Answered step by step

Verified Expert Solution

Question

1 Approved Answer

4. According to the Modigliani and Miller propositions, when graphing firm value against debt levels, the debt level that maximizes the value of the firm

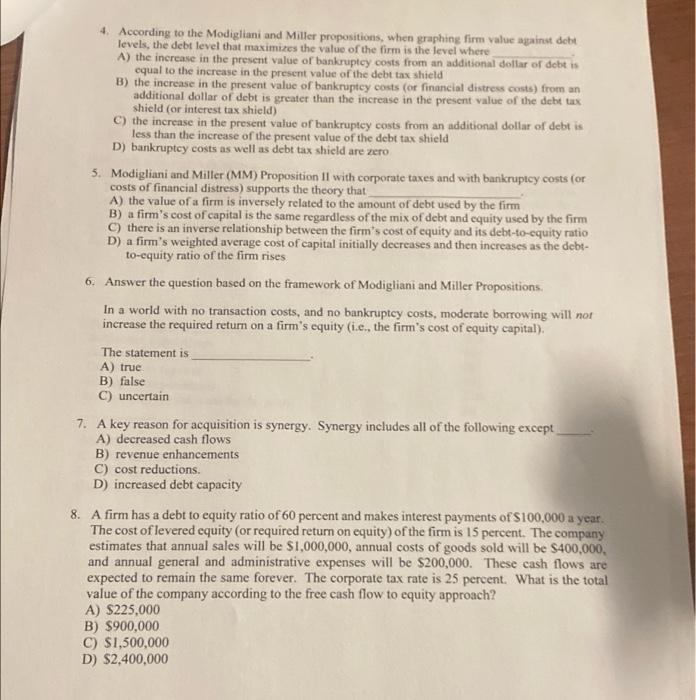

4. According to the Modigliani and Miller propositions, when graphing firm value against debt levels, the debt level that maximizes the value of the firm is the level where A) the increase in the present value of bankruptcy costs from an additional dollar of debt is equal to the increase in the present value of the debt tax shield B) the increase in the present Value of bankruptey costs (or financial distress costs) from an additional dollar of debt is greater than the increase in the present value of the debt tax shield (or interest tax shield) C) the increase in the present value of bankruptcy costs from an additional dollar of debt is less than the increase of the present value of the debt tax shield D) bankruptcy costs as well as debt tax shield are zero 5. Modigliani and Miller (MM) Proposition II with corporate taxes and with bankruptcy costs (or costs of financial distress) supports the theory that A) the value of a firm is inversely related to the amount of debt used by the firm B) a firm's cost of capital is the same regardless of the mix of debt and equity used by the firm C) there is an inverse relationship between the firm's cost of equity and its debt-to-equity ratio D) a firm's weighted average cost of capital initially decreases and then increases as the debt- to-equity ratio of the firm rises 6. Answer the question based on the framework of Modigliani and Miller Propositions. In a world with no transaction costs, and no bankruptcy costs, moderate borrowing will not increase the required return on a firm's equity (i.e., the firm's cost of equity capital). The statement is A) true B) false C) uncertain 7. A key reason for acquisition is synergy. Synergy includes all of the following except A) decreased cash flows B) revenue enhancements C) cost reductions D) increased debt capacity 8. A firm has a debt to equity ratio of 60 percent and makes interest payments of S100.000 a year. The cost of levered equity (or required retum on equity) of the firm is 15 percent. The company estimates that annual sales will be $1,000,000, annual costs of goods sold will be $400,000, and annual general and administrative expenses will be $200,000. These cash flows are expected to remain the same forever. The corporate tax rate is 25 percent. What is the total value of the company according to the free cash flow to equity approach? A) $225,000 B) $900,000 C) $1,500,000 D) $2,400,000

4. According to the Modigliani and Miller propositions, when graphing firm value against debt levels, the debt level that maximizes the value of the firm is the level where A) the increase in the present value of bankruptcy costs from an additional dollar of debt is equal to the increase in the present value of the debt tax shield B) the increase in the present Value of bankruptey costs (or financial distress costs) from an additional dollar of debt is greater than the increase in the present value of the debt tax shield (or interest tax shield) C) the increase in the present value of bankruptcy costs from an additional dollar of debt is less than the increase of the present value of the debt tax shield D) bankruptcy costs as well as debt tax shield are zero 5. Modigliani and Miller (MM) Proposition II with corporate taxes and with bankruptcy costs (or costs of financial distress) supports the theory that A) the value of a firm is inversely related to the amount of debt used by the firm B) a firm's cost of capital is the same regardless of the mix of debt and equity used by the firm C) there is an inverse relationship between the firm's cost of equity and its debt-to-equity ratio D) a firm's weighted average cost of capital initially decreases and then increases as the debt- to-equity ratio of the firm rises 6. Answer the question based on the framework of Modigliani and Miller Propositions. In a world with no transaction costs, and no bankruptcy costs, moderate borrowing will not increase the required return on a firm's equity (i.e., the firm's cost of equity capital). The statement is A) true B) false C) uncertain 7. A key reason for acquisition is synergy. Synergy includes all of the following except A) decreased cash flows B) revenue enhancements C) cost reductions D) increased debt capacity 8. A firm has a debt to equity ratio of 60 percent and makes interest payments of S100.000 a year. The cost of levered equity (or required retum on equity) of the firm is 15 percent. The company estimates that annual sales will be $1,000,000, annual costs of goods sold will be $400,000, and annual general and administrative expenses will be $200,000. These cash flows are expected to remain the same forever. The corporate tax rate is 25 percent. What is the total value of the company according to the free cash flow to equity approach? A) $225,000 B) $900,000 C) $1,500,000 D) $2,400,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started