Answered step by step

Verified Expert Solution

Question

1 Approved Answer

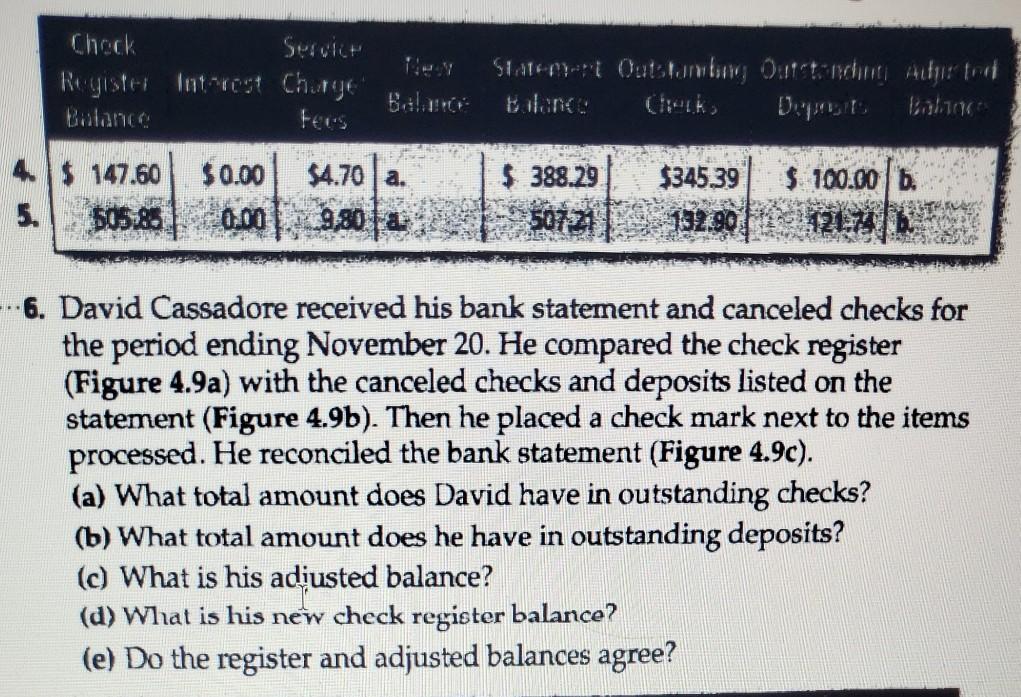

4 - 6 figures 4.9 a , 4.9 b , and 4.9 c are provided Check Service Register Interest Charge Balanga Fees Start Outuby Outstanchi

