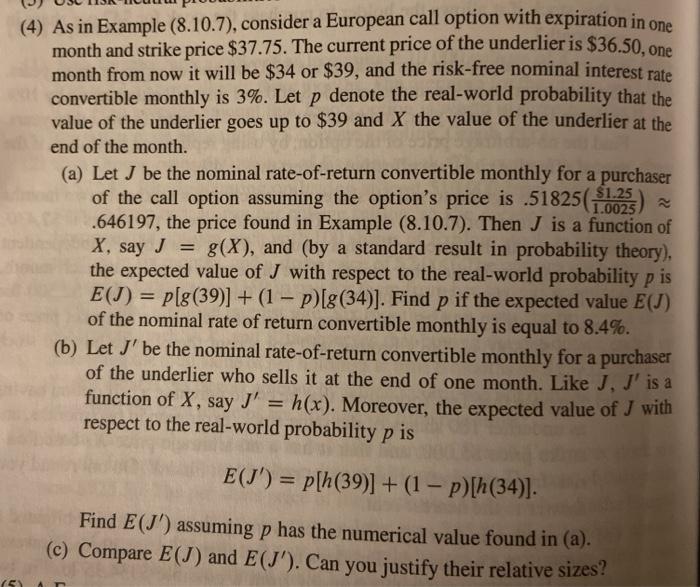

(4) As in Example (8.10.7), consider a European call option with expiration in one month and strike price $37.75. The current price of the underlier is $36.50, one month from now it will be $34 or $39, and the risk-free nominal interest rate convertible monthly is 3%. Let p denote the real-world probability that the value of the underlier goes up to $39 and X the value of the underlier at the end of the month. (a) Let J be the nominal rate-of-return convertible monthly for a purchaser of the call option assuming the option's price is .51825( $1.25 .646197, the price found in Example (8.10.7). Then J is a function of X, say J = g(x), and (by a standard result in probability theory), the expected value of J with respect to the real-world probability p is E(J) = p[g(39)] + (1 - p)[g(34)]. Find p if the expected value E(J) of the nominal rate of return convertible monthly is equal to 8.4%. (b) Let J' be the nominal rate-of-return convertible monthly for a purchaser of the underlier who sells it at the end of one month. Like J, J' is a function of X, say I' = h(x). Moreover, the expected value of J with respect to the real-world probability p is E(J') = p[h(39)] + (1 - p)[h(34)]. Find E(J') assuming p has the numerical value found in (a). (c) Compare E(I) and E(J'). Can you justify their relative sizes? (4) As in Example (8.10.7), consider a European call option with expiration in one month and strike price $37.75. The current price of the underlier is $36.50, one month from now it will be $34 or $39, and the risk-free nominal interest rate convertible monthly is 3%. Let p denote the real-world probability that the value of the underlier goes up to $39 and X the value of the underlier at the end of the month. (a) Let J be the nominal rate-of-return convertible monthly for a purchaser of the call option assuming the option's price is .51825( $1.25 .646197, the price found in Example (8.10.7). Then J is a function of X, say J = g(x), and (by a standard result in probability theory), the expected value of J with respect to the real-world probability p is E(J) = p[g(39)] + (1 - p)[g(34)]. Find p if the expected value E(J) of the nominal rate of return convertible monthly is equal to 8.4%. (b) Let J' be the nominal rate-of-return convertible monthly for a purchaser of the underlier who sells it at the end of one month. Like J, J' is a function of X, say I' = h(x). Moreover, the expected value of J with respect to the real-world probability p is E(J') = p[h(39)] + (1 - p)[h(34)]. Find E(J') assuming p has the numerical value found in (a). (c) Compare E(I) and E(J'). Can you justify their relative sizes