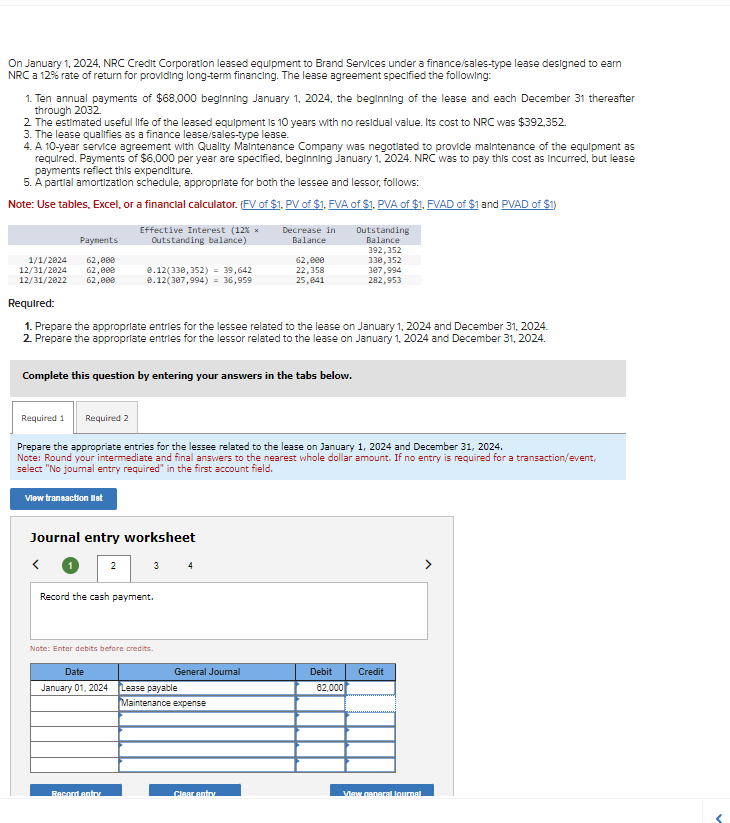

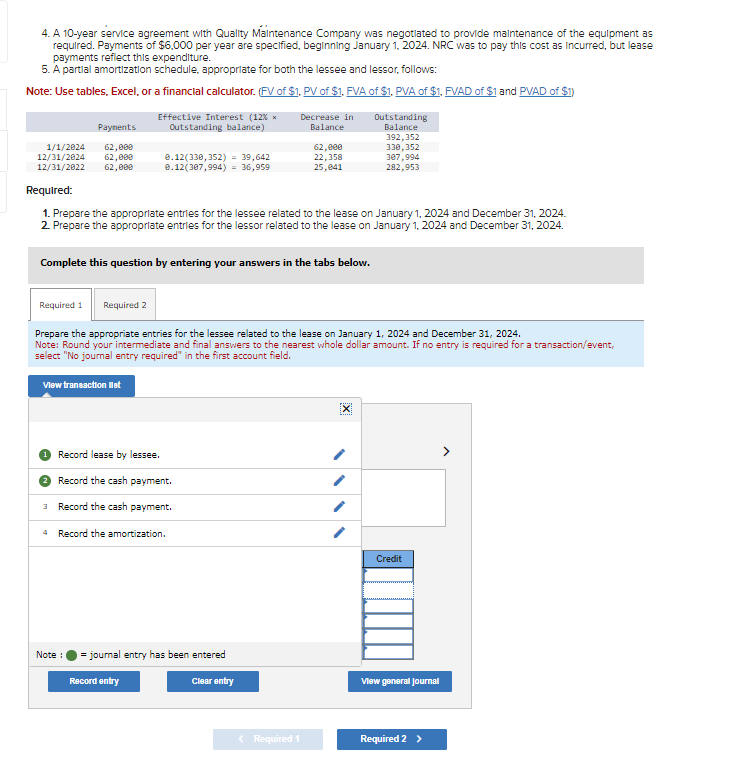

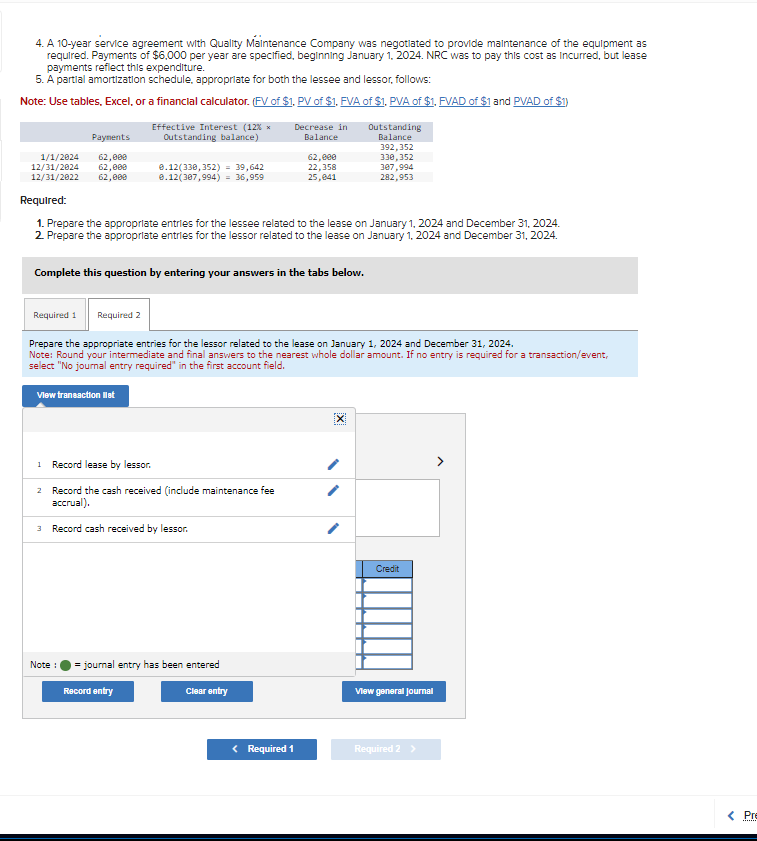

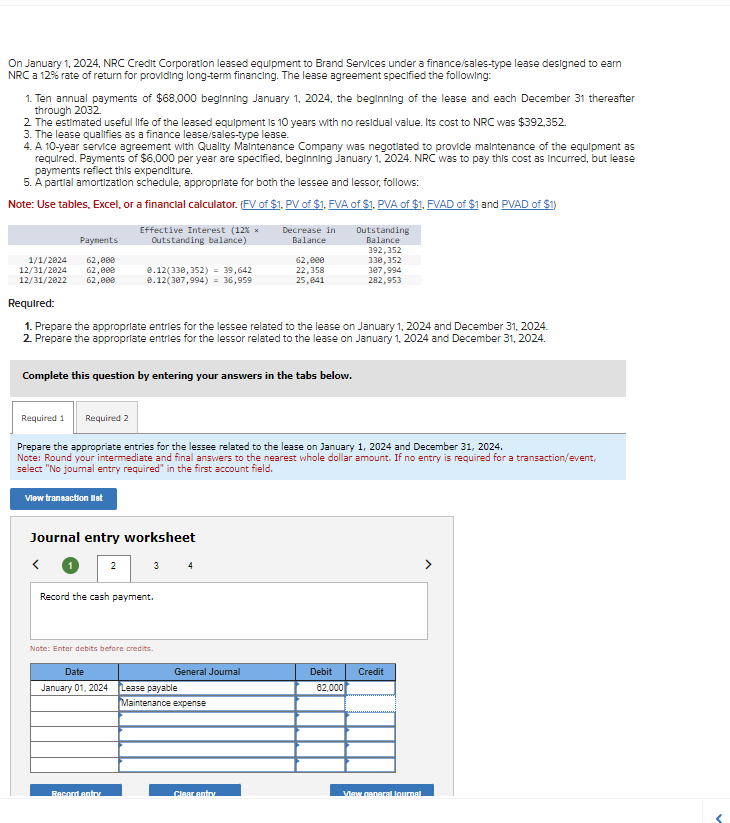

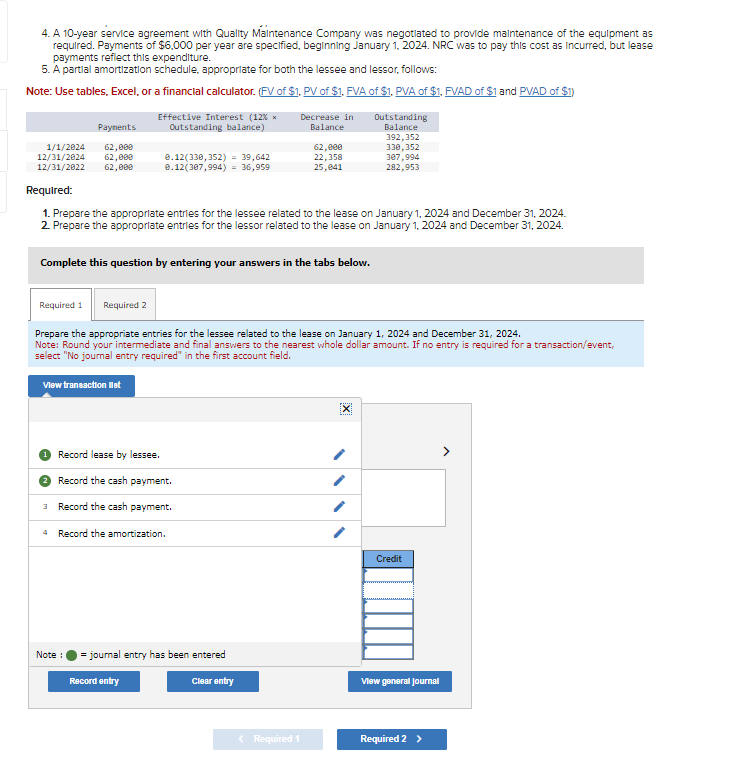

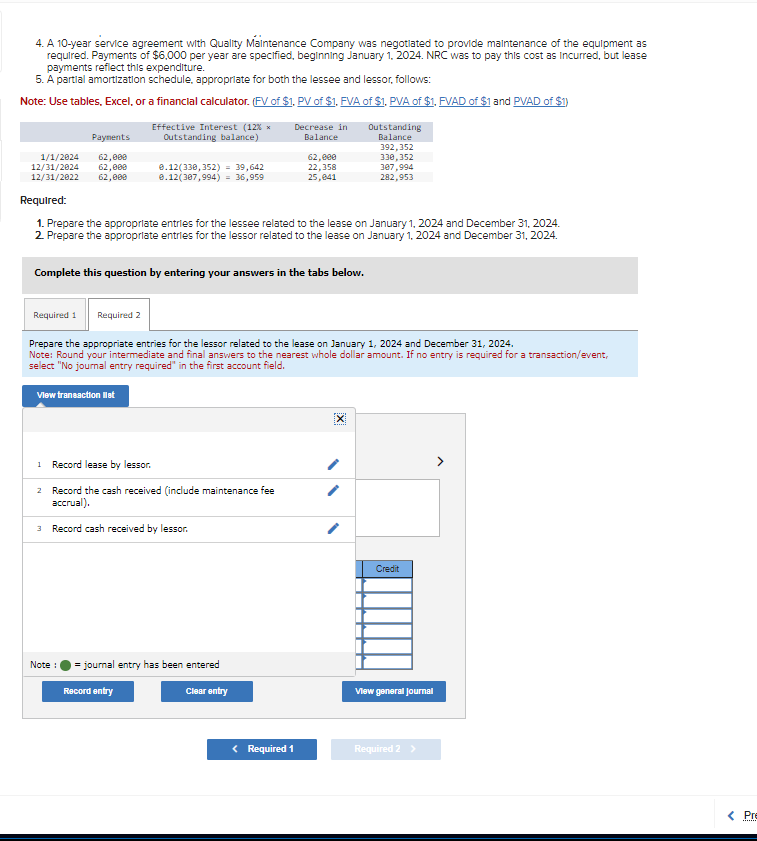

4. A 10-year service agreement with Quality Mintenance Company was negotlated to provide malntenance of the equipment as required. Payments of $6,000 per year are specified, beginning January 1, 2024. NRC was to pay this cost as Incurred, but lease payments reflect this expenditure. 5. A partlal amortization schedule, approprlate for both the lessee and lessor, follows: Note: Use tables, Excel, or a financlal calculator. (FV of \$1, PV of \$1, FVA of \$1, PVA of \$1, FVAD of \$1 and PVAD of \$1) Required: 1. Prepare the approprlate entrles for the lessee related to the lease on January 1, 2024 and December 31, 2024. 2. Prepare the approprlate entrles for the lessor related to the lease on January 1, 2024 and December 31, 2024. Complete this question by entering your answers in the tabs below. Prepare the appropriate