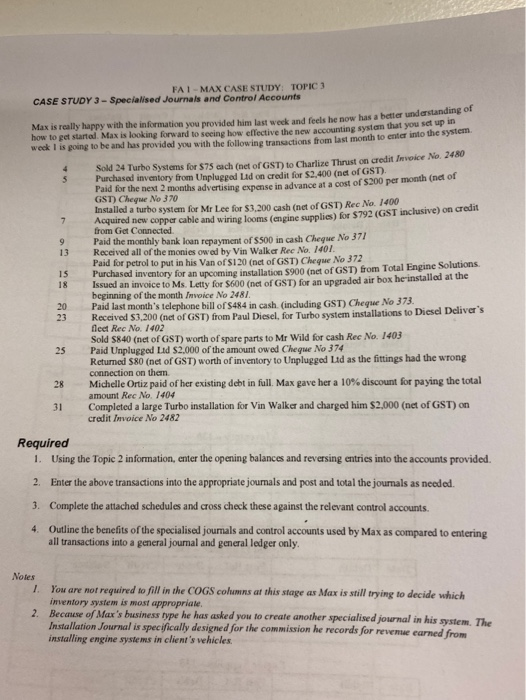

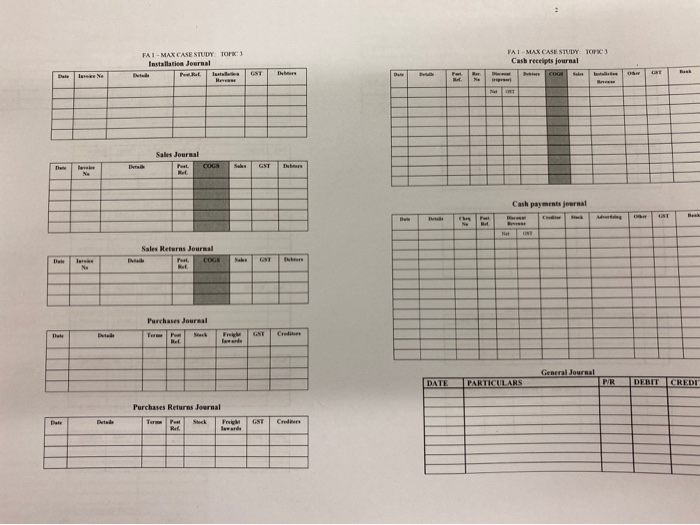

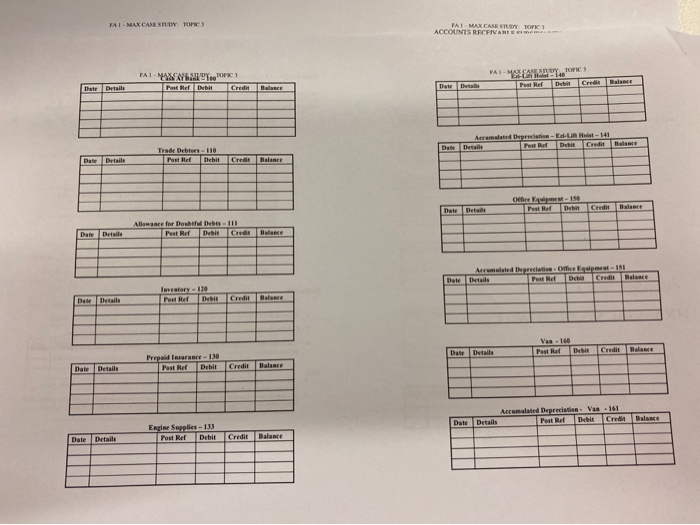

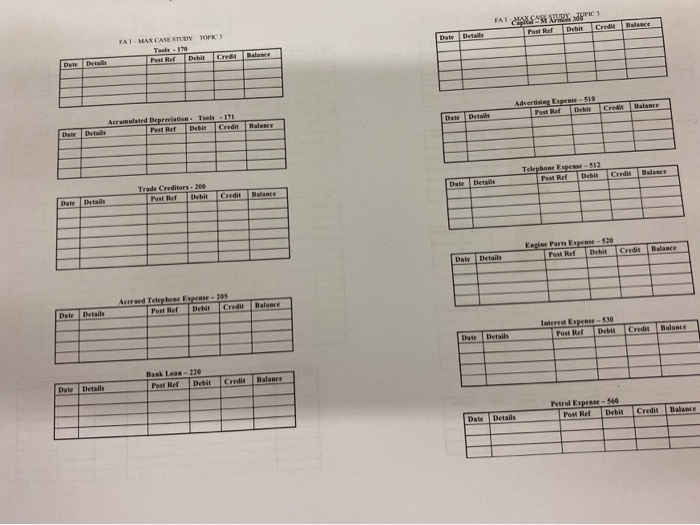

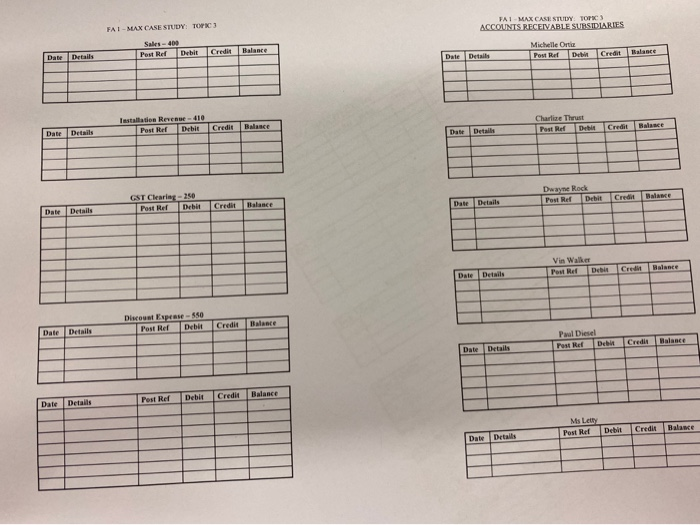

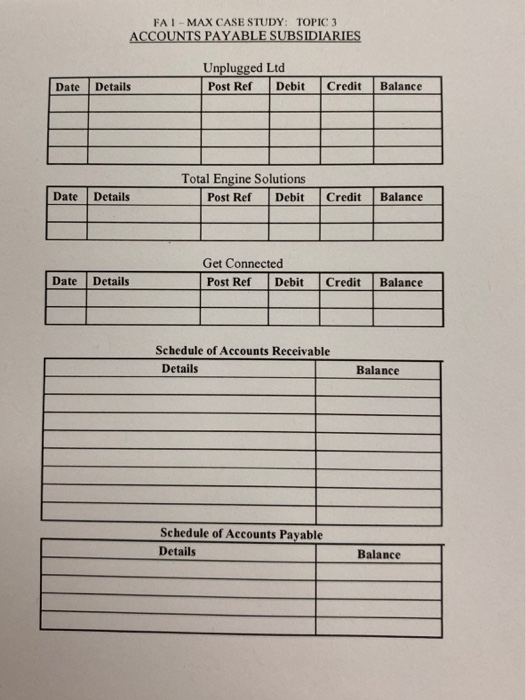

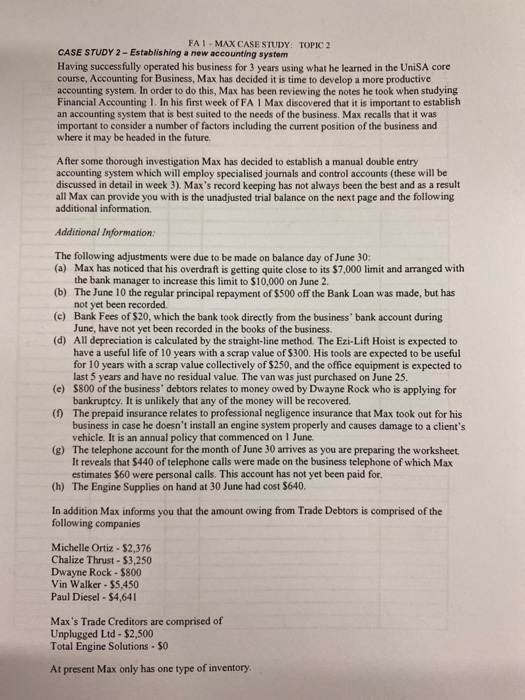

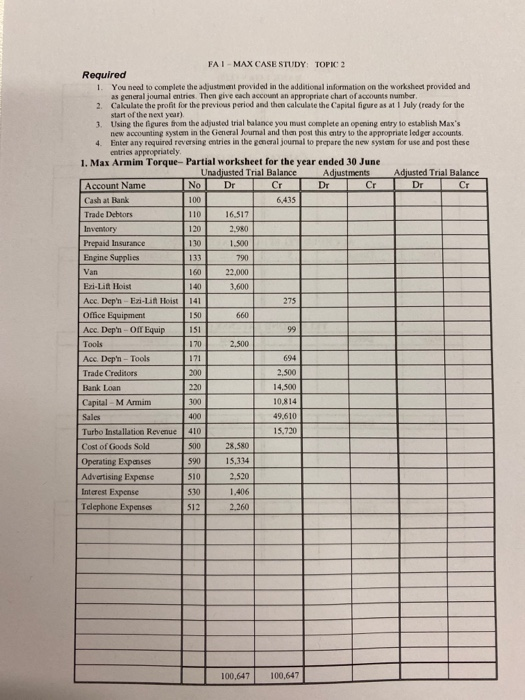

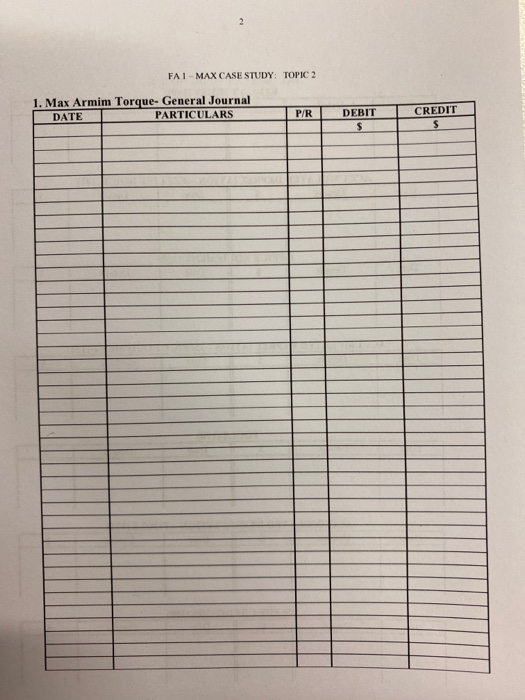

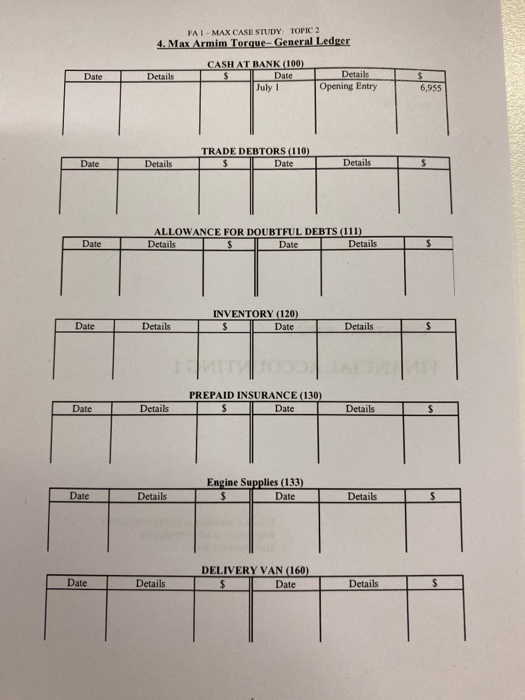

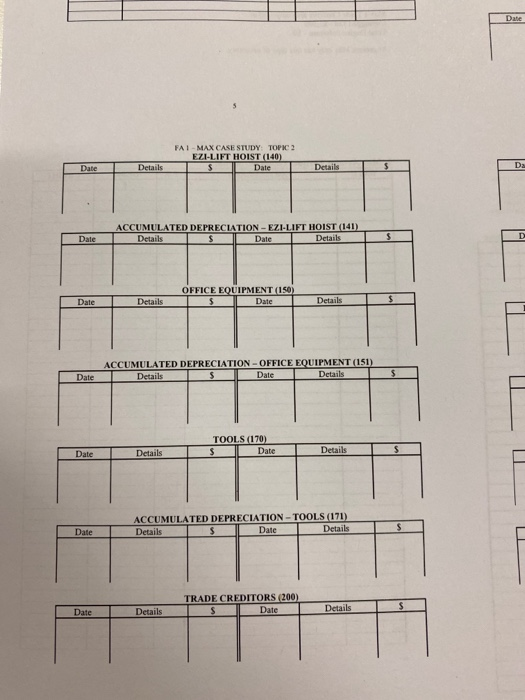

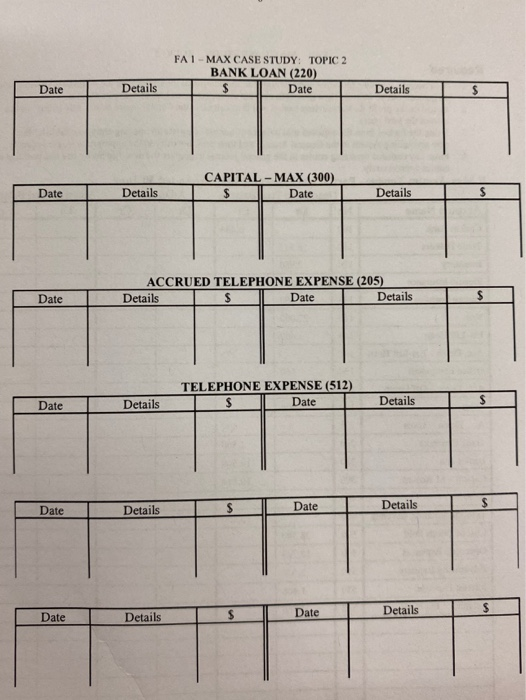

4 5 9 18 FAI-MAX CASE STUDY: TOPIC 3 CASE STUDY 3 - Specialised Journals and Control Accounts Max is really happy with the information you provided him last week and feels he now has a better understanding of how to get started. Max is looking forward to seeing how effective the new accounting system that you set up in week I is going to be and has provided you with the following transactions from last month to enter into the system. Sold 24 Turbo Systems for $75 cach (net of GST) to Charlize Thrust on credit Invoice No. 2480 Purchased inventory from Unplugged Lad on credit for $2,400 (net of GST). Paid for the next 2 months advertising expense in advance at a cost of $200 per month (net of GST) Cheque No 370 Installed a turbo system for Mr Lee for $3.200 cash (net of GST) Rec No. 1400 7 Acquired new copper cable and wiring looms (engine supplies) for $792 (GST inclusive) on credit from Get Connected Paid the monthly bank loan repayment of S500 in cash Cheque No 377 13 Received all of the monies owed by Vin Walker Rec No. 1401. Paid for petrol to put in his Van of S120 (net of GST) Cheque No 372 15 Purchased inventory for an upcoming installation $900 (net of GST) from Total Engine Solutions. Issued an invoice to Ms. Letty for $600 (net of GST) for an upgraded air box he installed at the beginning of the month Invoice No 2481. 20 Paid last month's telephone bill of $484 in cash. (including GST) Cheque No 373. 23 Received $3.200 (net of GST) from Paul Diesel, for Turbo system installations to Diesel Deliver's fleet Rec No. 1402 Sold 8840 (net of GST) worth of spare parts to Mr Wild for cash Rec No. 1403 Paid Unplugged Lad $2.000 of the amount owed Cheque No 374 Returned $80 (net of GST) worth of inventory to Unplugged Lid as the fittings had the wrong connection on them 28 Michelle Ortiz paid of her existing debt in full. Max gave her a 10% discount for paying the total amount Rec No. 1404 31 Completed a large Turbo installation for Vin Walker and charged him $2,000 (net of GST) on credit Invoice No 2482 Required 1. Using the Topic 2 information, enter the opening balances and reversing entries into the accounts provided. 2. Enter the above transactions into the appropriate journals and post and total the journals as needed. 3. Complete the attached schedules and cross check these against the relevant control accounts. 