= Assume that the price S of a risky asset follows a binomial model with S(0) = $100, u = 10% and d -10%.

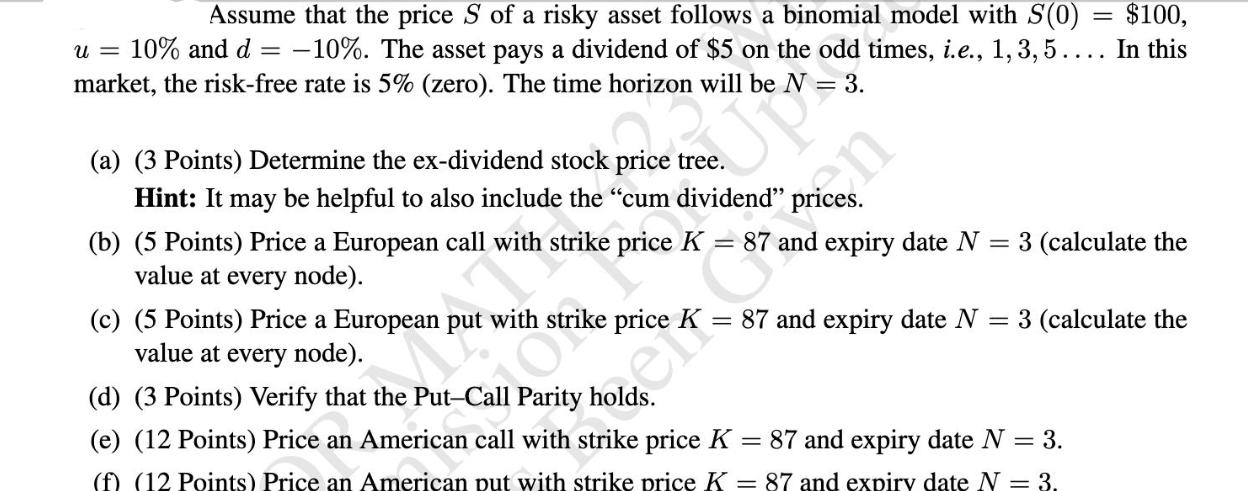

= Assume that the price S of a risky asset follows a binomial model with S(0) = $100, u = 10% and d -10%. The asset pays a dividend of $5 on the odd times, i.e., 1, 3, 5.... In this market, the risk-free rate is 5% (zero). The time horizon will be = 3. (a) (3 Points) Determine the ex-dividend stock price tree. Hint: It may be helpful to also include the "cum dividend" (b) (5 Points) Price a European call with strike price K = 87 and expiry date N value at every node). = 3 (calculate the (c) (5 Points) Price a European with strike price 87 and expiry date N = 3 (calculate the value at every node). (d) (3 Points) Verify that the Put-Call Parity holds. (e) (12 Points) Price an American call with strike price K = 87 and expiry date N = 3. (f) (12 Points) Price an American put with strike price K = 87 and expiry date N = 3.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To solve this problem we will follow the steps outlined in the question a Determine the exdividend stock price tree The exdividend stock price tree ca...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started