Answered step by step

Verified Expert Solution

Question

1 Approved Answer

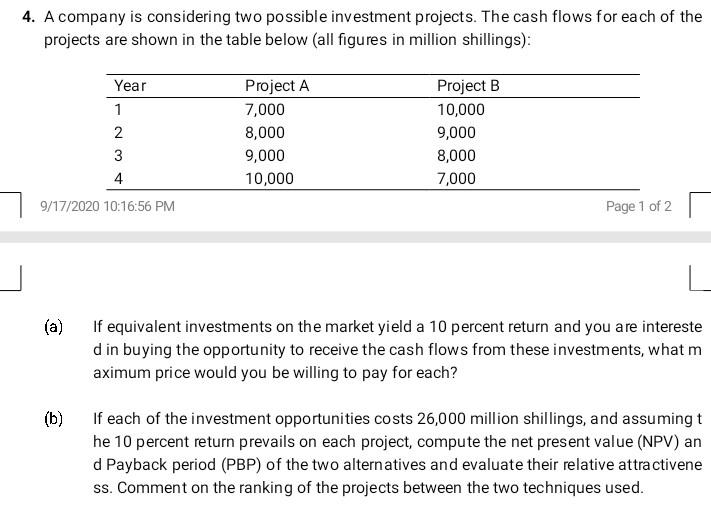

4. A company is considering two possible investment projects. The cash flows for each of the projects are shown in the table below (all figures

4. A company is considering two possible investment projects. The cash flows for each of the projects are shown in the table below (all figures in million shillings): 9/17/2020 10:16:56 PM Page 1 of 2 (a) If equivalent investments on the market yield a 10 percent return and you are intereste d in buying the opportunity to receive the cash flows from these investments, what m aximum price would you be willing to pay for each? (b) If each of the investment opportunities costs 26,000 million shillings, and assuming t he 10 percent return prevails on each project, compute the net present value (NPV) an d Payback period (PBP) of the two alternatives and evaluate their relative attractivene ss. Comment on the ranking of the projects between the two techniques used

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started