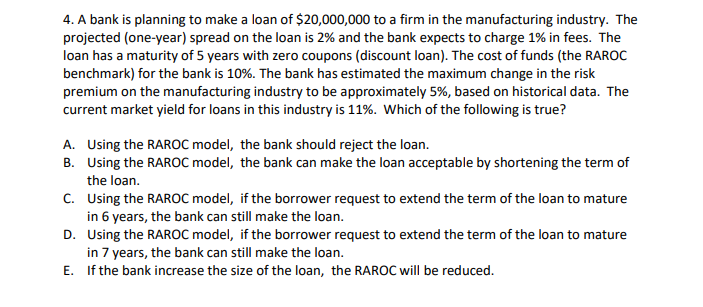

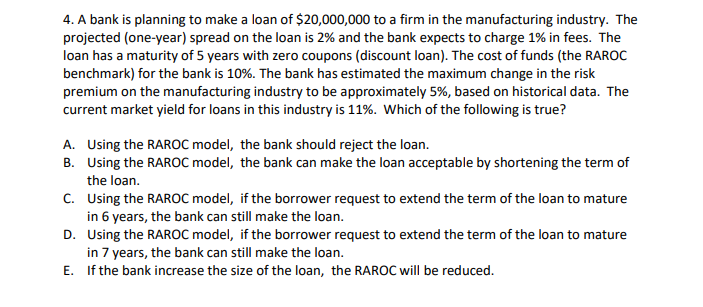

4. A bank is planning to make a loan of $20,000,000 to a firm in the manufacturing industry. The projected (one-year) spread on the loan is 2% and the bank expects to charge 1% in fees. The loan has a maturity of 5 years with zero coupons (discount loan). The cost of funds (the RAROC benchmark) for the bank is 10%. The bank has estimated the maximum change in the risk premium on the manufacturing industry to be approximately 5%, based on historical data. The current market yield for loans in this industry is 11%. Which of the following is true? A. Using the RAROC model, the bank should reject the loan. B. Using the RAROC model, the bank can make the loan acceptable by shortening the term of the loan. C. Using the RAROC model, if the borrower request to extend the term of the loan to mature in 6 years, the bank can still make the loan. D. Using the RAROC model, if the borrower request to extend the term of the loan to mature in 7 years, the bank can still make the loan. E. If the bank increase the size of the loan, the RAROC will be reduced. 4. A bank is planning to make a loan of $20,000,000 to a firm in the manufacturing industry. The projected (one-year) spread on the loan is 2% and the bank expects to charge 1% in fees. The loan has a maturity of 5 years with zero coupons (discount loan). The cost of funds (the RAROC benchmark) for the bank is 10%. The bank has estimated the maximum change in the risk premium on the manufacturing industry to be approximately 5%, based on historical data. The current market yield for loans in this industry is 11%. Which of the following is true? A. Using the RAROC model, the bank should reject the loan. B. Using the RAROC model, the bank can make the loan acceptable by shortening the term of the loan. C. Using the RAROC model, if the borrower request to extend the term of the loan to mature in 6 years, the bank can still make the loan. D. Using the RAROC model, if the borrower request to extend the term of the loan to mature in 7 years, the bank can still make the loan. E. If the bank increase the size of the loan, the RAROC will be reduced