Answered step by step

Verified Expert Solution

Question

1 Approved Answer

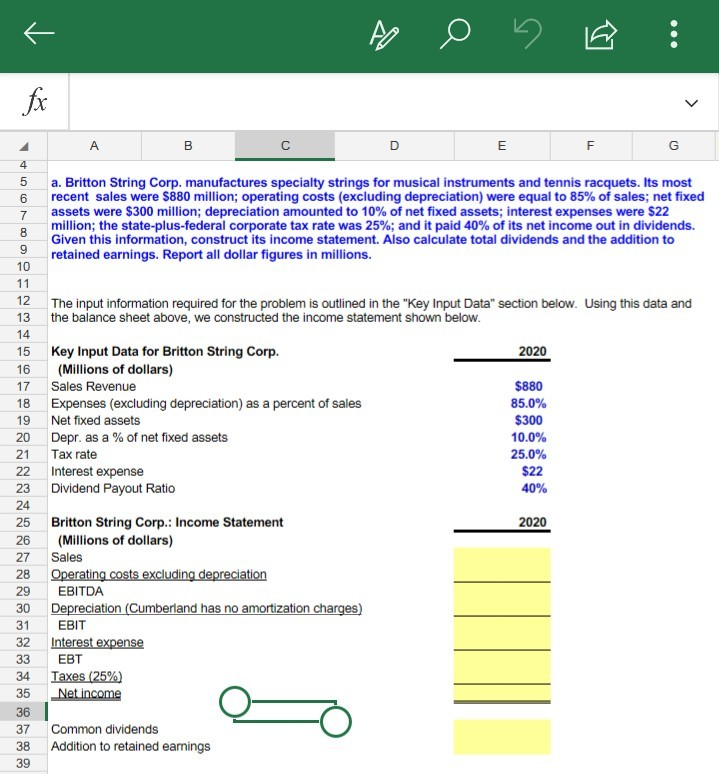

4 5 6 a. Britton String Corp. manufactures specialty strings for musical instruments and tennis racquets. Its most recent sales were $880 million; operating costs

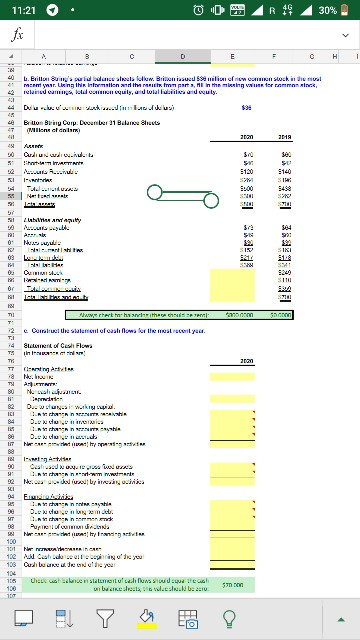

4 5 6 a. Britton String Corp. manufactures specialty strings for musical instruments and tennis racquets. Its most recent sales were $880 million; operating costs (excluding depreciation) were equal to 85% of sales: net fixed assets were $300 million; depreciation amounted to 10% of net fixed assets, interest expenses were $22 million; the state-plus-federal corporate tax rate was 25%; and it paid 40% of its net income out in dividends. Given this information, construct its income statement. Also calculate total dividends and the addition to retained earnings. Report all dollar figures in millions. 12 13 The input information required for the problem is outlined in the "Key Input Data" section below. Using this data and the balance sheet above, we constructed the income statement shown below 15 Key Input Data for Britton String Corp. 16 (Millions of dollars) 17 Sales Revenue 18 Expenses (excluding depreciation) as a percent of sales 19 Net fixed assets 20 Depr. as a % of net fixed assets 21 Tax rate 22 Interest expense 23 Dividend Payout Ratio 24 25 Britton String Corp. Income Statement 26 (Millions of dollars) 27 Sales 28 29 EBITDA 2020 85.0% $300 10.0% 25.0% $22 2020 Cumberland has no amortization 31 EBIT 33 EBT 34 37 Common dividends 38 Addition to retained eamings 39 11:21 518 530 20

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started