4. Outline the benefits of the specialised journals and control accounts used by Max as compared to entering all transactions into a general journal and general ledger only. 25 Notes 1 2. You are not required to fill in the COGS columns at this stage as Max is still trying to decide which imentory system is most appropriate Because of Max's business type he has asked you to create another specialised journal in his system. The Installation Journal is specifically designed for the commission he records for revenue earned from installing engine systems in client's vehicles, FAI-MAX CASE STUDY TOPIC Installaties Journal ht FAI-MAX CASE STUDY TOF Cash receipts journal ENT The Date lerne Bu Mar T! Sales Journal Pul. COKEN Nel Then GST Ne Cash payments journal Net LINE Sales Returns Journal Na Purchases Journal RF General Journal DATE PARTICULARS P/R DEBIT CREDI Purchases Returns Journal De Tere Crede Pest Rat FAI-MUX CASE STUDY TOPIC FATMAX CASE STUDY: TOPIC ACCOUNTS RECEIVARIE - FAI-MUAY TOP3 Post Ref Debit Credit FAI-MACAM STUDY TOPIC Foot Ref De Cr Date Details BE Date the Amated Depreciation - Holst-141 Dette Pour DENE Credit Balance Da Trade Deblers-110 Post Het Debit Date Details Credit Balance Office E-150 Post Ref De Det Credit Balance Allousare for Doubt Debts-III Pester Debit Date Details Accumulated plate.me Lepot - 181 Postel Det Credit Walace Dale Imetry-120 Power Debi Da Credit Vas - 160 Pest Det Date Prepaid lurance - 130 Post Ref Debil Date Balance Details Credit Accumulated Depreciaties. Vas - 161 Post Ref Debit Credit Date Details Eepine Supplies - 133 Post Ref Debit Details Date Credit Balance TA MAXSAM PPC 3 Post Debit Credit Date Details FAL MAX CASE STUDY TOP3 Tools - 170 Pest Rer Debit Cred Balance Date Advertising Expense - $10 Post Red De Credit Balance Date Details Accumulated Depreciation Tools - 171 Pest Raf Debi Credit Balsace Date Telephone Expe- $12 Pest Red Debit Credit Details Trade Creditors - 200 Post Her Credit Balance Date Details Eagle Parts Espase-520 Pest Rel Bethit Credit Balance Date Details Allereed Telephe Epos - 204 Post Bar Debit Credit Date Details Interest Expense - 530 Post Ref Debit Credit Date Details Back Less - 720 Post Ref Dehit Credit Balance Date Details Petrol Expose-560 Post Ref Debit Credit Balance Date Details FAL MAX CASE STUDY: TOP3 ACCOUNTS RECEIVABLE SUBSIDIARIES FAI-MAX CASE STUDY TOP3 Sales 400 Post Red Debit Credit Balance Michelle Orte Powe De Date Balance Details Date Credit Installation Revenue - 410 Post For Debit Credit Balas Charlize Thrust Post Ref Credit Bebe Balance Details Date Details Dwayne Rock Post Rel Debit Crran GST Clearing-250 Post Red Debat Walane Credit Date Details Date Details Vin Walker Pew Ref Debit Credit Balance Date Details Discount Expres - 550 Post Ref Debit Credit Date Details Paul Diesel Post Ref Debu Date Details Debit Credit Balance Pest Red Date Details Ms Letty Pest Ref Debit Credit Balance Date Details FAI-MAX CASE STUDY: TOPIC 3 