Answered step by step

Verified Expert Solution

Question

1 Approved Answer

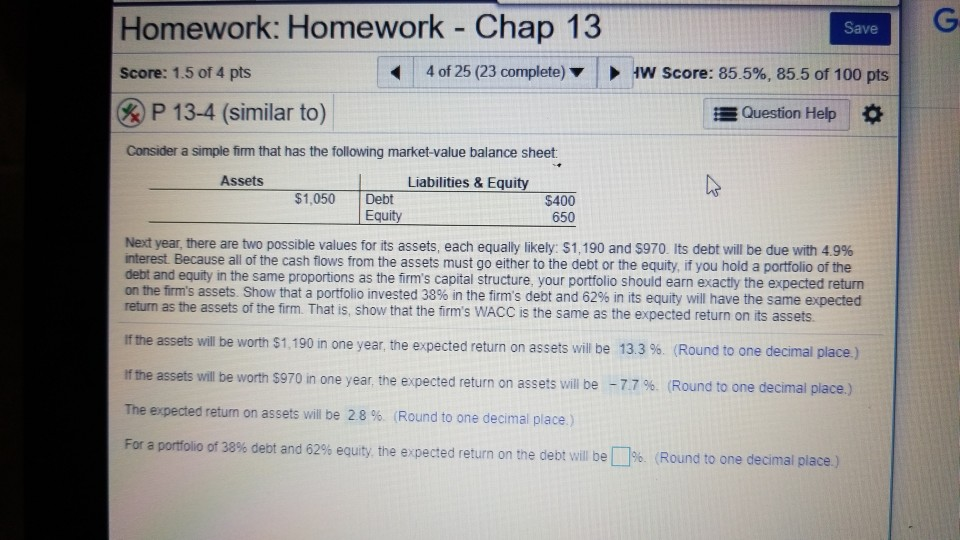

4. 5. 6. please answer this correctly I have only one attempt left. Homework: Homework - Chap 13 Save Score: 1.5 of 4 pts 4

4.

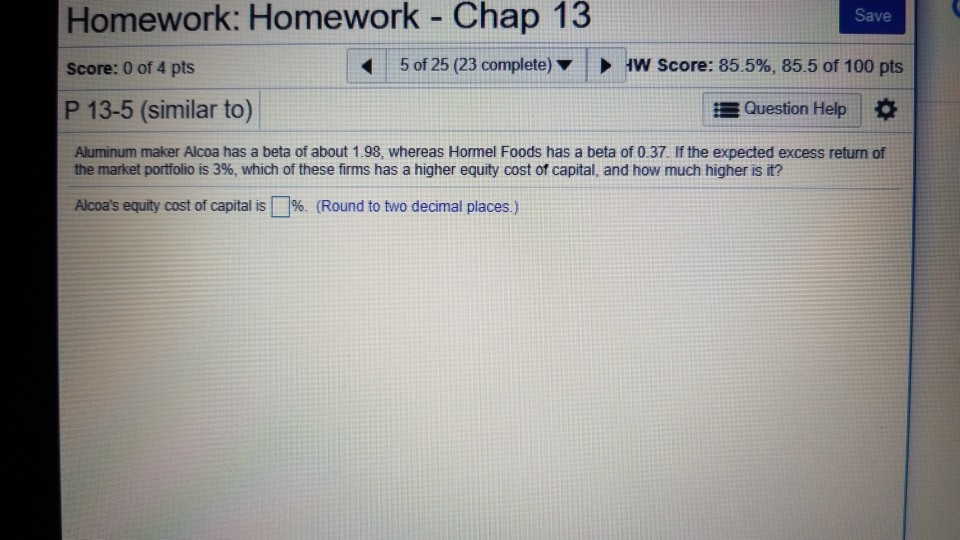

5.

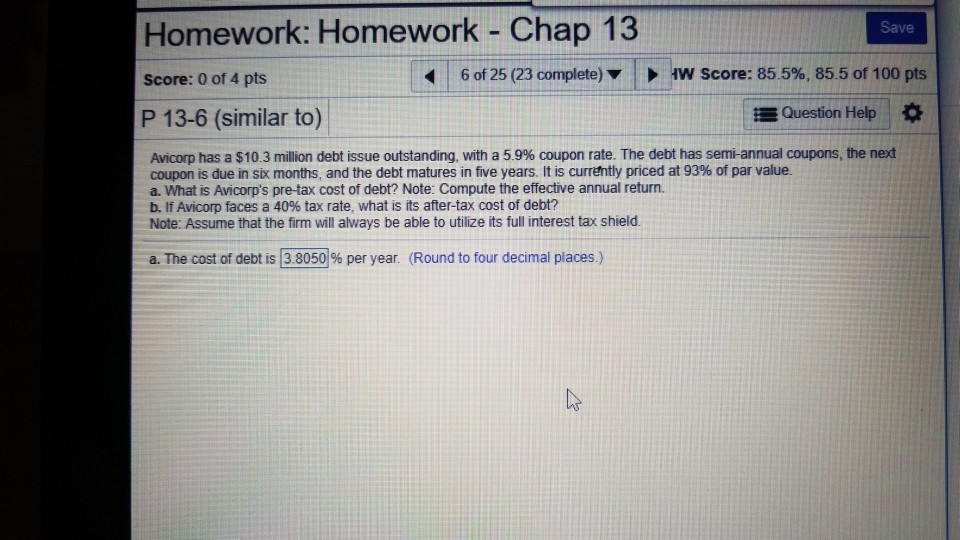

6.

please answer this correctly I have only one attempt left.

