4, 5, and 7

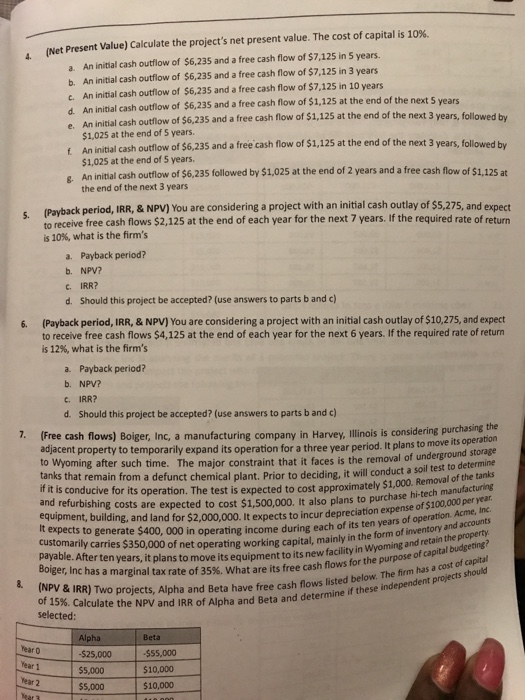

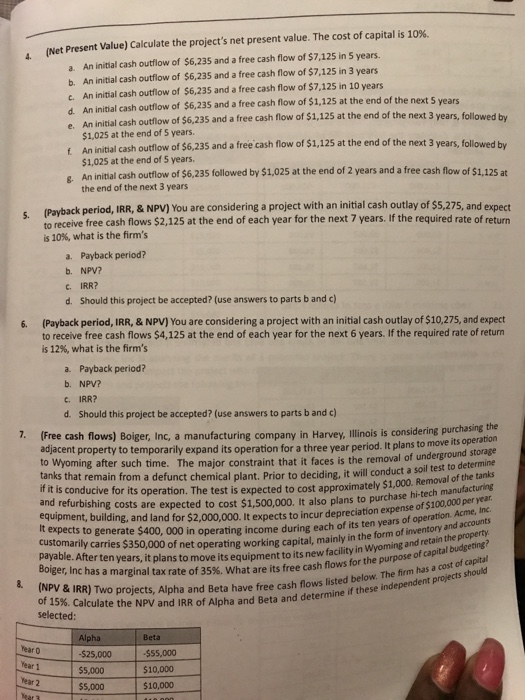

Calculate the project's net present value. the cost of capital is 10%, a. An initial cash outflow of $6, 235 and a free cash flow of $7, 125 in 5 years b An initial cash outflow of $6, 235 and a free cash flow of $7, 125 in 3 years c. An initial cash outflow of $6, 235 and a free cash flow of $7, 125 in 10 years d An initial cash outflow of $6, 235 and a free cash flow of $1, 125 at the end of the next S years e. An initial cash outflow of $6, 235 and a free cash flow of $1, 125 at the end of the next 3 years, followed by $1, 025 at the end of 5 years, f An initial cash outflow of $6, 235 and a free cash flow of $1, 125 at the end of the next 3 years, followed by $1, 025 at the end of 5 years, g An initial cash outflow of $6, 235 followed by $1, 025 at the end of 2 years and a free cash flow of $1, 125 at the end of the next 3 years You are considering a project with an initial cash outlay of $5, 275, and expect to receive free cash flows $2, 125 at the end of each year for the next 7 years. If the required rate of return is 10%, what is the firm's a. Payback period? b. NPV? c IRR? d. Should this project be accepted? (use answers to parts b and c) You are considering a project with an initial cash outlay of $10, 275, and expect to receive free cash flows $4, 125 at the end of each year for the next 6 years. If the required rate of return is 12%, what is the firm's a. Payback period? b. NPV? c. IRR? d. Should this project be accepted ? (use answers to parts b and c) (Free cash flows) Boiger, Inc, a manufacturing company in Harvey, Illinois is considering purchasing the adjacent property to temporarily expand its operation for a three year period. It plans to move its operation to Wyoming after such time. The major constraint that it faces is the removal of underground storage tanks that remain from a defunct chemical plant. Prior to deciding, it will conduct a soil test to determine if it is conducive for its operation. The test is expected to cost approximately $1,000. Removal of the thanks and refurbishing costs are expected to cost $1, 500,000. It also plans to purchase hi-tech manufacturing equipment, building, and land for $2,000,000. It expects to incur depreciation expanse of $100,000. per year It expects to generate $400,000 in operating income during each of its ten years of operation, Acme Inc. customarily carries $350,000 of net operating working capital, mainly in the form of inventory and accounts Payable. After ten years, it plans to move its equipment to its new facility in Wyoming and retain the property Boiger, Inc has a marginal tax rate of 35%. What are its free cash flows for the purpose of capital budgeting? Two projects, Alpha and Beta have free cash flows listed below. The firm has a cost of capital of 15%. Calculate the NPV and IRR of Alpha and Beta and determine if this independent projects should selected

4, 5, and 7

4, 5, and 7