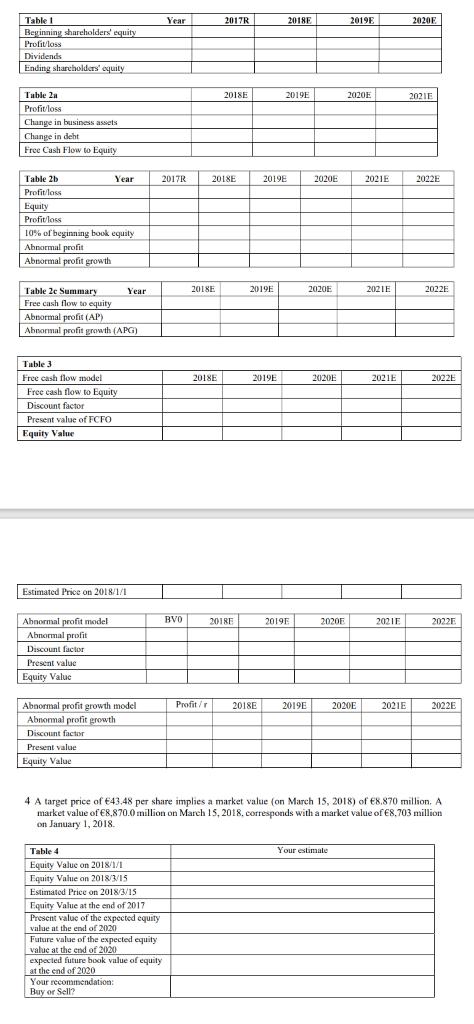

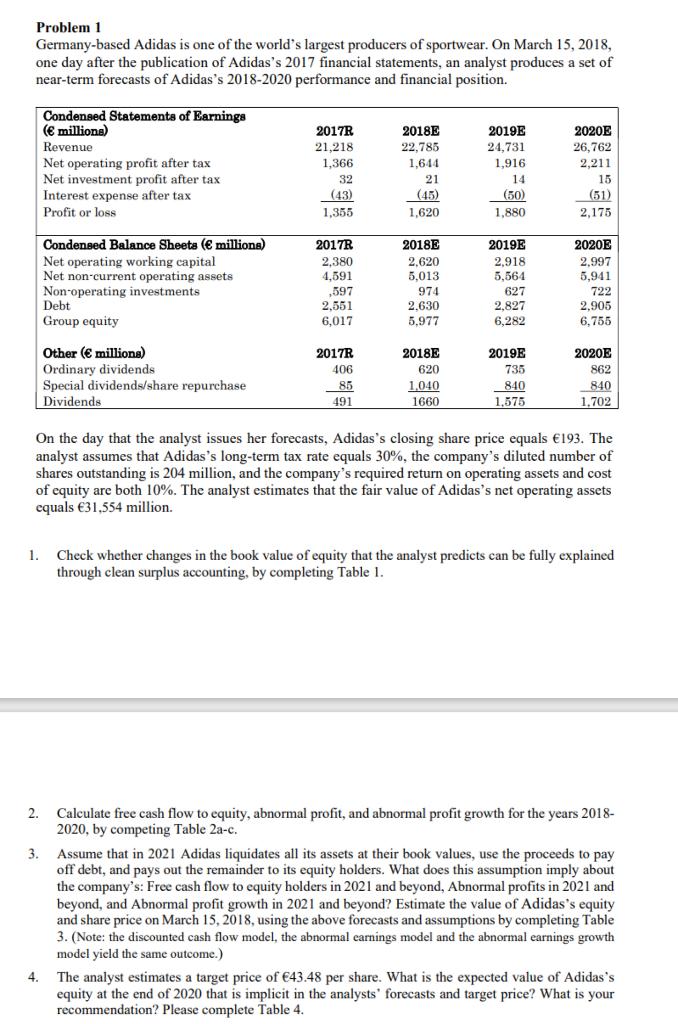

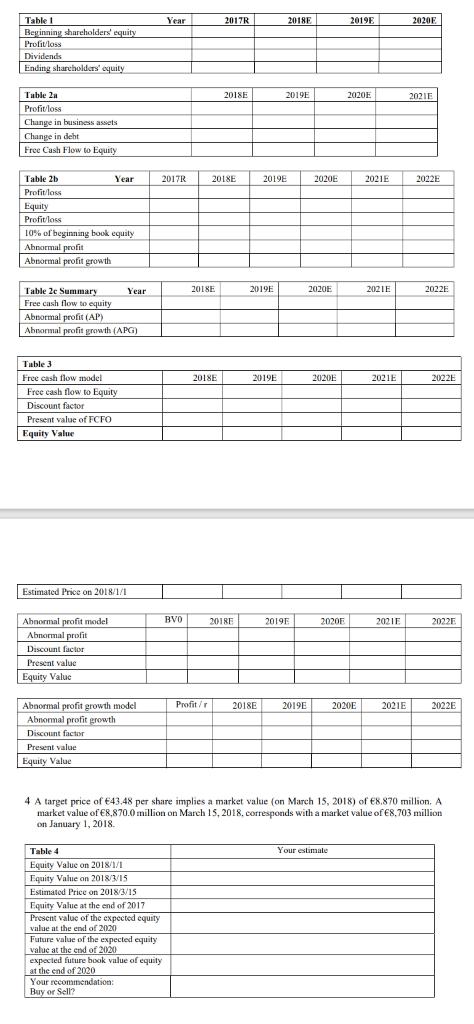

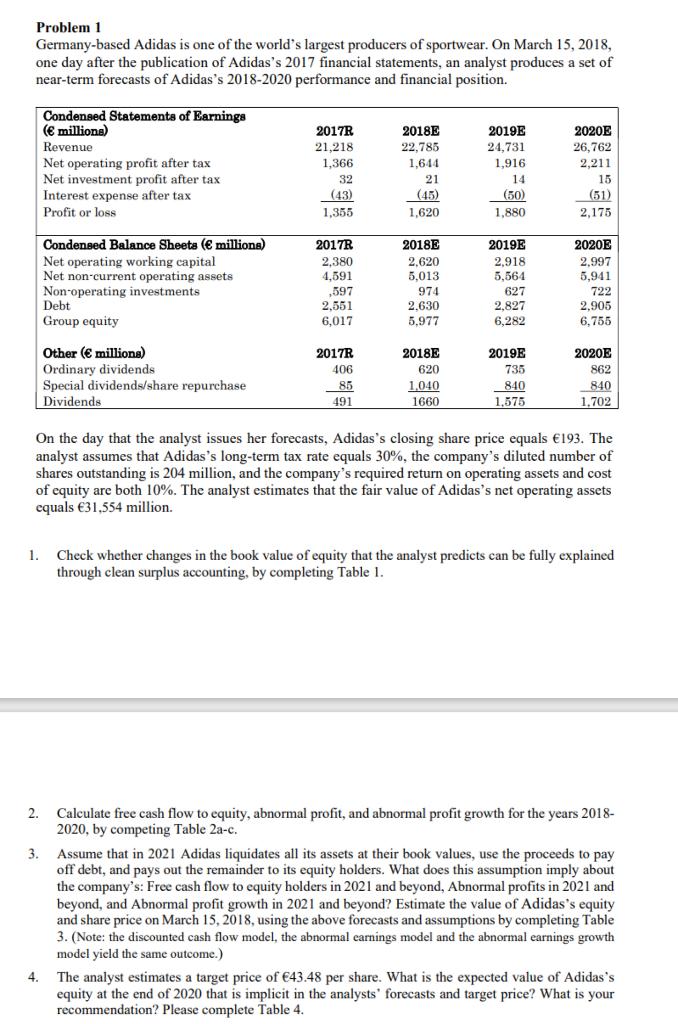

4 A target price of 643.48 per share implies a market value (on March 15, 2018) of 8.870 million. A market value of 8,870.0 million on March 15, 2018, corresponds with a market value of 8,703 million on January 1,2018. Problem 1 Germany-based Adidas is one of the world's largest producers of sportwear. On March 15, 2018, one day after the publication of Adidas's 2017 financial statements, an analyst produces a set of near-term forecasts of Adidas's 2018-2020 performance and financial position. On the day that the analyst issues her forecasts, Adidas's closing share price equals 193. The analyst assumes that Adidas's long-term tax rate equals 30%, the company's diluted number of shares outstanding is 204 million, and the company's required return on operating assets and cost of equity are both 10%. The analyst estimates that the fair value of Adidas's net operating assets equals 31,554 million. 1. Check whether changes in the book value of equity that the analyst predicts can be fully explained through clean surplus accounting, by completing Table 1 . 2. Calculate free cash flow to equity, abnormal profit, and abnormal profit growth for the years 20182020 , by competing Table 2ac. 3. Assume that in 2021 Adidas liquidates all its assets at their book values, use the proceeds to pay off debt, and pays out the remainder to its equity holders. What does this assumption imply about the company's: Free cash flow to equity holders in 2021 and beyond, Abnormal profits in 2021 and beyond, and Abnormal profit growth in 2021 and beyond? Estimate the value of Adidas's equity and share price on March 15,2018, using the above forecasts and assumptions by completing Table 3. (Note: the discounted cash flow model, the abnormal earnings model and the abnormal earnings growth model yield the same outcome.) 4. The analyst estimates a target price of 43.48 per share. What is the expected value of Adidas's equity at the end of 2020 that is implicit in the analysts' forecasts and target price? What is your recommendation? Please complete Table 4. 