Answered step by step

Verified Expert Solution

Question

1 Approved Answer

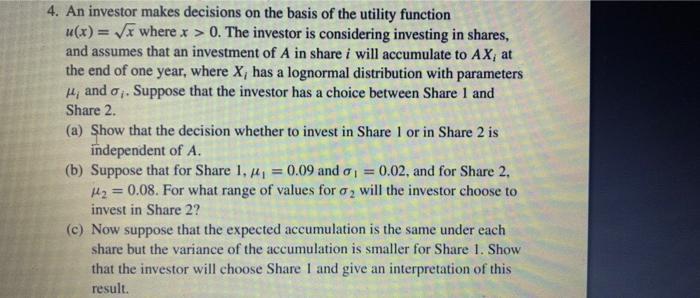

4. An investor makes decisions on the basis of the utility function u(x)=x where x > 0. The investor is considering investing in shares,

4. An investor makes decisions on the basis of the utility function u(x)=x where x > 0. The investor is considering investing in shares, and assumes that an investment of A in share i will accumulate to AX, at the end of one year, where X, has a lognormal distribution with parameters 14, and . Suppose that the investor has a choice between Share 1 and Share 2. (a) Show that the decision whether to invest in Share 1 or in Share 2 is independent of A. (b) Suppose that for Share 1, = 0.09 and = 0.02, and for Share 2, H2=0.08. For what range of values for 2 will the investor choose to invest in Share 2? (c) Now suppose that the expected accumulation is the same under each share but the variance of the accumulation is smaller for Share 1. Show that the investor will choose Share I and give an interpretation of this result.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started