ACCOUNTS PAYABLE SUBSIDIARIES Unplugged Ltd Post Ref Debit Date Details Credit Balance Total Engine Solutions Post Ref Debit Date Details Credit Balance Get Connected Post Ref Debit Date Details Credit Balance Schedule of Accounts Receivable Details Balance Schedule of Accounts Payable Details Balance FAI-MAX CASE STUDY: TOPIC 2 CASE STUDY 2 - Establishing a new accounting system Having successfully operated his business for 3 years using what he leared in the UniSA core course, Accounting for Business, Max has decided it is time to develop a more productive accounting system. In order to do this, Max has been reviewing the notes he took when studying Financial Accounting 1. In his first week of FA 1 Max discovered that it is important to establish an accounting system that is best suited to the needs of the business. Max recalls that it was important to consider a number of factors including the current position of the business and where it may be headed in the future. After some thorough investigation Max has decided to establish a manual double entry accounting system which will employ specialised journals and control accounts (these will be discussed in detail in week 3). Max's record keeping has not always been the best and as a result all Max can provide you with is the unadjusted trial balance on the next page and the following additional information Additional Information: The following adjustments were due to be made on balance day of June 30: (a) Max has noticed that his overdraft is getting quite close to its $7,000 limit and arranged with the bank manager to increase this limit to $10,000 on June 2. (b) The June 10 the regular principal repayment of $500 off the Bank Loan was made, but has not yet been recorded. (c) Bank Fees of $20, which the bank took directly from the business' bank account during June, have not yet been recorded in the books of the business. (d) All depreciation is calculated by the straight-line method. The Ezi-Lift Hoist is expected to have a useful life of 10 years with a scrap value of $300. His tools are expected to be useful for 10 years with a scrap value collectively of $250, and the office equipment is expected to last 5 years and have no residual value. The van was just purchased on June 25. (e) $800 of the business' debtors relates to money owed by Dwayne Rock who is applying for bankruptcy. It is unlikely that any of the money will be recovered. (1) The prepaid insurance relates to professional negligence insurance that Max took out for his business in case he doesn't install an engine system properly and causes damage to a client's vehicle. It is an annual policy that commenced on 1 June (g) The telephone account for the month of June 30 arrives as you are preparing the worksheet. It reveals that $440 of telephone calls were made on the business telephone of which Max estimates $60 were personal calls. This account has not