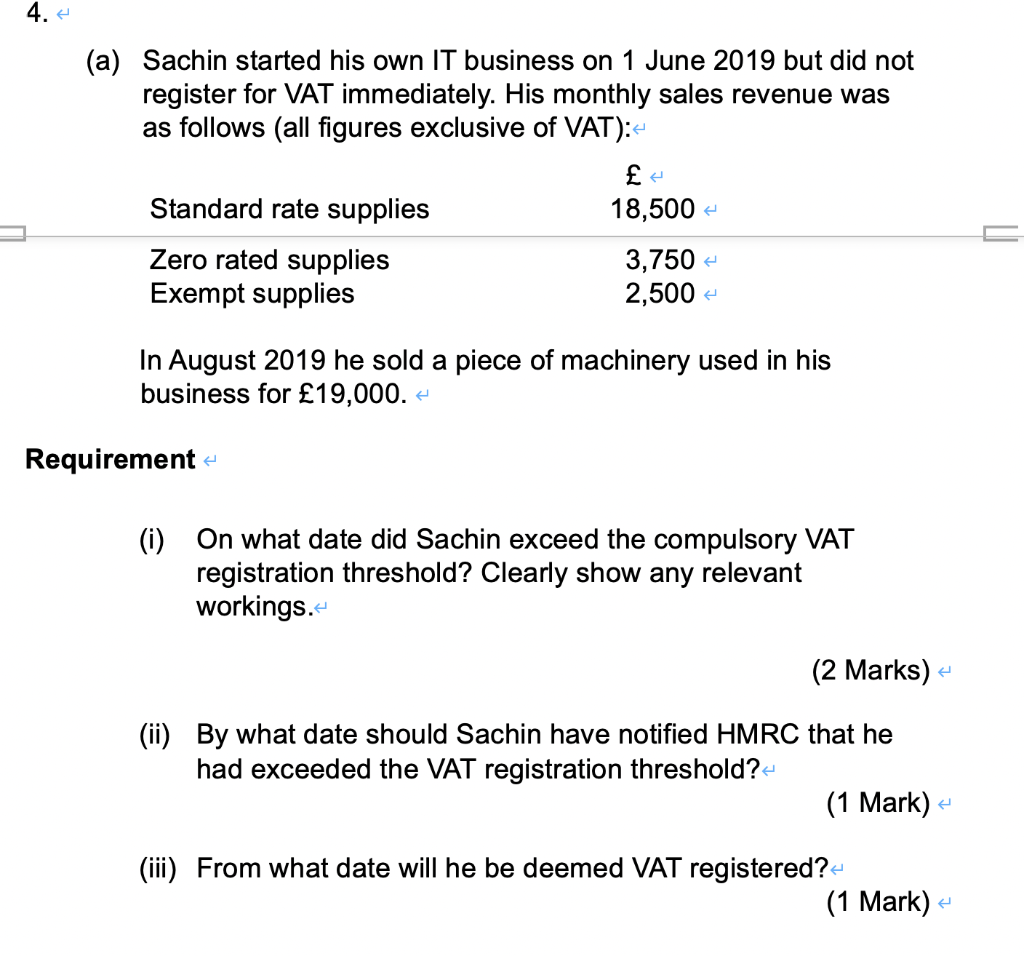

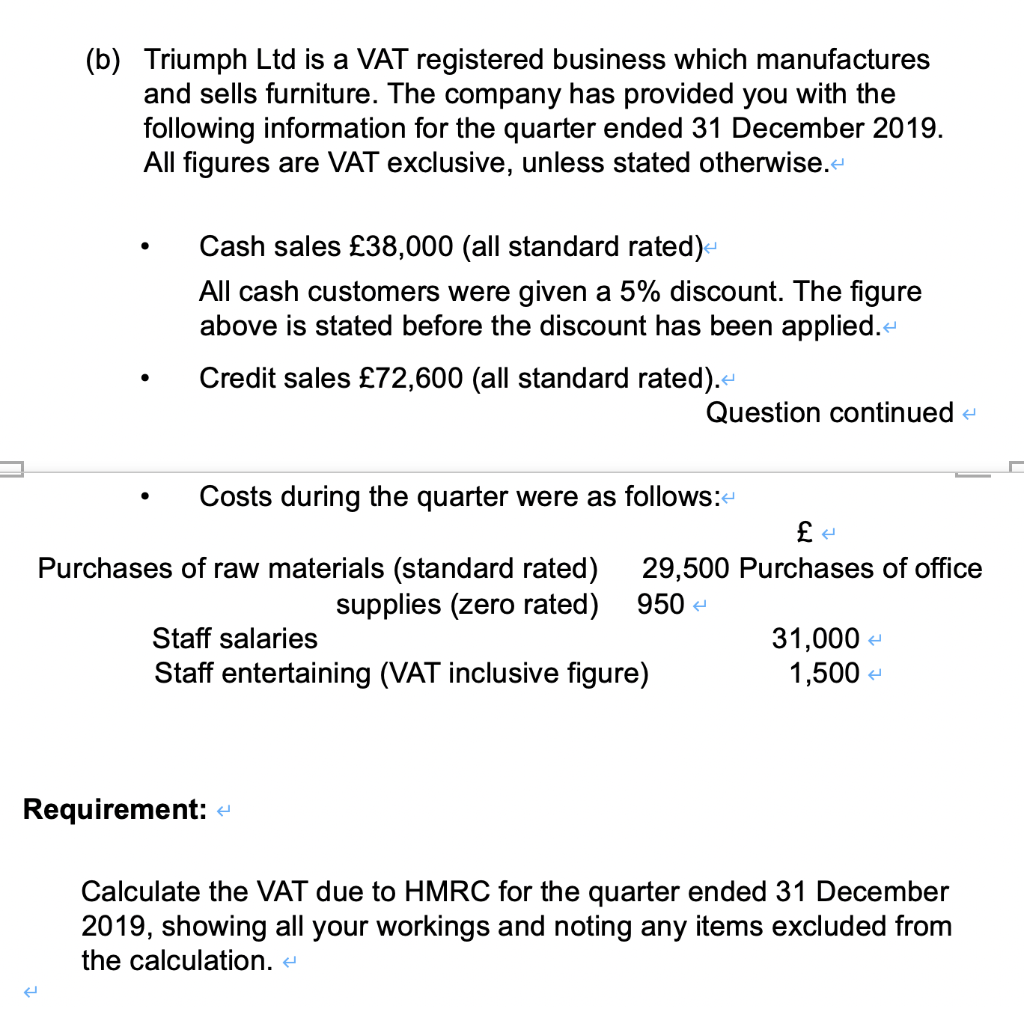

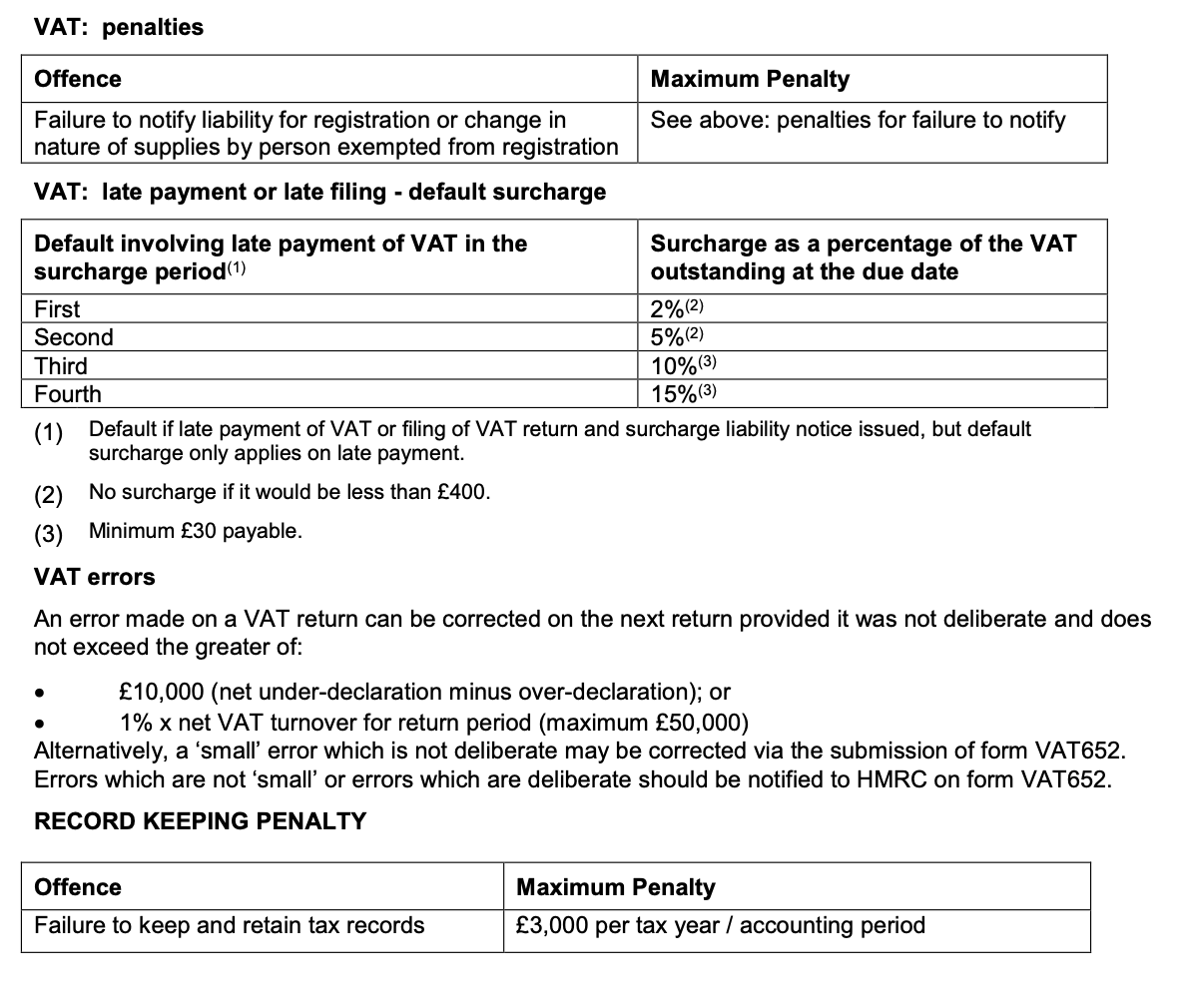

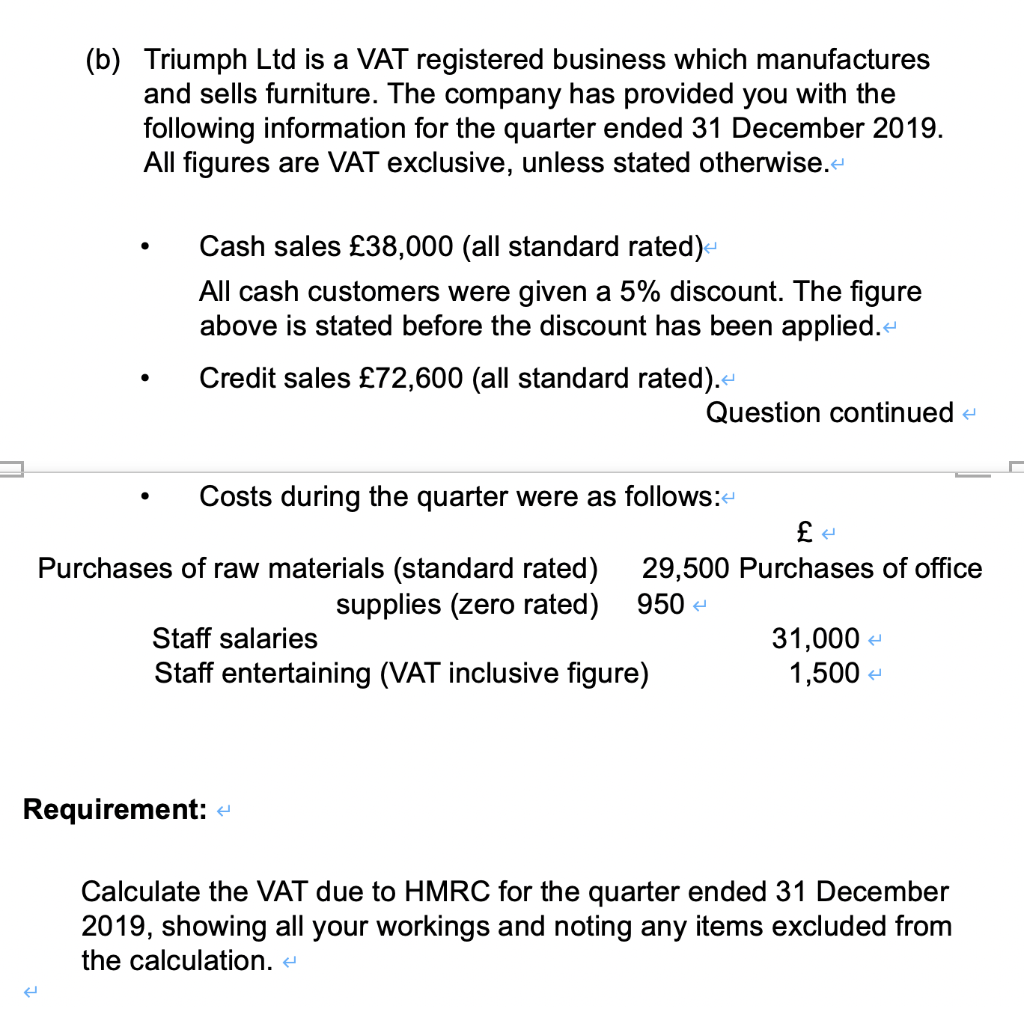

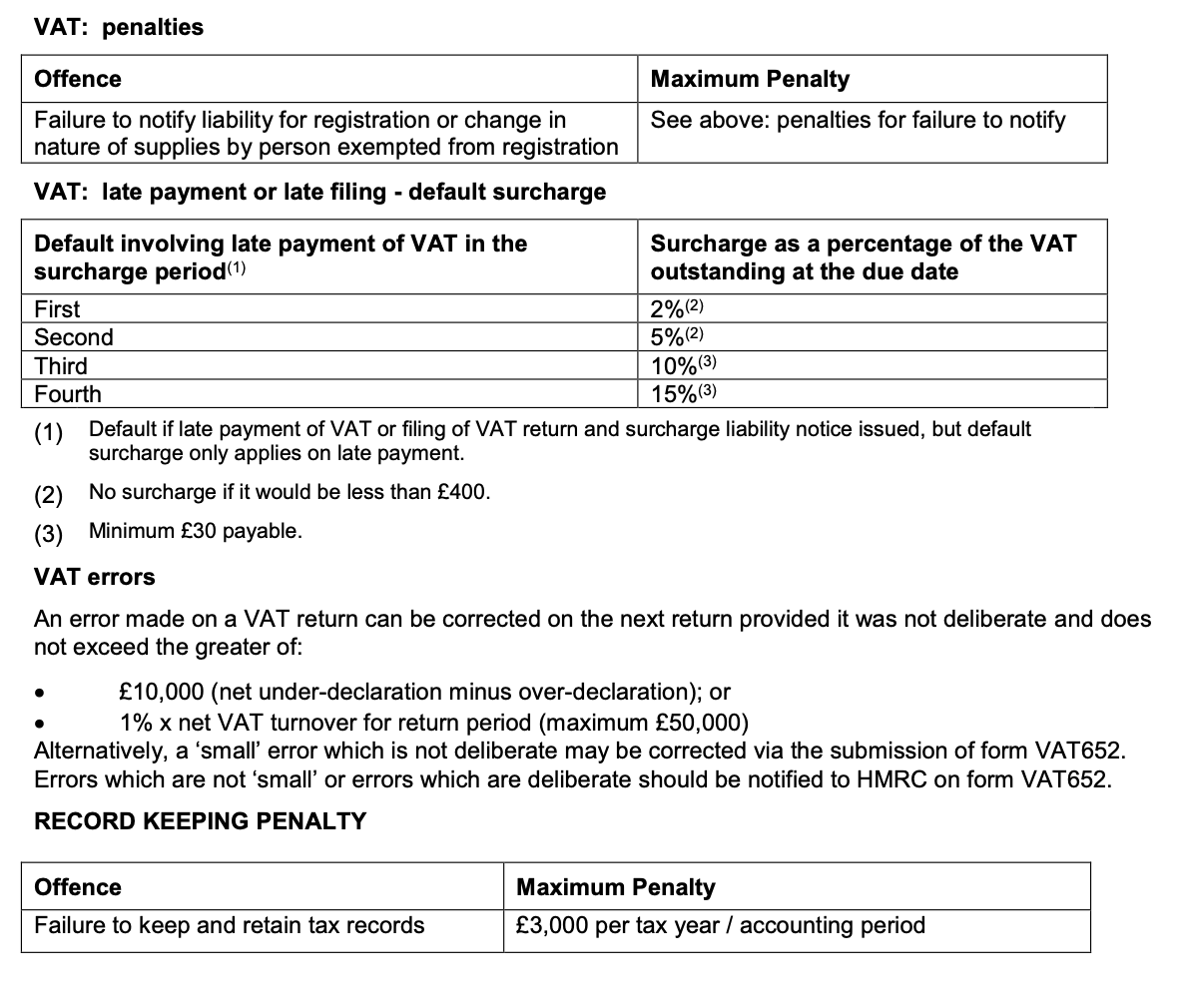

4. (a) Sachin started his own IT business on 1 June 2019 but did not register for VAT immediately. His monthly sales revenue was as follows (all figures exclusive of VAT):- - Standard rate supplies 18,500 Zero rated supplies 3,750 Exempt supplies 2,500 In August 2019 he sold a piece of machinery used in his business for 19,000. Requirement (i) On what date did Sachin exceed the compulsory VAT registration threshold? Clearly show any relevant workings. (2 Marks) (ii) By what date should Sachin have notified HMRC that he had exceeded the VAT registration threshold? (1 Mark) (iii) From what date will he be deemed VAT registered? (1 Mark) (b) Triumph Ltd is a VAT registered business which manufactures and sells furniture. The company has provided you with the following information for the quarter ended 31 December 2019. All figures are VAT exclusive, unless stated otherwise. Cash sales 38,000 (all standard