4 - 6 figures 4.9 a , 4.9 b , and 4.9 c are provided

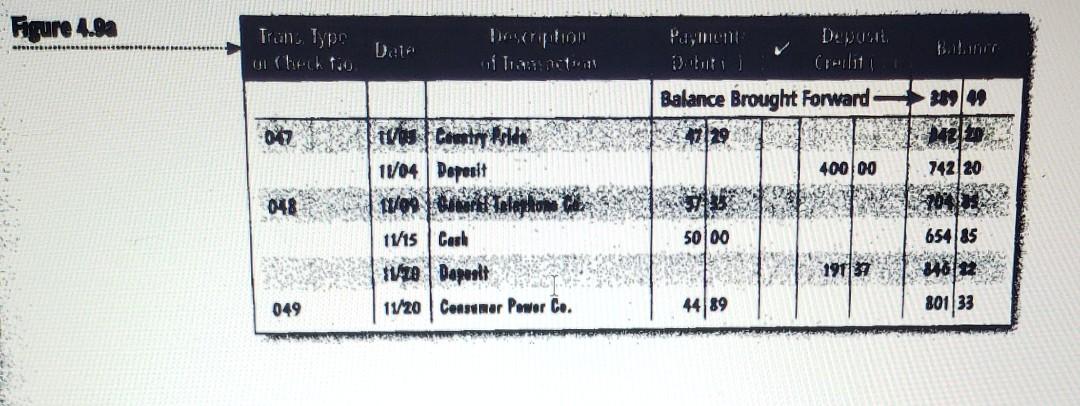

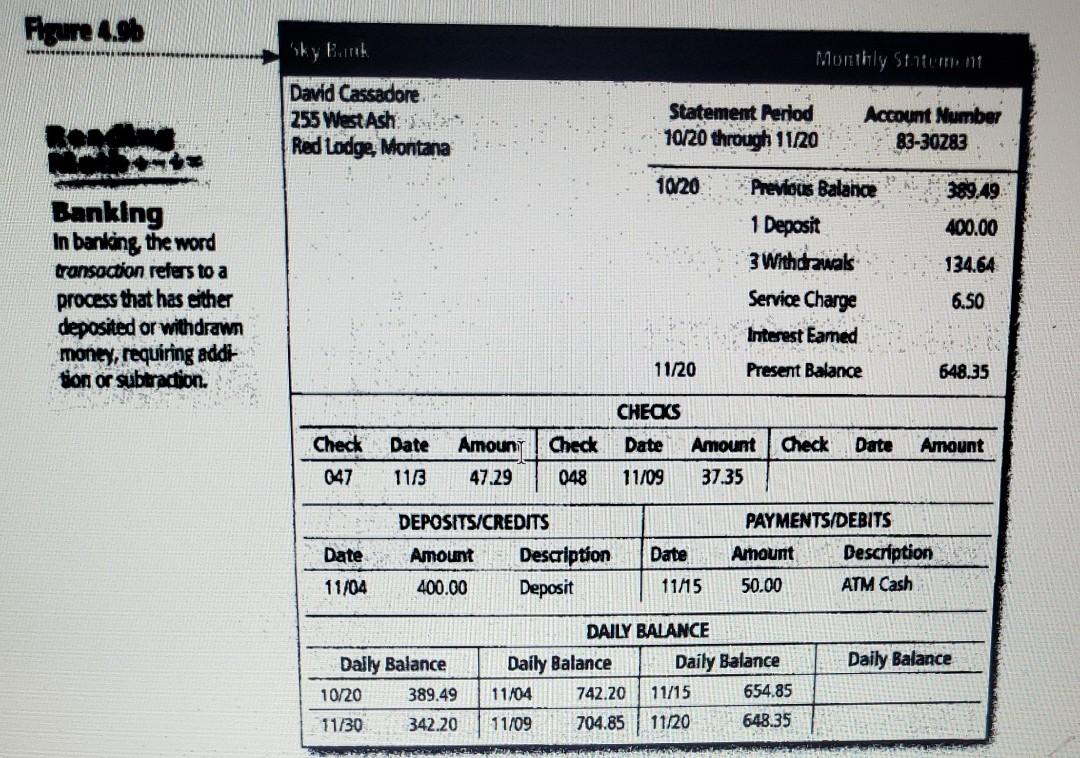

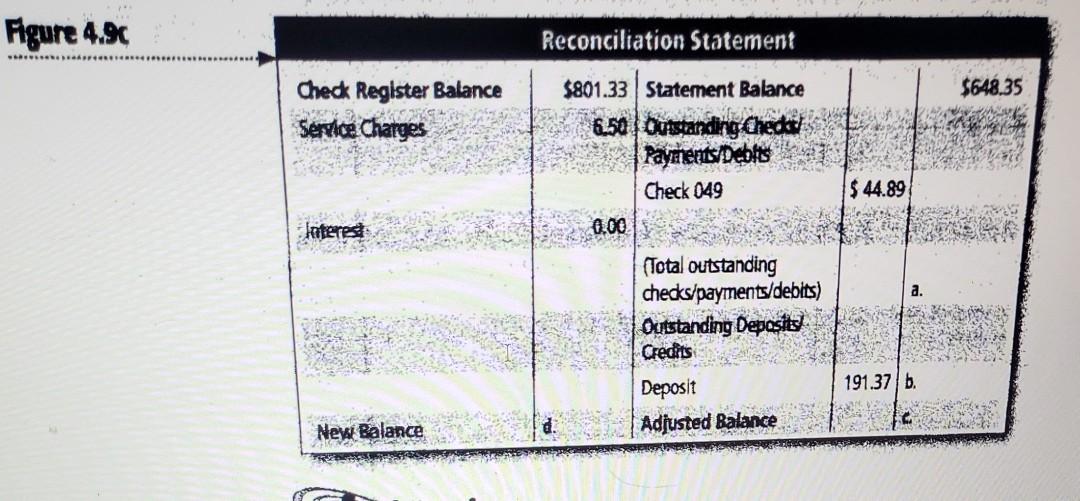

Check Service Register Interest Charge Balanga Fees Start Outuby Outstanchi aut tout CHEK Bislite $ 0.00 $ 100.00 $ 147.60 60586 $4.70 | a. 9.80 la 388.29 507-21 $345.39 132.901 5. -- 6. David Cassadore received his bank statement and canceled checks for the period ending November 20. He compared the check register (Figure 4.9a) with the canceled checks and deposits listed on the statement (Figure 4.9b). Then he placed a check mark next to the items processed. He reconciled the bank statement (Figure 4.9c). (a) What total amount does David have in outstanding checks? (b) What total amount does he have in outstanding deposits? () What is his adjusted balance? (d) What is his new check register balance? (e) Do the register and adjusted balances agree? Figure 4.90 Truall, Typr Det Balance Brought Forward ** BER 07 tas Coming Holder 11/04 Deposit 400 00 742/20 048 11/15 Cash 50.00 65485 ivmo Deposit 191139 98112 049 11/20 Consumer Power Co. 4489 801 33 Figura 4.96 'iky Bank Monthly statement David Cassadore 255 West Ash Red Lodge, Montana Statement Period 10/20 through 11/20 Account Number 83-30283 10/20 389.49 400.00 Previous Balance 1 Deposit 3 Withdrawals Service Charge Interest Eamed Banking In banking the word transaction refers to a process that has either deposited or withdrawn money, requiring addi tion or subtraction. 134.64 6.SO 11/20 Present Balance 648.35 CHECKS Check Date Check Date Amount Date 1113 Amount 47.29 Check 048 Amount 37.35 047 11/09 Date DEPOSITS/CREDITS Amount Description 400.00 Deposit Date PAYMENTS/DEBITS Amount Description 50.00 ATM Cash 11/04 11/15 Daily Balance Dally Balance 10/20 389.49 11/30 342.20 DAILY BALANCE Daily Balance Daily Balance 11/04 742.20 11/15 654.85 11/09 704.85 11/20 648.35 Figure 4.96 Reconciliation Statement $648.35 Check Register Balance Service Charges $801.33 Statement Balance 6.50 Outstanding Checkout Payments/Debits Check 049 0,00 $44.89 Interest a. (Total outstanding checks/payments/debits) Outstanding