Answered step by step

Verified Expert Solution

Question

1 Approved Answer

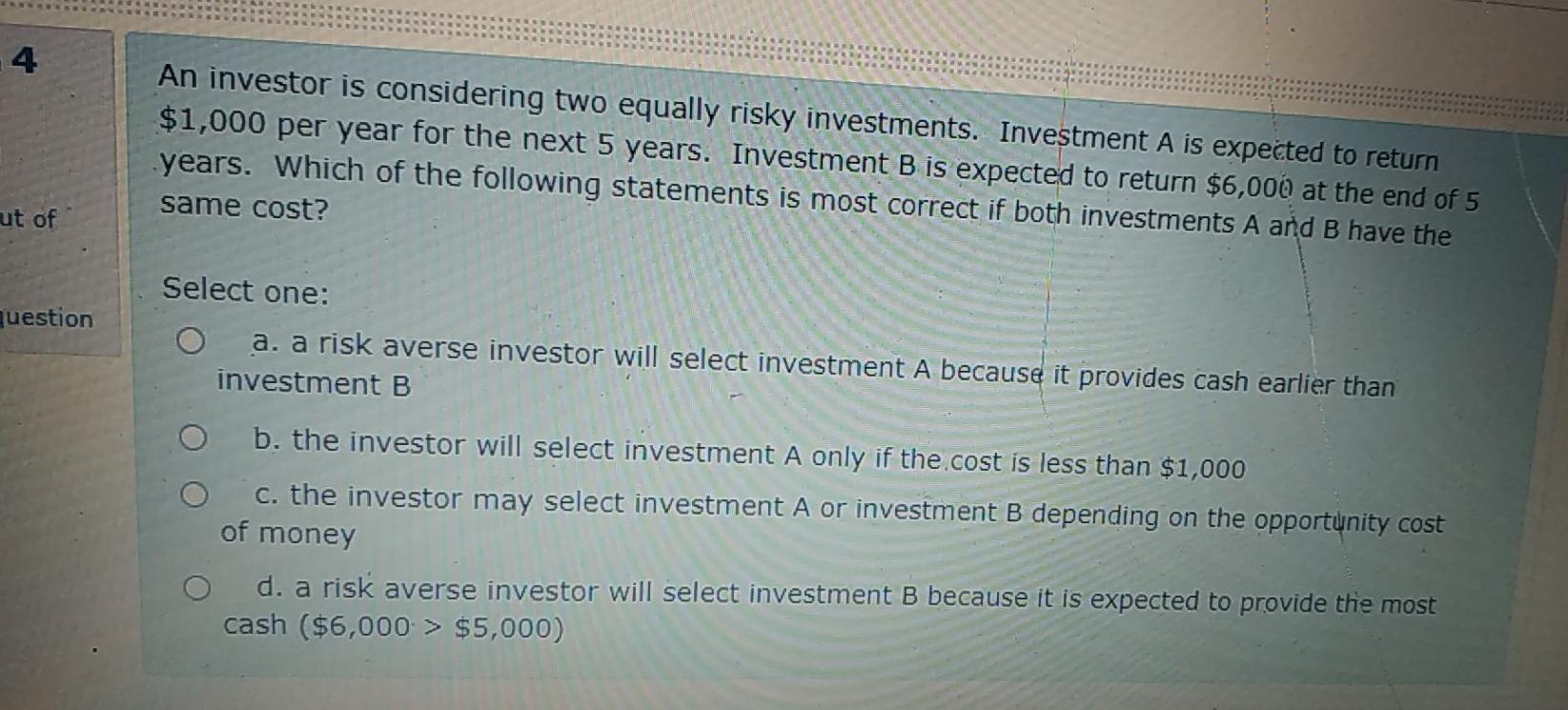

4 An investor is considering two equally risky investments. Investment A is expected to return $1,000 per year for the next 5 years. Investment B