yet been paid for. (h) The Engine Supplies on hand at 30 June had cost $640. In addition Max informs you that the amount owing from Trade Debtors is comprised of the following companies Michelle Ortiz - $2,376 Chalize Thrust - $3,250 Dwayne Rock - $800 Vin Walker - $5,450 Paul Diesel - $4,641 Max's Trade Creditors are comprised of Unplugged Ltd - $2,500 Total Engine Solutions - $0 At present Max only has one type of inventory. FAI-MAX CASE STUDYTOPIC 2 Required 1 You need to complete the adjustment provided in the additional information on the worksheet provided and as general journal entries. Then give each account an appropriate chart of accounts number Calculate the profit for the previous period and then calculate the Capital figure as at 1 July (ready for the start of the next year) 3. Using the figures from the adjusted trial balance you must complete an opening entry to establish Max's new accounting system in the General Journal and then post this entry to the appropriate ledger accounts. 4. Enter any required reversing entries in the general joumal to prepare the new system for use and post these entries appropriately 1. Max Armim Torque- Partial worksheet for the year ended 30 June Unadjusted Trial Balance Adjustments Adjusted Trial Balance Account Name No Dr Cr Dr Cr Dr Cr Cash at Bank 100 6,435 Trade Debtors 110 16.517 Inventory 130 2.980 Prepaid Insurance 130 1.500 Engine Supplies 133 790 Van 160 22.000 Exi-Lin Hoist 3,600 Acc. Dep'n - Ex-Lin Hoist 141 275 Office Equipment 150 660 Acc. Depin-Off Equip 151 99 Tools 170 2,500 Ace. Depin - Tools 171 694 Trade Creditors 200 2.500 Bank Loan 220 14,500 Capital - M Armim 10,814 Sales 400 49.610 Turbo Installation Revenue 410 15.720 Cost of Goods Sold 500 28.580 Operating Expenses 590 15,334 Advertising Expanse 510 2.520 Interest Expense 530 1,406 Telephone Expenses S12 2.260 100,647 100,647 2 FAI-MAX CASE STUDY: TOPIC 2 1. Max Armim Torque- General Journal DATE PARTICULARS P/R DEBIT $ CREDIT $ FAI-MAX CASE STUDY: TOPIC 2 4. Max Armim Torque-General Ledger Date Details CASH AT BANK (100) Date July 1 Details Opening Entry $ 6,955 TRADE DEBTORS (110) Date Date Details Details $ ALLOWANCE FOR DOUBTFUL DEBTS (111) Details Date Details Date $ INVENTORY (120) $ Date Details Date Details $ PREPAID INSURANCE (130) S Date Date Details Details $ Date Engine Supplies (133) $ Date Details Details $ DELIVERY VAN (160) $ Date Date Details Details $ Date FAI-MAX CASE STUDY TOPIC 2 EZI-LIFT HOIST (140) Date Da Date Details Details ACCUMULATED DEPRECIATION - EZI-LIFT HOIST (141) Details $ Date Details Date $ D OFFICE EQUIPMENT (150) Date Date Details Details $ ACCUMULATED DEPRECIATION - OFFICE EQUIPMENT (151) Details Date Details $ Date TOOLS (170) $ Date Date Details Details $ ACCUMULATED DEPRECIATION - TOOLS (171) Details Date Details $ Date TRADE CREDITORS (200) $ Date Date $ Details Details FAI-MAX CASE STUDY: TOPIC 2 BANK LOAN (220) Date Date Details Details $ CAPITAL - MAX (300) $ Date Date Details Details ACCRUED TELEPHONE EXPENSE (205) Details $ Date Details Date TELEPHONE EXPENSE (512) $ Date Details Date Details Details Date Date $ Details $ Date Details Details $ Date 4 5 9 18 FAI-MAX CASE STUDY: TOPIC 3 CASE STUDY 3 - Specialised Journals and Control Accounts Max is really happy with the information you provided him last week and feels he now has a better understanding of how to get started. Max is looking forward to seeing how effective the new accounting system that you set up in week I is going to be and has provided you with the following transactions from last month to enter into the system. Sold 24 Turbo Systems for $75 cach (net of GST) to Charlize Thrust on credit Invoice No. 2480 Purchased inventory from Unplugged Lad on credit for $2,400 (net of GST). Paid for the next 2 months advertising expense in advance at a cost of $200 per month (net of GST) Cheque No 370 Installed a turbo system for Mr Lee for $3.200 cash (net of GST) Rec No. 1400 7 Acquired new copper cable and wiring looms (engine supplies) for $792 (GST inclusive) on credit from Get Connected Paid the monthly bank loan repayment of S500 in cash Cheque No 377 13 Received all of the monies owed by Vin Walker Rec No. 1401. Paid for petrol to put in his Van of S120 (net of GST) Cheque No 372 15 Purchased inventory for an upcoming installation $900 (net of GST) from Total Engine Solutions. Issued an invoice to Ms. Letty for $600 (net of GST) for an upgraded air box he installed at the beginning of the month Invoice No 2481. 20 Paid last month's telephone bill of $484 in cash. (including GST) Cheque No 373. 23 Received $3.200 (net of GST) from Paul Diesel, for Turbo system installations to Diesel Deliver's fleet Rec No. 1402 Sold 8840 (net of GST) worth of spare parts to Mr Wild for cash Rec No. 1403 Paid Unplugged Lad $2.000 of the amount owed Cheque No 374 Returned $80 (net of GST) worth of inventory to Unplugged Lid as the fittings had the wrong connection on them 28 Michelle Ortiz paid of her existing debt in full. Max gave her a 10% discount for paying the total amount Rec No. 1404 31 Completed a large Turbo installation for Vin Walker and charged him $2,000 (net of GST) on credit Invoice No 2482 Required 1. Using the Topic 2 information, enter the opening balances and reversing entries into the accounts provided. 2. Enter the above transactions into the appropriate journals and post and total the journals as needed. 3. Complete the attached schedules and cross check these against the relevant control accounts. 