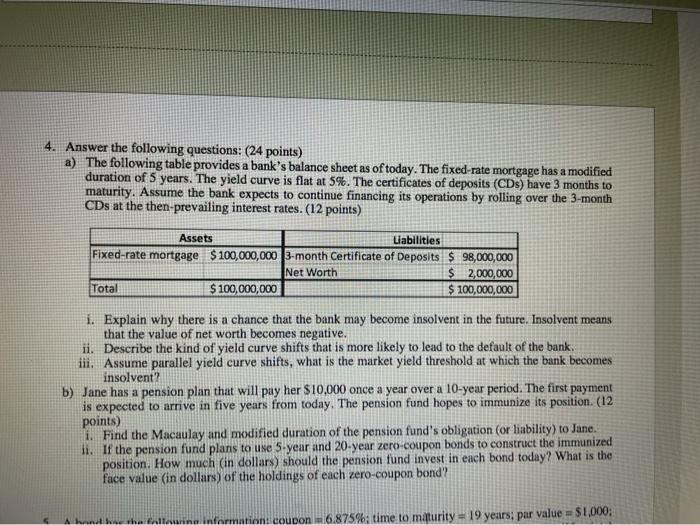

4. Answer the following questions: (24 points) a) The following table provides a bank's balance sheet as of today. The fixed-rate mortgage has a modified duration of 5 years. The yield curve is flat at 5%. The certificates of deposits (CDs) have 3 months to maturity. Assume the bank expects to continue financing its operations by rolling over the 3-month CDs at the then-prevailing interest rates. (12 points) Assets Liabilities Fixed-rate mortgage $100,000,000 3-month Certificate of Deposits $ 98,000,000 Net Worth $ 2,000,000 Total $100,000,000 $ 100,000,000 i. Explain why there is a chance that the bank may become insolvent in the future. Insolvent means that the value of net worth becomes negative. ii. Describe the kind of yield curve shifts that is more likely to lead to the default of the bank. iii. Assume parallel yield curve shifts, what is the market yield threshold at which the bank becomes insolvent? b) Jane has a pension plan that will pay her $10,000 once a year over a 10-year period. The first payment is expected to arrive in five years from today. The pension fund hopes to immunize its position. (12 points) i. Find the Macaulay and modified duration of the pension fund's obligation (or liability) to Jane. ii. If the pension fund plans to use 5-year and 20-year zero-coupon bonds to construct the immunized position. How much (in dollars) should the pension fund invest in each bond today? What is the face value (in dollars) of the holdings of each zero-coupon bond? handhah Alaina intern coupon 6.8754.time to maturity = 19 years: par value = $1,000: 4. Answer the following questions: (24 points) a) The following table provides a bank's balance sheet as of today. The fixed-rate mortgage has a modified duration of 5 years. The yield curve is flat at 5%. The certificates of deposits (CDs) have 3 months to maturity. Assume the bank expects to continue financing its operations by rolling over the 3-month CDs at the then-prevailing interest rates. (12 points) Assets Liabilities Fixed-rate mortgage $100,000,000 3-month Certificate of Deposits $ 98,000,000 Net Worth $ 2,000,000 Total $100,000,000 $ 100,000,000 i. Explain why there is a chance that the bank may become insolvent in the future. Insolvent means that the value of net worth becomes negative. ii. Describe the kind of yield curve shifts that is more likely to lead to the default of the bank. iii. Assume parallel yield curve shifts, what is the market yield threshold at which the bank becomes insolvent? b) Jane has a pension plan that will pay her $10,000 once a year over a 10-year period. The first payment is expected to arrive in five years from today. The pension fund hopes to immunize its position. (12 points) i. Find the Macaulay and modified duration of the pension fund's obligation (or liability) to Jane. ii. If the pension fund plans to use 5-year and 20-year zero-coupon bonds to construct the immunized position. How much (in dollars) should the pension fund invest in each bond today? What is the face value (in dollars) of the holdings of each zero-coupon bond? handhah Alaina intern coupon 6.8754.time to maturity = 19 years: par value = $1,000