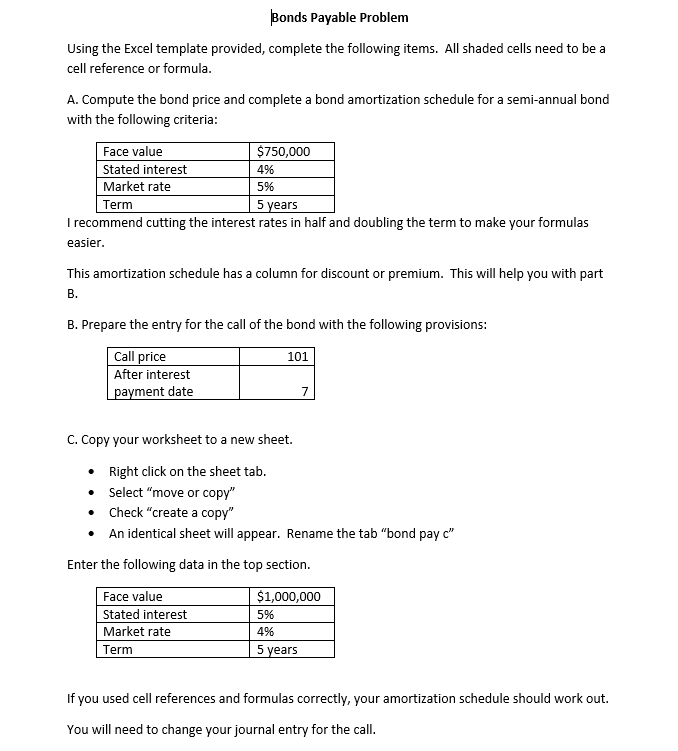

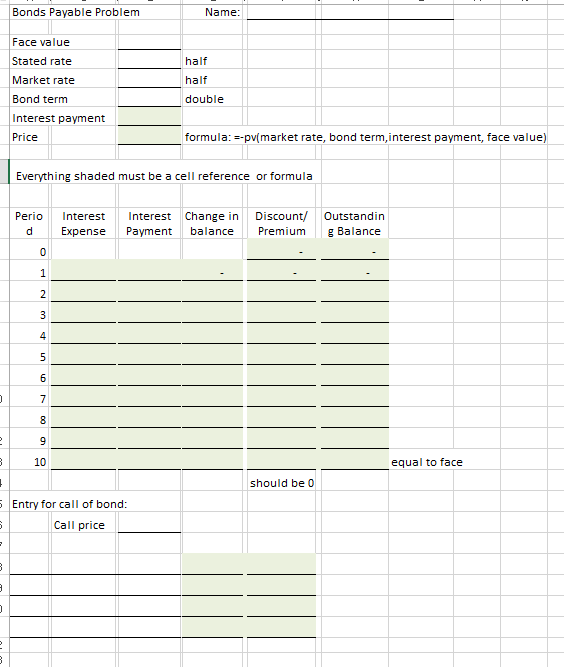

4% 5% Bonds Payable Problem Using the Excel template provided, complete the following items. All shaded cells need to be a cell reference or formula. A. Compute the bond price and complete a bond amortization schedule for a semi-annual bond with the following criteria: Face value $750,000 Stated interest Market rate Term I recommend cutting the interest rates in half and doubling the term to make your formulas easier. This amortization schedule has a column for discount or premium. This will help you with part B. B. Prepare the entry for the call of the bond with the following provisions: Call price After interest payment date 5 years 101 7 C. Copy your worksheet to a new sheet. Right click on the sheet tab. Select "move or copy" Check "create a copy" An identical sheet will appear. Rename the tab "bond pay c" Enter the following data in the top section. Face value $1,000,000 Stated interest Market rate Term 5 years 5% 4% If you used cell references and formulas correctly, your amortization schedule should work out. You will need to change your journal entry for the call. Bonds Payable Problem Name: half half Face value Stated rate Market rate Bond term Interest payment Price double formula: --pv(market rate, bond term, interest payment, face value) Everything shaded must be a cell reference or formula Perio d Interest Expense Interest Change in Discount/ Outstandin Payment balance Premium g Balance 0 1 N 3 4 5 6 7 00 2 9 B 10 equal to face . should be 0 5 Entry for call of bond: 3 Call price - B ] 4% 5% Bonds Payable Problem Using the Excel template provided, complete the following items. All shaded cells need to be a cell reference or formula. A. Compute the bond price and complete a bond amortization schedule for a semi-annual bond with the following criteria: Face value $750,000 Stated interest Market rate Term I recommend cutting the interest rates in half and doubling the term to make your formulas easier. This amortization schedule has a column for discount or premium. This will help you with part B. B. Prepare the entry for the call of the bond with the following provisions: Call price After interest payment date 5 years 101 7 C. Copy your worksheet to a new sheet. Right click on the sheet tab. Select "move or copy" Check "create a copy" An identical sheet will appear. Rename the tab "bond pay c" Enter the following data in the top section. Face value $1,000,000 Stated interest Market rate Term 5 years 5% 4% If you used cell references and formulas correctly, your amortization schedule should work out. You will need to change your journal entry for the call. Bonds Payable Problem Name: half half Face value Stated rate Market rate Bond term Interest payment Price double formula: --pv(market rate, bond term, interest payment, face value) Everything shaded must be a cell reference or formula Perio d Interest Expense Interest Change in Discount/ Outstandin Payment balance Premium g Balance 0 1 N 3 4 5 6 7 00 2 9 B 10 equal to face . should be 0 5 Entry for call of bond: 3 Call price - B ]