Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Accounting 367 Spring 2024 Prof. Barry Leibowicz Queens College, CUNY Tax Research Problem John Smith is an employee of Raytheon Corporation who specializes in

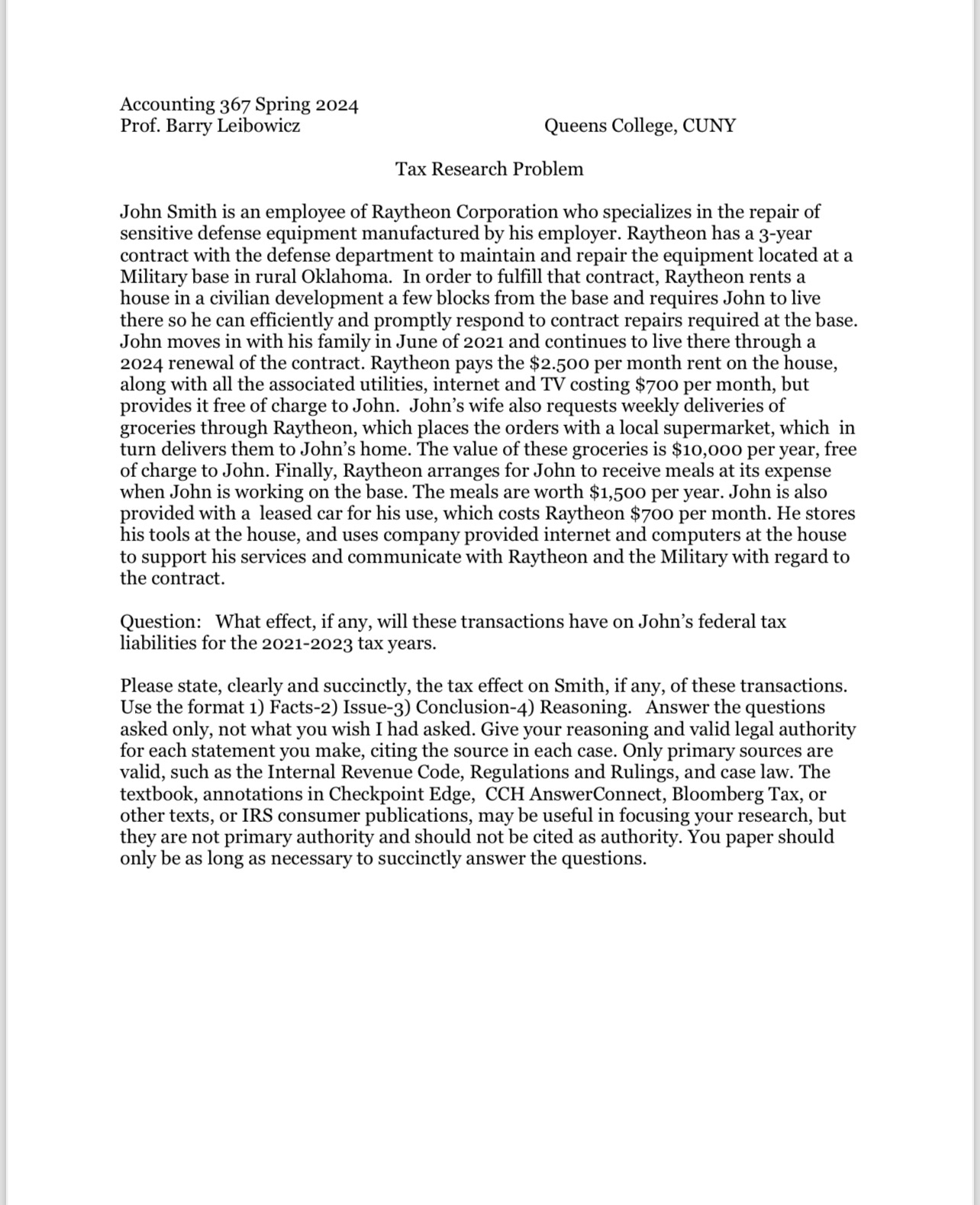

Accounting 367 Spring 2024 Prof. Barry Leibowicz Queens College, CUNY Tax Research Problem John Smith is an employee of Raytheon Corporation who specializes in the repair of sensitive defense equipment manufactured by his employer. Raytheon has a 3-year contract with the defense department to maintain and repair the equipment located at a Military base in rural Oklahoma. In order to fulfill that contract, Raytheon rents a house in a civilian development a few blocks from the base and requires John to live there so he can efficiently and promptly respond to contract repairs required at the base. John moves in with his family in June of 2021 and continues to live there through a 2024 renewal of the contract. Raytheon pays the $2.500 per month rent on the house, along with all the associated utilities, internet and TV costing $700 per month, but provides it free of charge to John. John's wife also requests weekly deliveries of groceries through Raytheon, which places the orders with a local supermarket, which in turn delivers them to John's home. The value of these groceries is $10,000 per year, free of charge to John. Finally, Raytheon arranges for John to receive meals at its expense when John is working on the base. The meals are worth $1,500 per year. John is also provided with a leased car for his use, which costs Raytheon $700 per month. He stores his tools at the house, and uses company provided internet and computers at the house to support his services and communicate with Raytheon and the Military with regard to the contract. Question: What effect, if any, will these transactions have on John's federal tax liabilities for the 2021-2023 tax years. Please state, clearly and succinctly, the tax effect on Smith, if any, of these transactions. Use the format 1) Facts-2) Issue-3) Conclusion-4) Reasoning. Answer the questions asked only, not what you wish I had asked. Give your reasoning and valid legal authority for each statement you make, citing the source in each case. Only primary sources are valid, such as the Internal Revenue Code, Regulations and Rulings, and case law. The textbook, annotations in Checkpoint Edge, CCH AnswerConnect, Bloomberg Tax, or other texts, or IRS consumer publications, may be useful in focusing your research, but they are not primary authority and should not be cited as authority. You paper should only be as long as necessary to succinctly answer the questions.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started