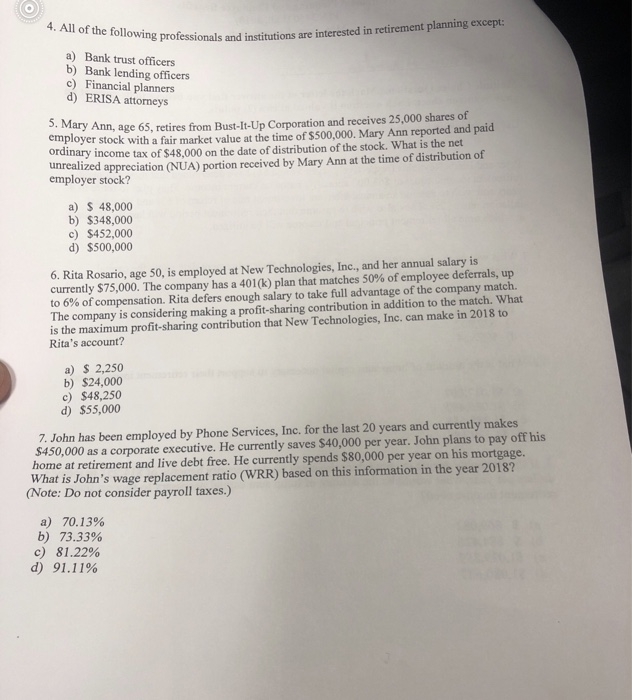

4. All of the following ng professionals and institutions are interested in retirement planning except: i a) Bank trust officers b) Bank lending officers c) Financial planners d) ERISA attorneys ary Ann, age 65, retires from Bust-It-Up Corporation and receives 25,000 shares of employer ordi 5. M stock with a fair market value at the time of $500,000. Mary Ann reported and paid nary income tax of $48,000 on the date of distribution of the stock. What is the net employer stock? ized appreciation (NUA) portion recived by Mary Ann at the time of distribution of a) 48,000 b) $348,000 c) $452,000 d) $500,000 6. Rita Rosario, age 50, is employed at New Technologies, Inc., and her annual salary is currently $75,000. The company has a 401 (k) plan that matches 50% of employee deferrals, up to 6% ofcom pensation. Rita defers enough salary to take full advantage of the company match. The company is considering making a profit-sharing contribution in addition to the match. What is the maximum profit-sharing contribution that New Technologies, Inc. can make in 2018 to Rita's account? a) 2,250 b) $24,000 c) $48,250 d) $55,000 $450,000 as a corporate executive. He currently saves $40,000 per year. John plans to pay off his Wh Note: Do not consider payroll taxes.) 7. John has been employed by Phone Services, Inc. for the last 20 years and currently makes home at retirement and live debt free. He currently spends $80,000 per year on his mortgage. at is John's wage replacement ratio (WRR) based on this information in the year 2018? a) 70.13% b) 73.33% c) 81.22% d) 91.11% 4. All of the following ng professionals and institutions are interested in retirement planning except: i a) Bank trust officers b) Bank lending officers c) Financial planners d) ERISA attorneys ary Ann, age 65, retires from Bust-It-Up Corporation and receives 25,000 shares of employer ordi 5. M stock with a fair market value at the time of $500,000. Mary Ann reported and paid nary income tax of $48,000 on the date of distribution of the stock. What is the net employer stock? ized appreciation (NUA) portion recived by Mary Ann at the time of distribution of a) 48,000 b) $348,000 c) $452,000 d) $500,000 6. Rita Rosario, age 50, is employed at New Technologies, Inc., and her annual salary is currently $75,000. The company has a 401 (k) plan that matches 50% of employee deferrals, up to 6% ofcom pensation. Rita defers enough salary to take full advantage of the company match. The company is considering making a profit-sharing contribution in addition to the match. What is the maximum profit-sharing contribution that New Technologies, Inc. can make in 2018 to Rita's account? a) 2,250 b) $24,000 c) $48,250 d) $55,000 $450,000 as a corporate executive. He currently saves $40,000 per year. John plans to pay off his Wh Note: Do not consider payroll taxes.) 7. John has been employed by Phone Services, Inc. for the last 20 years and currently makes home at retirement and live debt free. He currently spends $80,000 per year on his mortgage. at is John's wage replacement ratio (WRR) based on this information in the year 2018? a) 70.13% b) 73.33% c) 81.22% d) 91.11%