rated) All cash customers were given a 5% discount. The figure above is stated before the discount has been applied. Credit sales 72,600 (all standard rated). Question continued Costs during the quarter were as follows:- Purchases of raw materials (standard rated) 29,500 Purchases of office supplies (zero rated) 950 Staff salaries 31,000+ Staff entertaining (VAT inclusive figure) 1,500 Requirement: Calculate the VAT due to HMRC for the quarter ended 31 December 2019, showing all your workings and noting any items excluded from the calculation. VAT: penalties Offence Maximum Penalty See above: penalties for failure to notify Failure to notify liability for registration or change in nature of supplies by person exempted from registration VAT: late payment or late filing - default surcharge Default involving late payment of VAT in the Surcharge as a percentage of the VAT surcharge period (1) outstanding at the due date First 2%(2) Second 5%(2) Third 10%(3) Fourth 15%(3) (1) Default if late payment of VAT or filing VAT return and surcharge liability notice issued, but default surcharge only applies on late payment. (2) No surcharge if it would be less than 400. (3) Minimum 30 payable. VAT errors An error made on a VAT return can be corrected on the next return provided it was not deliberate and does not exceed the greater of: 10,000 (net under-declaration minus over-declaration); or 1% x net VAT turnover for return period (maximum 50,000) Alternatively, a 'small error which is not deliberate may be corrected via the submission of form VAT652. Errors which are not 'small' or errors which are deliberate should be notified to HMRC on form VAT652. RECORD KEEPING PENALTY Offence Failure to keep and retain tax records Maximum Penalty 3,000 per tax year / accounting period 4. (a) Sachin started his own IT business on 1 June 2019 but did not register for VAT immediately. His monthly sales revenue was as follows (all figures exclusive of VAT):- - Standard rate supplies 18,500 Zero rated supplies 3,750 Exempt supplies 2,500 In August 2019 he sold a piece of machinery used in his business for 19,000. Requirement (i) On what date did Sachin exceed the compulsory VAT registration threshold? Clearly show any relevant workings. (2 