Question

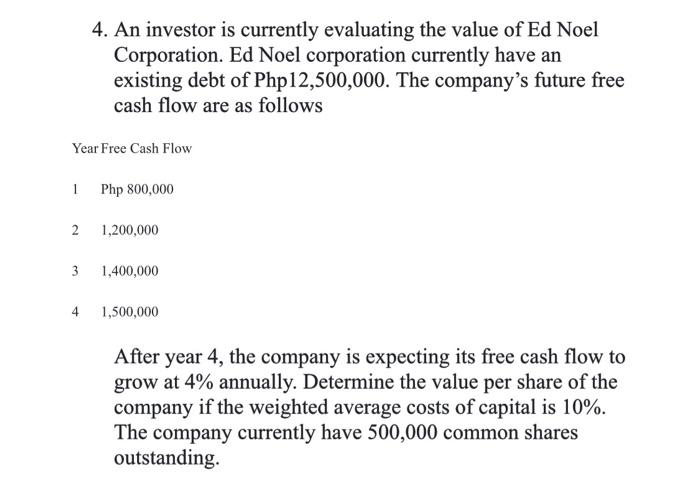

4. An investor is currently evaluating the value of Ed Noel Corporation. Ed Noel corporation currently have an existing debt of Php12,500,000. The company's

4. An investor is currently evaluating the value of Ed Noel Corporation. Ed Noel corporation currently have an existing debt of Php12,500,000. The company's future free cash flow are as follows Year Free Cash Flow 1 Php 800,000 2 1,200,000 3 1,400,000 4 1,500,000 After year 4, the company is expecting its free cash flow to grow at 4% annually. Determine the value per share of the company if the weighted average costs of capital is 10%. The company currently have 500,000 common shares outstanding.

Step by Step Solution

3.52 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

The value per share is calculated as total value of equity divided by number of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Global Investments

Authors: Bruno Solnik, Dennis McLeavey

6th edition

321527704, 978-0321527707

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App