Answered step by step

Verified Expert Solution

Question

1 Approved Answer

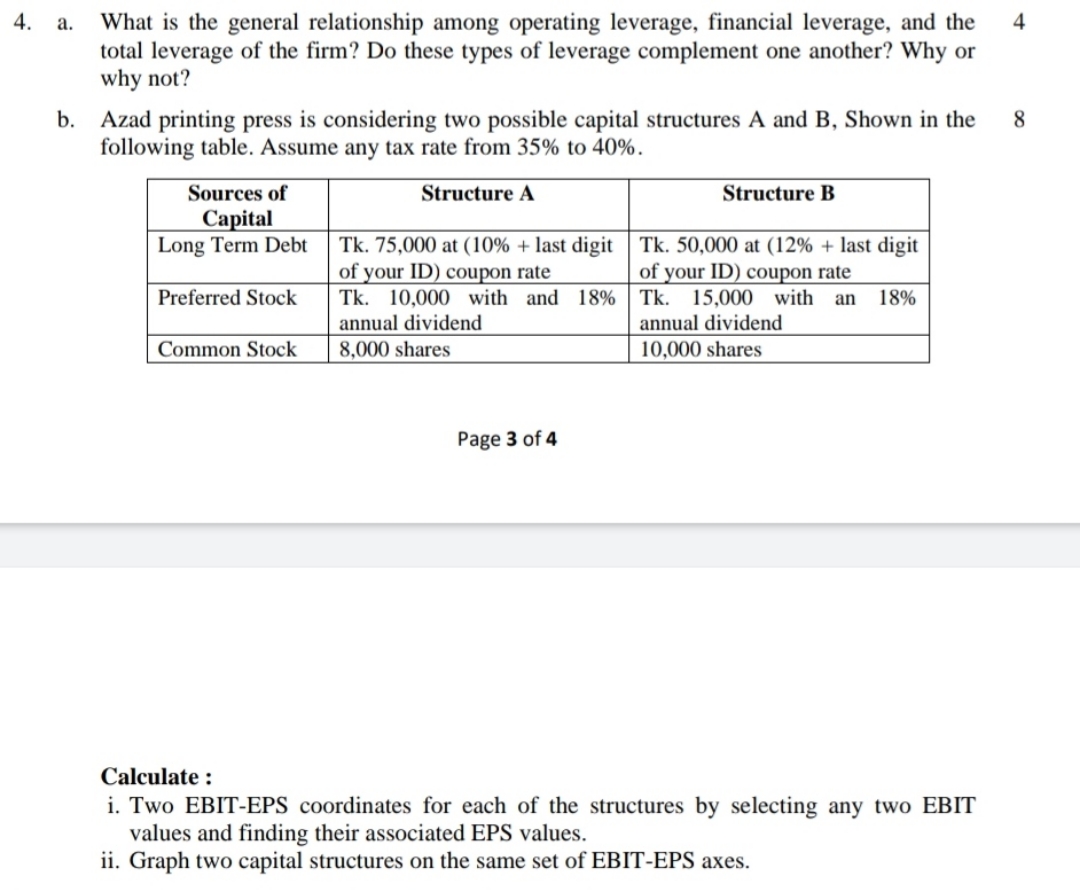

4. a. What is the general relationship among operating leverage, financial leverage, and the total leverage of the firm? Do these types of leverage

4. a. What is the general relationship among operating leverage, financial leverage, and the total leverage of the firm? Do these types of leverage complement one another? Why or why not? b. Azad printing press is considering two possible capital structures A and B, Shown in the following table. Assume any tax rate from 35% to 40%. Structure B 4 8 Sources of Capital Long Term Debt Structure A Tk. 75,000 at (10% + last digit of your ID) coupon rate Tk. 50,000 at (12% + last digit of your ID) coupon rate Preferred Stock Tk. 10,000 with and 18% Tk. 15,000 with an 18% annual dividend Common Stock 8,000 shares annual dividend 10,000 shares Page 3 of 4 Calculate: i. Two EBIT-EPS coordinates for each of the structures by selecting any two EBIT values and finding their associated EPS values. ii. Graph two capital structures on the same set of EBIT-EPS axes.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started