Marks) (ii) By what date should Sachin have notified HMRC that he had exceeded the VAT registration threshold? (1 Mark) (iii) From what date will he be deemed VAT registered? (1 Mark) (b) Triumph Ltd is a VAT registered business which manufactures and sells furniture. The company has provided you with the following information for the quarter ended 31 December 2019. All figures are VAT exclusive, unless stated otherwise. Cash sales 38,000 (all standard rated) All cash customers were given a 5% discount. The figure above is stated before the discount has been applied. Credit sales 72,600 (all standard rated). Question continued Costs during the quarter were as follows:- Purchases of raw materials (standard rated) 29,500 Purchases of office supplies (zero rated) 950 Staff salaries 31,000+ Staff entertaining (VAT inclusive figure) 1,500 Requirement: Calculate the VAT due to HMRC for the quarter ended 31 December 2019, showing all your workings and noting any items excluded from the calculation. VAT: penalties Offence Maximum Penalty See above: penalties for failure to notify Failure to notify liability for registration or change in nature of supplies by person exempted from registration VAT: late payment or late filing - default surcharge Default involving late payment of VAT in the Surcharge as a percentage of the VAT surcharge period (1) outstanding at the due date First 2%(2) Second 5%(2) Third 10%(3) Fourth 15%(3) (1) Default if late payment of VAT or filing VAT return and surcharge liability notice issued, but default surcharge only applies on late payment. (2) No surcharge if it would be less than 400. (3) Minimum 30 payable. VAT errors An error made on a VAT return can be corrected on the next return provided it was not deliberate and does not exceed the greater of: 10,000 (net under-declaration minus over-declaration); or 1% x net VAT turnover for return period (maximum 50,000) Alternatively, a 'small error which is not deliberate may be corrected via the submission of form VAT652. Errors which are not 'small' or errors which are deliberate should be notified to HMRC on form VAT652. RECORD KEEPING PENALTY Offence Failure to keep and retain tax records Maximum Penalty 3,000 per tax year / accounting period