Homework: Homework - Chap 13 Save Score: 1.5 of 4 pts 4 of 25 (23 complete) Score: 85.5%, 85.5 of 100 pts & P 13-4 (similar to) Question Help & Consider a simple fim that has the following market-value balance sheet Assets Liabilities & Equity $1,050 Debt $400 650 Next year, there are two possible values for its assets, each equally likely. S 1.190 and S970 its debt will be due with 4.9% interest Because all of the cash flows from the assets must go either to the debt or the equity, if you hold a portfolio of the debt and equity in the same proportions as the firm's capital structure, your portfolio should earn exactly the expected return on the firms assets. Show that a portfolio invested 38% in the firm's debt and 62% in its equity will have the same expected return as the assets of the firm. That is, show that the firm's WACC is the same as the expected return on its assets. assets will be worth $1,190 in one year, the expected return on assets will be 13.3 %, (Round to one decimal place) If the The expected return on assets will be 28 %. (Round to one decimal place) For a portfolio of 38% debt and 62% equity the expected return on the debt will be assets will be worth $970 one year, the expected return on assets will be -7.7 %. Round to one decimal place.) % Round to one deci al place. Homework: Homework - Chap 13 Save Score: 0 of 4 pts 5 of 25 (23 complete) Score: 85.5%, 85.5 of 100 pts P 13-5 (similar to) Question Help * Aluminum maker Alcoa has a beta of about 1.98, whereas Hormel Foods has a beta of 0.37. If the expected excess return of the market portfolio is 396, which of these firms has a higher equity cost of capital, and how much higher is it? Alcoa's equity cost of capital is %. (Round to two decimal places) Homework: Homework - Chap 13 Save Score: 0 of 4 pts 6 of 25 (23 complete) | -|w score: 85.5%, 85.5 of 100 pts P 13-6 (similar to) Question Help * Ancorp has a $10.3 million debt issue outstanding, with a 5.9% coupon rate. The debt has semi-annual coupons the next coupon is due in six months, and the debt matures in five years. It is currently priced at 93% of par value. a. What is Avicorp's pre-tax cost of debt? Note: Compute the effective annual return. b. If Avicorp faces a 40% tax rate, what is its after-tax cost of debt? Note: Assume that the firm will always be able to utilize its full interest tax shield. a. The cost of debt is 3.8050% per year. (Round to four decimal places.) Homework: Homework - Chap 13 Save Score: 1.5 of 4 pts 4 of 25 (23 complete) Score: 85.5%, 85.5 of 100 pts & P 13-4 (similar to) Question Help & Consider a simple fim that has the following market-value balance sheet Assets Liabilities & Equity $1,050 Debt $400 650 Next year, there are two possible values for its assets, each equally likely. S 1.190 and S970 its debt will be due with 4.9% interest Because all of the cash flows from the assets must go either to the debt or the equity, if you hold a portfolio of the debt and equity in the same proportions as the firm's capital structure, your portfolio should earn exactly the expected return on the firms assets. Show that a portfolio invested 38% in the firm's debt and 62% in its equity will have the same expected return as the assets of the firm. That is, show that the firm's WACC is the same as the expected return on its assets. assets will be worth $1,190 in one year, the expected return on assets will be 13.3 %, (Round to one decimal place) If the The expected return on assets will be 28 %. (Round to one decimal place) For a portfolio of 38% debt and 62% equity the expected return on the debt will be assets will be worth $970 one year, the expected return on assets will be -7.7 %. Round to one decimal place.) % Round to one deci al place. Homework: Homework - Chap 13 Save Score: 0 of 4 pts 5 of 25 (23 complete) Score: 85.5%, 85.5 of 100 pts P 13-5 (similar to) Question Help * Aluminum maker Alcoa has a beta of about 1.98, whereas Hormel Foods has a beta of 0.37. If the expected excess return of the market portfolio is 396, which of these firms has a higher equity cost of capital, and how much higher is it? Alcoa's equity cost of capital is %. (Round to two decimal places) Homework: Homework - Chap 13 Save Score: 0 of 4 pts 6 of 25 (23 complete) | -|w score: 85.5%, 85.5 of 100 pts P 13-6 (similar to) Question Help * Ancorp has a $10.3 million debt issue outstanding, with a 5.9% coupon rate. The debt has semi-annual coupons the next coupon is due in six months, and the debt matures in five years. It is currently priced at 93% of par value. a. What is Avicorp's pre-tax cost of debt? Note: Compute the effective annual return. b. If Avicorp faces a 40% tax rate, what is its after-tax cost of debt? Note: Assume that the firm will always be able to utilize its full interest tax shield. a. The cost of debt is 3.8050% per year. (Round to four decimal places.)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started