Answered step by step

Verified Expert Solution

Question

1 Approved Answer

4 A retail investor has compiled the following data relating to Towels Ltd. based on her analysis of the financial statements for the financial year

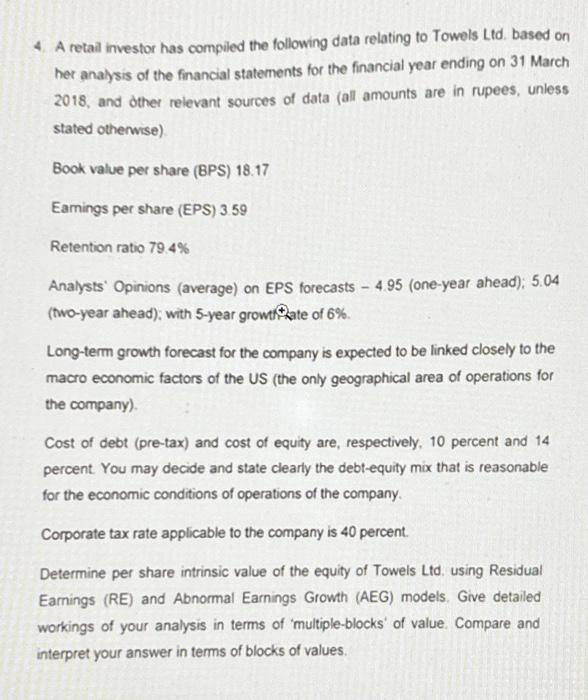

4 A retail investor has compiled the following data relating to Towels Ltd. based on her analysis of the financial statements for the financial year ending on 31 March 2018, and other relevant sources of data (all amounts are in rupees, unless stated otherwise).

Book value per share (BPS) 18.17

Earnings per share (EPS) 3.59

Retention ratio 79.4%

Analysts Opinions (average) on EPS forecasts - 4.95 (one-year ahead); 5.04 (two-year ahead); with 5-year growtate of 6%. Long-term growth forecast for the company is expected to be linked closely to the macro economic factors of the US (the only geographical area of operations for the company).

Cost of debt (pre-tax) and cost of equity are, respectively, 10 percent and 14 percent. You may decide and state clearly the debt-equity mix that is reasonable for the economic conditions of operations of the company. Corporate tax rate applicable to the company is 40 percent.

Determine per share intrinsic value of the equity of Towels Ltd. using Residual Earnings (RE) and Abnormal Earnings Growth (AEG) models. Give detailed workings of your analysis in terms of multiple-blocks of value. Compare and interpret your answer in terms of blocks of values.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started