4. Outline the benefits of the specialised journals and control accounts used by Max as compared to entering all transactions into a general journal and general ledger only. 25 Notes 1 2. You are not required to fill in the COGS columns at this stage as Max is still trying to decide which imentory system is most appropriate Because of Max's business type he has asked you to create another specialised journal in his system. The Installation Journal is specifically designed for the commission he records for revenue earned from installing engine systems in client's vehicles, FAI-MAX CASE STUDY TOPIC Installaties Journal ht FAI-MAX CASE STUDY TOF Cash receipts journal ENT The Date lerne Bu Mar T! Sales Journal Pul. COKEN Nel Then GST Ne Cash payments journal Net LINE Sales Returns Journal Na Purchases Journal RF General Journal DATE PARTICULARS P/R DEBIT CREDI Purchases Returns Journal De Tere Crede Pest Rat FAI-MUX CASE STUDY TOPIC FATMAX CASE STUDY: TOPIC ACCOUNTS RECEIVARIE - FAI-MUAY TOP3 Post Ref Debit Credit FAI-MACAM STUDY TOPIC Foot Ref De Cr Date Details BE Date the Amated Depreciation - Holst-141 Dette Pour DENE Credit Balance Da Trade Deblers-110 Post Het Debit Date Details Credit Balance Office E-150 Post Ref De Det Credit Balance Allousare for Doubt Debts-III Pester Debit Date Details Accumulated plate.me Lepot - 181 Postel Det Credit Walace Dale Imetry-120 Power Debi Da Credit Vas - 160 Pest Det Date Prepaid lurance - 130 Post Ref Debil Date Balance Details Credit Accumulated Depreciaties. Vas - 161 Post Ref Debit Credit Date Details Eepine Supplies - 133 Post Ref Debit Details Date Credit Balance TA MAXSAM PPC 3 Post Debit Credit Date Details FAL MAX CASE STUDY TOP3 Tools - 170 Pest Rer Debit Cred Balance Date Advertising Expense - $10 Post Red De Credit Balance Date Details Accumulated Depreciation Tools - 171 Pest Raf Debi Credit Balsace Date Telephone Expe- $12 Pest Red Debit Credit Details Trade Creditors - 200 Post Her Credit Balance Date Details Eagle Parts Espase-520 Pest Rel Bethit Credit Balance Date Details Allereed Telephe Epos - 204 Post Bar Debit Credit Date Details Interest Expense - 530 Post Ref Debit Credit Date Details Back Less - 720 Post Ref Dehit Credit Balance Date Details Petrol Expose-560 Post Ref Debit Credit Balance Date Details FAL MAX CASE STUDY: TOP3 ACCOUNTS RECEIVABLE SUBSIDIARIES FAI-MAX CASE STUDY TOP3 Sales 400 Post Red Debit Credit Balance Michelle Orte Powe De Date Balance Details Date Credit Installation Revenue - 410 Post For Debit Credit Balas Charlize Thrust Post Ref Credit Bebe Balance Details Date Details Dwayne Rock Post Rel Debit Crran GST Clearing-250 Post Red Debat Walane Credit Date Details Date Details Vin Walker Pew Ref Debit Credit Balance Date Details Discount Expres - 550 Post Ref Debit Credit Date Details Paul Diesel Post Ref Debu Date Details Debit Credit Balance Pest Red Date Details Ms Letty Pest Ref Debit Credit Balance Date Details FAI-MAX CASE STUDY: TOPIC 3 ACCOUNTS PAYABLE SUBSIDIARIES Unplugged Ltd Post Ref Debit Date Details Credit Balance Total Engine Solutions Post Ref Debit Date Details Credit Balance Get Connected Post Ref Debit Date Details Credit Balance Schedule of Accounts Receivable Details