Answered step by step

Verified Expert Solution

Question

1 Approved Answer

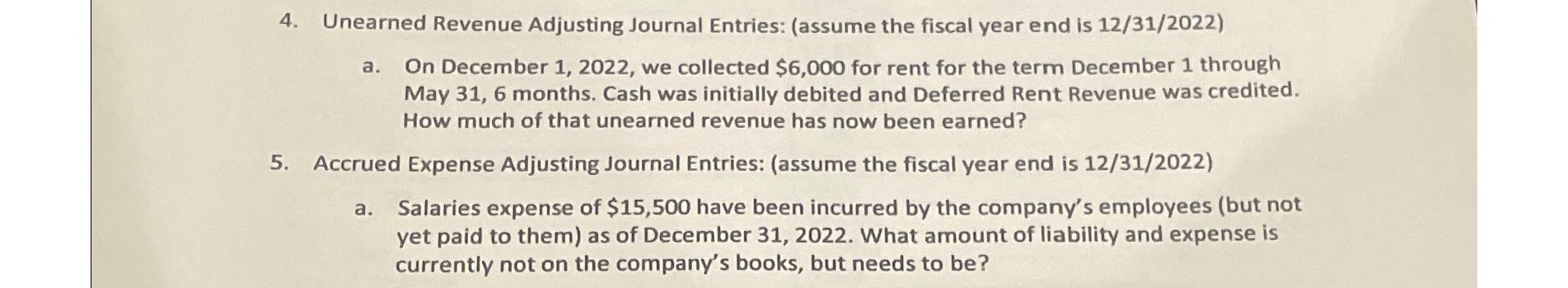

4. 5. Unearned Revenue Adjusting Journal Entries: (assume the fiscal year end is 12/31/2022) On December 1, 2022, we collected $6,000 for rent for

4. 5. Unearned Revenue Adjusting Journal Entries: (assume the fiscal year end is 12/31/2022) On December 1, 2022, we collected $6,000 for rent for the term December 1 through May 31, 6 months. Cash was initially debited and Deferred Rent Revenue was credited. How much of that unearned revenue has now been earned? a. Accrued Expense Adjusting Journal Entries: (assume the fiscal year end is 12/31/2022) Salaries expense of $15,500 have been incurred by the company's employees (but not yet paid to them) as of December 31, 2022. What amount of liability and expense is currently not on the company's books, but needs to be? a.

Step by Step Solution

★★★★★

3.46 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

The image you provided contains two accounting problems related to preparing adjusting journal entries for unearned revenue and accrued expenses Lets ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started