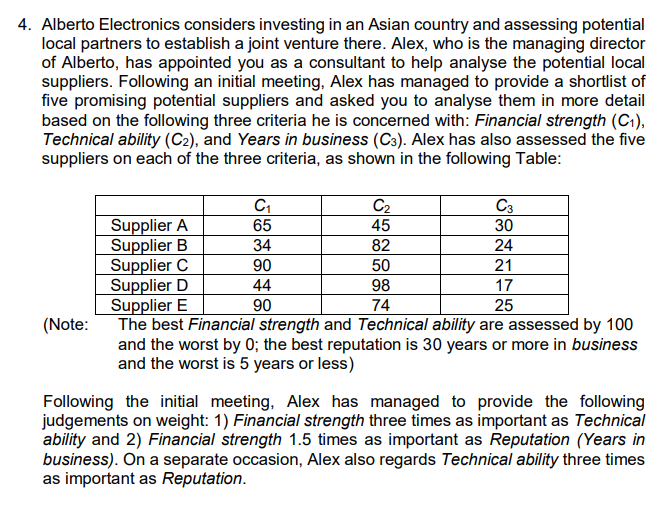

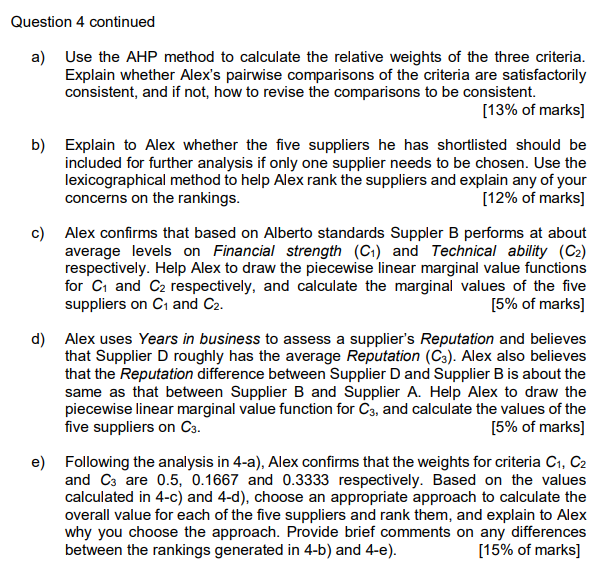

4. Alberto Electronics considers investing in an Asian country and assessing potential local partners to establish a joint venture there. Alex, who is the managing director of Alberto, has appointed you as a consultant to help analyse the potential local suppliers. Following an initial meeting, Alex has managed to provide a shortlist of five promising potential suppliers and asked you to analyse them in more detail based on the following three criteria he is concerned with: Financial strength (C1), Technical ability (C2), and Years in business (C3). Alex has also assessed the five suppliers on each of the three criteria, as shown in the following Table: C1 C2 C3 Supplier A 65 45 30 Supplier B 34 82 24 Supplier C 90 50 21 Supplier D 44 98 17 Supplier E 90 74 25 The best Financial strength and Technical ability are assessed by 100 and the worst by 0; the best reputation is 30 years or more in business and the worst is 5 years or less) (Note: Following the initial meeting, Alex has managed to provide the following judgements on weight: 1) Financial strength three times as important as Technical ability and 2) Financial strength 1.5 times as important as Reputation (Years in business). On a separate occasion, Alex also regards Technical ability three times as important as Reputation. Question 4 continued a) Use the AHP method to calculate the relative weights of the three criteria. Explain whether Alex's pairwise comparisons of the criteria are satisfactorily consistent, and if not, how to revise the comparisons to be consistent. [13% of marks] b) Explain to Alex whether the five suppliers he has shortlisted should be included for further analysis if only one supplier needs to be chosen. Use the lexicographical method to help Alex rank the suppliers and explain any of your concerns on the rankings. [12% of marks] c) Alex confirms that based on Alberto standards Suppler B performs at about average levels on Financial strength (C1) and Technical ability (C2) respectively. Help Alex to draw the piecewise linear marginal value functions for Ct and Cz respectively, and calculate the marginal values of the five suppliers on C1 and C2. [5% of marks] d) Alex uses Years in business to assess a supplier's Reputation and believes that Supplier D roughly has the average Reputation (C3). Alex also believes that the Reputation difference between Supplier D and Supplier B is about the same as that between Supplier B and Supplier A. Help Alex to draw the piecewise linear marginal value function for C3, and calculate the values of the five suppliers on C3. [5% of marks] e) Following the analysis in 4-a), Alex confirms that the weights for criteria C1, C2 and C3 are 0.5, 0.1667 and 0.3333 respectively. Based on the values calculated in 4-c) and 4-d), choose an appropriate approach to calculate the overall value for each of the five suppliers and rank them, and explain to Alex why you choose the approach. Provide brief comments on any differences between the rankings generated in 4-b) and 4-e). [15% of marks] 4. Alberto Electronics considers investing in an Asian country and assessing potential local partners to establish a joint venture there. Alex, who is the managing director of Alberto, has appointed you as a consultant to help analyse the potential local suppliers. Following an initial meeting, Alex has managed to provide a shortlist of five promising potential suppliers and asked you to analyse them in more detail based on the following three criteria he is concerned with: Financial strength (C1), Technical ability (C2), and Years in business (C3). Alex has also assessed the five suppliers on each of the three criteria, as shown in the following Table: C1 C2 C3 Supplier A 65 45 30 Supplier B 34 82 24 Supplier C 90 50 21 Supplier D 44 98 17 Supplier E 90 74 25 The best Financial strength and Technical ability are assessed by 100 and the worst by 0; the best reputation is 30 years or more in business and the worst is 5 years or less) (Note: Following the initial meeting, Alex has managed to provide the following judgements on weight: 1) Financial strength three times as important as Technical ability and 2) Financial strength 1.5 times as important as Reputation (Years in business). On a separate occasion, Alex also regards Technical ability three times as important as Reputation. Question 4 continued a) Use the AHP method to calculate the relative weights of the three criteria. Explain whether Alex's pairwise comparisons of the criteria are satisfactorily consistent, and if not, how to revise the comparisons to be consistent. [13% of marks] b) Explain to Alex whether the five suppliers he has shortlisted should be included for further analysis if only one supplier needs to be chosen. Use the lexicographical method to help Alex rank the suppliers and explain any of your concerns on the rankings. [12% of marks] c) Alex confirms that based on Alberto standards Suppler B performs at about average levels on Financial strength (C1) and Technical ability (C2) respectively. Help Alex to draw the piecewise linear marginal value functions for Ct and Cz respectively, and calculate the marginal values of the five suppliers on C1 and C2. [5% of marks] d) Alex uses Years in business to assess a supplier's Reputation and believes that Supplier D roughly has the average Reputation (C3). Alex also believes that the Reputation difference between Supplier D and Supplier B is about the same as that between Supplier B and Supplier A. Help Alex to draw the piecewise linear marginal value function for C3, and calculate the values of the five suppliers on C3. [5% of marks] e) Following the analysis in 4-a), Alex confirms that the weights for criteria C1, C2 and C3 are 0.5, 0.1667 and 0.3333 respectively. Based on the values calculated in 4-c) and 4-d), choose an appropriate approach to calculate the overall value for each of the five suppliers and rank them, and explain to Alex why you choose the approach. Provide brief comments on any differences between the rankings generated in 4-b) and 4-e). [15% of marks]