Answered step by step

Verified Expert Solution

Question

1 Approved Answer

4. a. b. C. 1. d. Taxable income of a corporation a. differs from accounting income due to differences in Intraperiod allocation between the

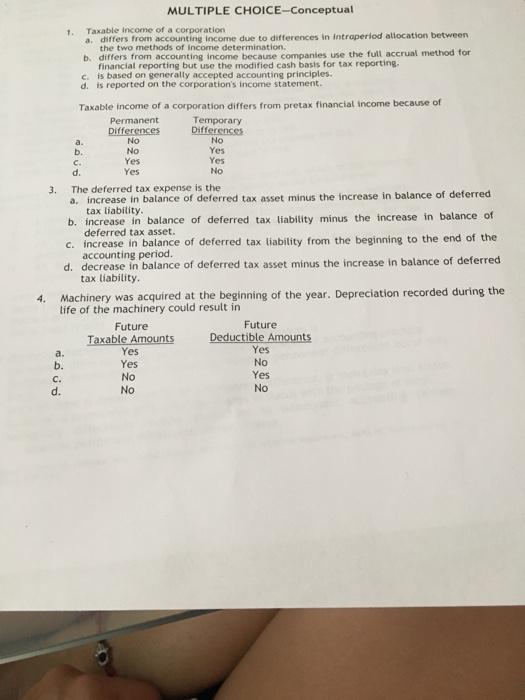

4. a. b. C. 1. d. Taxable income of a corporation a. differs from accounting income due to differences in Intraperiod allocation between the two methods of income determination. b. differs from accounting income because companies use the full accrual method for financial reporting but use the modified cash basis for tax reporting. c. is based on generally accepted accounting principles. d. is reported on the corporation's income statement. Taxable income of a corporation differs from pretax financial income because of Permanent Differences No No Yes Yes a. b. MULTIPLE CHOICE-Conceptual C. d. 3. The deferred tax expense is the a. increase in balance of deferred tax asset minus the increase in balance of deferred. tax liability. b. increase in balance of deferred tax liability minus the increase in balance of deferred tax asset. c. increase in balance of deferred tax liability from the beginning to the end of the accounting period. d. decrease in balance of deferred tax asset minus the increase in balance of deferred tax liability. Machinery was acquired at the beginning of the year. Depreciation recorded during the life of the machinery could result in Future Taxable Amounts Yes Yes No No Temporary Differences No Yes Yes No Future Deductible Amounts Yes No Yes No

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The image you provided shows multiplechoice questions related to accounting concepts and terms specifically addressing differences in income due to ti...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started