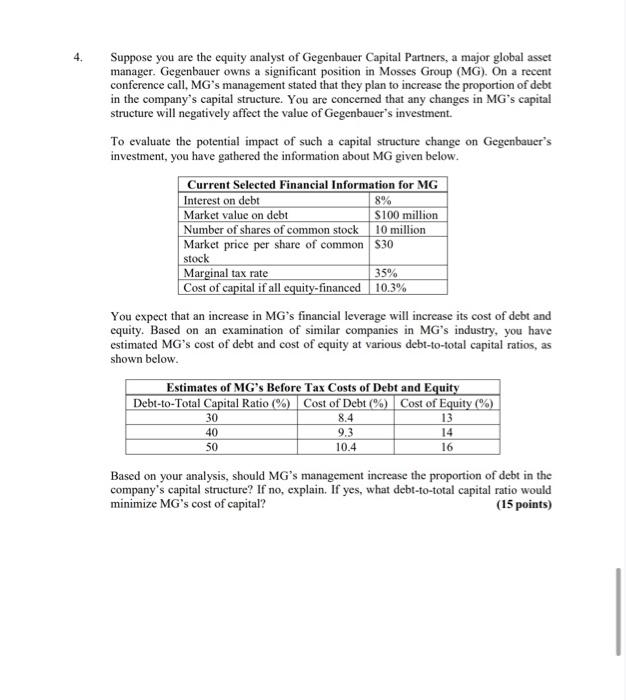

4. 8% Suppose you are the equity analyst of Gegenbauer Capital Partners, a major global asset manager. Gegenbauer owns a significant position in Mosses Group (MG). On a recent conference call, MG's management stated that they plan to increase the proportion of debt in the company's capital structure. You are concerned that any changes in MG's capital structure will negatively affect the value of Gegenbauer's investment. To evaluate the potential impact of such a capital structure change on Gegenbauer's investment, you have gathered the information about MG given below. Current Selected Financial Information for MG Interest on debt Market value on debt S100 million Number of shares of common stock 10 million Market price per share of common S30 stock Marginal tax rate 35% Cost of capital if all equity-financed 10.3% You expect that an increase in MG's financial leverage will increase its cost of debt and equity. Based on an examination of similar companies in MG's industry, you have estimated MG's cost of debt and cost of equity at various debt-to-total capital ratios, as shown below. Estimates of MG's Before Tax Costs of Debt and Equity Debt-to-Total Capital Ratio (%) Cost of Debt (%) Cost of Equity (%) 30 8.4 13 9.3 50 10.4 16 40 14 Based on your analysis, should MG's management increase the proportion of debt in the company's capital structure? If no, explain. If yes, what debt-to-total capital ratio would minimize MG's cost of capital? (15 points) 4. 8% Suppose you are the equity analyst of Gegenbauer Capital Partners, a major global asset manager. Gegenbauer owns a significant position in Mosses Group (MG). On a recent conference call, MG's management stated that they plan to increase the proportion of debt in the company's capital structure. You are concerned that any changes in MG's capital structure will negatively affect the value of Gegenbauer's investment. To evaluate the potential impact of such a capital structure change on Gegenbauer's investment, you have gathered the information about MG given below. Current Selected Financial Information for MG Interest on debt Market value on debt S100 million Number of shares of common stock 10 million Market price per share of common S30 stock Marginal tax rate 35% Cost of capital if all equity-financed 10.3% You expect that an increase in MG's financial leverage will increase its cost of debt and equity. Based on an examination of similar companies in MG's industry, you have estimated MG's cost of debt and cost of equity at various debt-to-total capital ratios, as shown below. Estimates of MG's Before Tax Costs of Debt and Equity Debt-to-Total Capital Ratio (%) Cost of Debt (%) Cost of Equity (%) 30 8.4 13 9.3 50 10.4 16 40 14 Based on your analysis, should MG's management increase the proportion of debt in the company's capital structure? If no, explain. If yes, what debt-to-total capital ratio would minimize MG's cost of capital? (15 points)