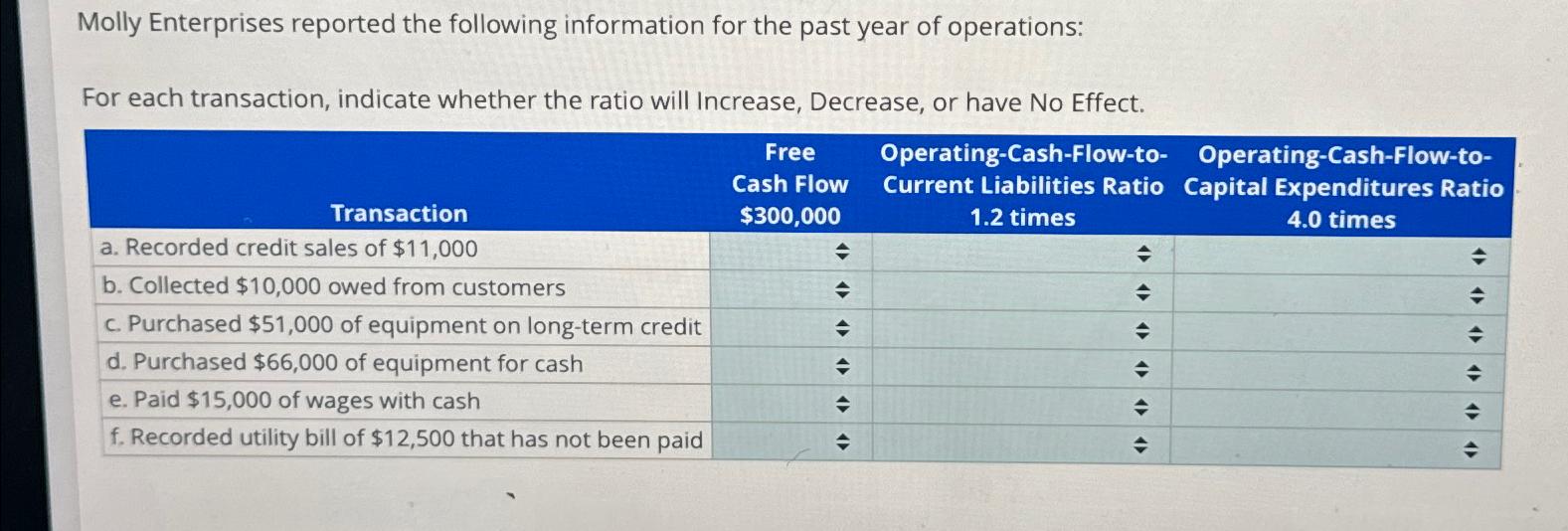

Molly Enterprises reported the following information for the past year of operations: For each transaction, indicate whether the ratio will Increase, Decrease, or have

Molly Enterprises reported the following information for the past year of operations: For each transaction, indicate whether the ratio will Increase, Decrease, or have No Effect. Operating-Cash-Flow-to- Transaction a. Recorded credit sales of $11,000 b. Collected $10,000 owed from customers c. Purchased $51,000 of equipment on long-term credit d. Purchased $66,000 of equipment for cash e. Paid $15,000 of wages with cash f. Recorded utility bill of $12,500 that has not been paid Free Cash Flow $300,000 1.2 times Operating-Cash-Flow-to- Current Liabilities Ratio Capital Expenditures Ratio 4.0 times = 4

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To analyze the impact of each transaction on the given financial ratios Free Cash Flow OperatingCashFlowtoCurrent Liabilities Ratio OperatingCashFlowt...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started