Balance Schedule of Accounts Payable Details Balance FAI-MAX CASE STUDY: TOPIC 2 CASE STUDY 2 - Establishing a new accounting system Having successfully operated his business for 3 years using what he leared in the UniSA core course, Accounting for Business, Max has decided it is time to develop a more productive accounting system. In order to do this, Max has been reviewing the notes he took when studying Financial Accounting 1. In his first week of FA 1 Max discovered that it is important to establish an accounting system that is best suited to the needs of the business. Max recalls that it was important to consider a number of factors including the current position of the business and where it may be headed in the future. After some thorough investigation Max has decided to establish a manual double entry accounting system which will employ specialised journals and control accounts (these will be discussed in detail in week 3). Max's record keeping has not always been the best and as a result all Max can provide you with is the unadjusted trial balance on the next page and the following additional information Additional Information: The following adjustments were due to be made on balance day of June 30: (a) Max has noticed that his overdraft is getting quite close to its $7,000 limit and arranged with the bank manager to increase this limit to $10,000 on June 2. (b) The June 10 the regular principal repayment of $500 off the Bank Loan was made, but has not yet been recorded. (c) Bank Fees of $20, which the bank took directly from the business' bank account during June, have not yet been recorded in the books of the business. (d) All depreciation is calculated by the straight-line method. The Ezi-Lift Hoist is expected to have a useful life of 10 years with a scrap value of $300. His tools are expected to be useful for 10 years with a scrap value collectively of $250, and the office equipment is expected to last 5 years and have no residual value. The van was just purchased on June 25. (e) $800 of the business' debtors relates to money owed by Dwayne Rock who is applying for bankruptcy. It is unlikely that any of the money will be recovered. (1) The prepaid insurance relates to professional negligence insurance that Max took out for his business in case he doesn't install an engine system properly and causes damage to a client's vehicle. It is an annual policy that commenced on 1 June (g) The telephone account for the month of June 30 arrives as you are preparing the worksheet. It reveals that $440 of telephone calls were made on the business telephone of which Max estimates $60 were personal calls. This account has not yet been paid for. (h) The Engine Supplies on hand at 30 June had cost $640. In addition Max informs you that the amount owing from Trade Debtors is comprised of the following companies Michelle Ortiz - $2,376 Chalize Thrust - $3,250 Dwayne Rock - $800 