4 A target price of 643.48 per share implies a market value (on March 15, 2018) of 8.870 million. A market value of 8,870.0 million on March 15, 2018, corresponds with a market value of 8,703 million on January 1,2018. Problem 1 Germany-based Adidas is one of the world's largest producers of sportwear. On March 15, 2018, one day after the publication of Adidas's 2017 financial statements, an analyst produces a set of near-term forecasts of Adidas's 2018-2020 performance and financial position. On the day that the analyst issues her forecasts, Adidas's closing share price equals 193. The analyst assumes that Adidas's long-term tax rate equals 30%, the company's diluted number of shares outstanding is 204 million, and the company's required return on operating assets and cost of equity are both 10%. The analyst estimates that the fair value of Adidas's net operating assets equals 31,554 million. 1. Check whether changes in the book value of equity that the analyst predicts can be fully explained through clean surplus accounting, by completing Table 1 . 2. Calculate free cash flow to equity, abnormal profit, and abnormal profit growth for the years 20182020 , by competing Table 2ac. 3. Assume that in 2021 Adidas liquidates all its assets at their book values, use the proceeds to pay off debt, and pays out the remainder to its equity holders. What does this assumption imply about the company's: Free cash flow to equity holders in 2021 and beyond, Abnormal profits in 2021 and beyond, and Abnormal profit growth in 2021 and beyond? Estimate the value of Adidas's equity and share price on March 15,2018, using the above forecasts and assumptions by completing Table 3. (Note: the discounted cash flow model, the abnormal earnings model and the abnormal earnings growth model yield the same outcome.) 4. The analyst estimates a target price of 43.48 per share. What is the expected value of Adidas's equity at the end of 2020 that is implicit in the analysts' forecasts and target price? What is your recommendation? Please complete Table 4