Answered step by step

Verified Expert Solution

Question

1 Approved Answer

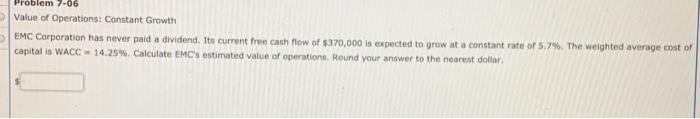

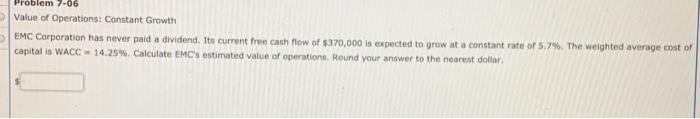

4 5 Problem 7-06 Value of Operations: Constant Growth EMC Corporation has never paid a dividend. Its current free cash flow of $370,000 is expected

4

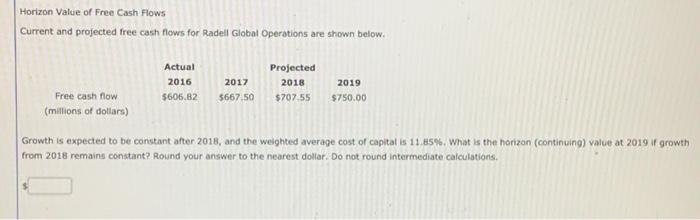

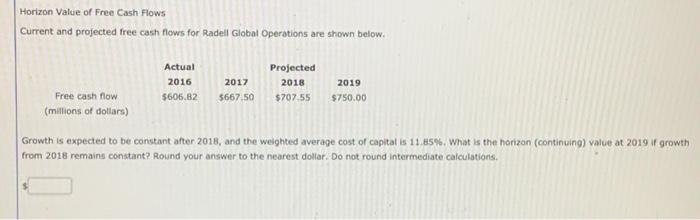

Problem 7-06 Value of Operations: Constant Growth EMC Corporation has never paid a dividend. Its current free cash flow of $370,000 is expected to grow at a constant rate of 5.7%. The weighted average cost of capital is WACC - 14.25% Calculate EMC's estimated value of operations, Round your answer to the nearest dollar Horizon Value of Free Cash Flows Current and projected free cash flows for Radell Global Operations are shown below. Actual Projected 2016 2017 2018 2019 Free cash flow $606.82 5667.50 $707.55 $750.00 (millions of dollars) Growth is expected to be constant after 2016, and the weighted average cost of capital is 11.85%. What is the horizon (continuing) value at 2019 ir growth from 2018 remains constant? Round your answer to the nearest dollar. Do not round intermediate calculations

5

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started