entries for the lessee related to the lease on January 1, 2024 and December 31, 2024. Note: Round your intermediate and final answers to the nearest whole dollar amount. If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Record lease by lessee. 4. A 10-year service agreement with Quality Mintenance Company was negotlated to provide maintenance of the equipment as required. Payments of $6,000 per year are speclified, beginning January 1, 2024. NRC was to pay this cost as Incurred, but lease payments reflect this expendlture. 5. A partlal amortization schedule, approprlate for both the lessee and lessor, follows: Note: Use tables, Excel, or a financlal calculator. (FV of \$1, PV of \$1, FVA of \$1, PVA of \$1, FVAD of \$1 and PVAD of \$1) Required: 1. Prepare the approprlate entrles for the lessee related to the lease on January 1, 2024 and December 31, 2024. 2 Prepare the approprlate entrles for the lessor related to the lease on January 1, 2024 and December 31, 2024. Complete this question by entering your answers in the tabs below. Prepare the appropriate entries for the lessor related to the lease on January 1, 2024 and December 31, 2024. Note: Round your intermediate and final answers to the nearest whole dollar amount. If no entry is required for a transaction/event, select "No journal entry required" in the first account field. \begin{tabular}{|l|l|} \hline 1 Record lease by lessor: & \\ \hline 2Recordthecashreceived(includemaintenancefeeaccrual). & \\ \hline 3 Record cash received by lessor: & Credit \\ \hline & \end{tabular} On January 1, 2024, NRC Credit Corporation leased equipment to Brand Services under a finance/sales-type lease designed to earn NRC a 12% rate of return for providing long-term financing. The lease agreement specified the following: 1. Ten annual payments of $68,000 beginning January 1,2024 , the beginning of the lease and each December 31 thereafter through 2032. 2 The estimated useful life of the leased equipment is 10 years with no residual value. Its cost to NRC was $392,352. 3. The lease qualifies as a finance lease/sales-type lease. 4. A 10-year service agreement with Quality Malntenance Company was negotlated to provide malntenance of the equipment as required. Payments of $6,000 per year are speclifed, beginning January 1, 2024. NRC was to pay this cost as Incurred, but lease payments reflect this expenditure. 5. A partial amortization schedule, approprlate for both the lessee and lessor, follows: Note: Use tables, Excel, or a financial calculator. (FV of \$1, PV of \$1, FVA of \$1, PVA of \$1. FVAD of \$1 and PVAD of \$1) Required: 1. Prepare the approprlate entries for the lessee related to the lease on January 1, 2024 and December 31, 2024. 2 Prepare the approprlate entrles for the lessor related to the lease on January 1, 2024 and December 31, 2024. Complete this question by entering your answers in the tabs below. Prepare the appropriate entries for the lessee related to the lease on January 1, 2024 and December 31, 2024. Note: Round your intermediate and final answers to the nearest whole dollar amount. If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Journal entry worksheet 4 Note: Enter debits before credits