current yield is calculated as the annual interest payment divided by the current price. Unlike the yield to maturity or the yield to call, it does not represent the actual return that investors should expect because it does not account for the capital gain or loss that will be realized if the bond is held until it matures or is called. This yield was popular before calculators and computers came along because it was easy to calculate; however, because it can be misleading, the yield to maturity and yield to call are more relevant. The yield to maturity (YTM) is the rate of return earned on a bond if it is held to maturity. It is the interest rate that forces the present value of the bond to equal the present values of the interest payments received during the life of the bond and the maturity value received at the bond's maturity. Calculate YTM using a financial calculator by entering the number of payment periods until maturity for N, the price of the bond for PV, the interest payments for PMT, and the maturity value for FV. Then solve for I/YR=YTM. Remember, you need to make the appropriate adjustments for a semiannual bond and realize that the calculated I/YR is on a periodic basis so you will need to multiply the rate by 2 to obtain the annual rate. In addition, you need to make sure that the signs for PMT and FV are identical and that the opposite sign is used for PV; otherwise, your answer will be incorrect. The yield to call (YTC) is the rate of return earned on a bond when it is called before its maturity date. The equation for solving for the YTC is shown below: Priceofbond=t=1N(1+rd)tINT+(1+rd)NCallprice Calculate YTC using a financial calculator by entering the number of payment periods until call for N, the price of the bond for PV, the interest payments for PMT, and the call price for FV. Then you can solve for I/YR= YTC. Again, remember you need to make the appropriate adjustments for a semiannual bond and realize that the calculated I/YR is on a periodic basis so you will need to multiply the rate by 2 to obtain the annual rate. In addition, you need to make sure that the signs for PMT and FV are identical and the opposite sign is used for PV; otherwise, your answer will be incorrect. A company is more likely to call its bonds if they are able to replace their current high-coupon debt with less expensive financing. A bond is more likely to be called if its price is par-because this means that the going market interest rate is less than its coupon rate. Quantitative Problem: Ace Products has a bond issue outstanding with 15 years remaining to maturity, a coupon rate of 9% with semiannual payments of $45, and a par value of $1,000. The price of each bond in the issue is $1,180.00. The bond issue is callable in 5 years at a call price of $1,090. What is the bond's current yield? Do not round intermediate calculations. Round your answer to two decimal places. % What is the bond's nominal annual yield to maturity (YTM)? Do not round intermediate calculations. Round your answer to two decimal places. % What is the bond's nominal annual yield to call (YTC)? Do not round intermediate calculations. Round your answer to two decimal places. % Assuming interest rates remain at current levels, will the bond issue be called? The firm call the bond