Deposit Credits 191.37 b. Deposit Adjusted Balance New Balance Check Service Register Interest Charge Balanga Fees Start Outuby Outstanchi aut tout CHEK Bislite $ 0.00 $ 100.00 $ 147.60 60586 $4.70 | a. 9.80 la 388.29 507-21 $345.39 132.901 5. -- 6. David Cassadore received his bank statement and canceled checks for the period ending November 20. He compared the check register (Figure 4.9a) with the canceled checks and deposits listed on the statement (Figure 4.9b). Then he placed a check mark next to the items processed. He reconciled the bank statement (Figure 4.9c). (a) What total amount does David have in outstanding checks? (b) What total amount does he have in outstanding deposits? () What is his adjusted balance? (d) What is his new check register balance? (e) Do the register and adjusted balances agree? Figure 4.90 Truall, Typr Det Balance Brought Forward ** BER 07 tas Coming Holder 11/04 Deposit 400 00 742/20 048 11/15 Cash 50.00 65485 ivmo Deposit 191139 98112 049 11/20 Consumer Power Co. 4489 801 33 Figura 4.96 'iky Bank Monthly statement David Cassadore 255 West Ash Red Lodge, Montana Statement Period 10/20 through 11/20 Account Number 83-30283 10/20 389.49 400.00 Previous Balance 1 Deposit 3 Withdrawals Service Charge Interest Eamed Banking In banking the word transaction refers to a process that has either deposited or withdrawn money, requiring addi tion or subtraction. 134.64 6.SO 11/20 Present Balance 648.35 CHECKS Check Date Check Date Amount Date 1113 Amount 47.29 Check 048 Amount 37.35 047 11/09 Date DEPOSITS/CREDITS Amount Description 400.00 Deposit Date PAYMENTS/DEBITS Amount Description 50.00 ATM Cash 11/04 11/15 Daily Balance Dally Balance 10/20 389.49 11/30 342.20 DAILY BALANCE Daily Balance Daily Balance 11/04 742.20 11/15 654.85 11/09 704.85 11/20 648.35 Figure 4.96 Reconciliation Statement $648.35 Check Register Balance Service Charges $801.33 Statement Balance 6.50 Outstanding Checkout Payments/Debits Check 049 0,00 $44.89 Interest a. (Total outstanding checks/payments/debits) Outstanding Deposit Credits 191.37 b. Deposit Adjusted Balance New Balance

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started