Question

4. A pension fund has the following liability: A 20-yr annuity, that will pay coupons of 7% at the end of each year.(t=1...t=20). The pension

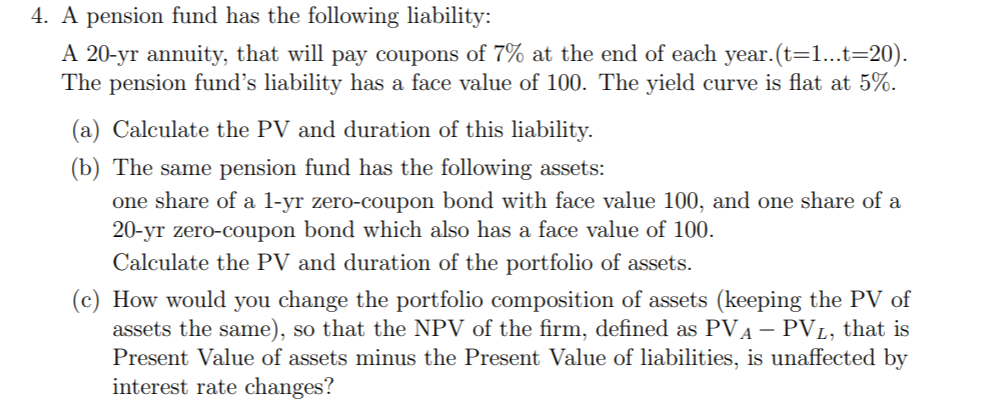

4. A pension fund has the following liability: A 20-yr annuity, that will pay coupons of 7% at the end of each year.(t=1...t=20). The pension funds liability has a face value of 100. The yield curve is flat at 5%. (a) Calculate the PV and duration of this liability. (b) The same pension fund has the following assets: one share of a 1-yr zero-coupon bond with face value 100, and one share of a 20-yr zero-coupon bond which also has a face value of 100. Calculate the PV and duration of the portfolio of assets. (c) How would you change the portfolio composition of assets (keeping the PV of assets the same), so that the NPV of the firm, defined as PVA PVL, that is Present Value of assets minus the Present Value of liabilities, is unaffected by interest rate changes?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started