Vin Walker - $5,450 Paul Diesel - $4,641 Max's Trade Creditors are comprised of Unplugged Ltd - $2,500 Total Engine Solutions - $0 At present Max only has one type of inventory. FAI-MAX CASE STUDYTOPIC 2 Required 1 You need to complete the adjustment provided in the additional information on the worksheet provided and as general journal entries. Then give each account an appropriate chart of accounts number Calculate the profit for the previous period and then calculate the Capital figure as at 1 July (ready for the start of the next year) 3. Using the figures from the adjusted trial balance you must complete an opening entry to establish Max's new accounting system in the General Journal and then post this entry to the appropriate ledger accounts. 4. Enter any required reversing entries in the general joumal to prepare the new system for use and post these entries appropriately 1. Max Armim Torque- Partial worksheet for the year ended 30 June Unadjusted Trial Balance Adjustments Adjusted Trial Balance Account Name No Dr Cr Dr Cr Dr Cr Cash at Bank 100 6,435 Trade Debtors 110 16.517 Inventory 130 2.980 Prepaid Insurance 130 1.500 Engine Supplies 133 790 Van 160 22.000 Exi-Lin Hoist 3,600 Acc. Dep'n - Ex-Lin Hoist 141 275 Office Equipment 150 660 Acc. Depin-Off Equip 151 99 Tools 170 2,500 Ace. Depin - Tools 171 694 Trade Creditors 200 2.500 Bank Loan 220 14,500 Capital - M Armim 10,814 Sales 400 49.610 Turbo Installation Revenue 410 15.720 Cost of Goods Sold 500 28.580 Operating Expenses 590 15,334 Advertising Expanse 510 2.520 Interest Expense 530 1,406 Telephone Expenses S12 2.260 100,647 100,647 2 FAI-MAX CASE STUDY: TOPIC 2 1. Max Armim Torque- General Journal DATE PARTICULARS P/R DEBIT $ CREDIT $ FAI-MAX CASE STUDY: TOPIC 2 4. Max Armim Torque-General Ledger Date Details CASH AT BANK (100) Date July 1 Details Opening Entry $ 6,955 TRADE DEBTORS (110) Date Date Details Details $ ALLOWANCE FOR DOUBTFUL DEBTS (111) Details Date Details Date $ INVENTORY (120) $ Date Details Date Details $ PREPAID INSURANCE (130) S Date Date Details Details $ Date Engine Supplies (133) $ Date Details Details $ DELIVERY VAN (160) $ Date Date Details Details $ Date FAI-MAX CASE STUDY TOPIC 2 EZI-LIFT HOIST (140) Date Da Date Details Details ACCUMULATED DEPRECIATION - EZI-LIFT HOIST (141) Details $ Date Details Date $ D OFFICE EQUIPMENT (150) Date Date Details Details $ ACCUMULATED DEPRECIATION - OFFICE EQUIPMENT (151) Details Date Details $ Date TOOLS (170) $ Date Date Details Details $ ACCUMULATED DEPRECIATION - TOOLS (171) Details Date Details $ Date TRADE CREDITORS (200) $ Date Date $ Details Details FAI-MAX CASE STUDY: TOPIC 2 BANK LOAN (220) Date Date Details Details $ CAPITAL - MAX (300) $ Date Date Details Details ACCRUED TELEPHONE EXPENSE (205) Details $ Date Details Date TELEPHONE EXPENSE (512) $ Date Details Date Details Details Date Date $ Details $ Date Details Details $ Date