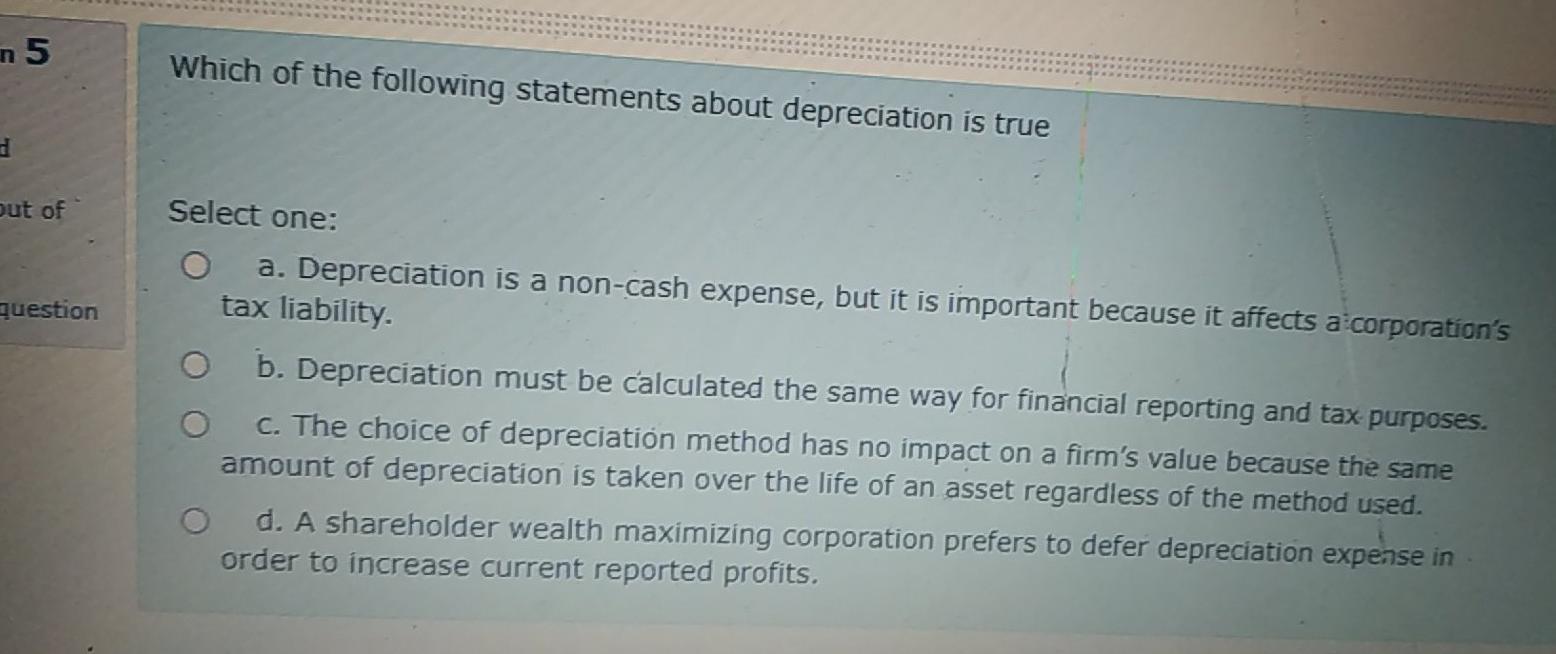

4 An investor is considering two equally risky investments. Investment A is expected to return $1,000 per year for the next 5 years. Investment B is expected to return $6,000 at the end of 5 years. Which of the following statements is most correct if both investments A and B have the same cost? ut of question Select one: a. a risk averse investor will select investment A because it provides cash earlier than investment B b. the investor will select investment A only if the cost is less than $1,000 c. the investor may select investment A or investment B depending on the opportunity cost of money d. a risk averse investor will select investment B because it is expected to provide the most cash ($6,000 > $5,000) n 5 Which of the following statements about depreciation is true out of question Select one: a. Depreciation is a non-cash expense, but it is important because it affects a corporation's tax liability. O b. Depreciation must be calculated the same way for financial reporting and tax purposes. C. The choice of depreciation method has no impact on a firm's value because the same amount of depreciation is taken over the life of an asset regardless of the method used. d. A shareholder wealth maximizing corporation prefers to defer depreciation expense in order to increase current reported profits. 6 Working capital management is ut of Select one: a. the decision making process with respect to investment in fixed assets. uestion b. The decision-making process with funding choices and the mix of long-term sources of funds C the management of the firm's current assets and short-term financing

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started