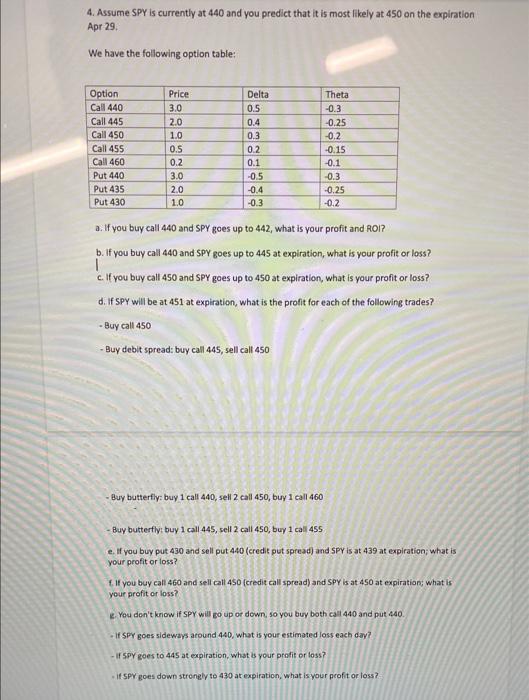

4. Assume SPY is currently at 440 and you predict that it is most likely at 450 on the expiration Apr 29. We have the following option table: Option Call 440 Call 445 Call 450 Call 455 Call 460 Put 440 Put 435 Put 430 Nolo Price 3.0 2.0 1.0 0.5 0.2 3.0 2.0 1.0 Delta 0.5 0.4 0.3 0.2 0.1 -0.5 -0.4 -0.3 Theta -0.3 -0.25 -0.2 -0.15 -0.1 -0.3 -0.25 -0.2 a. If you buy call 440 and SPY goes up to 442, what is your profit and ROI? b. If you buy call 440 and Spy goes up to 445 at expiration, what is your profit or loss? | c. If you buy call 450 and SPY goes up to 450 at expiration, what is your profit or loss? d. If SPY will be at 451 at expiration, what is the profit for each of the following trades? - Buy call 450 Buy debit spread: buy call 445, sell call 450 Buy butterfly: buy 1 call 440, sell 2 call 450, buy 1 call 460 Buy butterfly: buy 1 call 445, sell 2 call 450, buy 1 call 455 e. If you buy put 430 and sell put 440 (credit put spread) and SPY is at 439 at expiration; what is your profit or loss? 1. If you buy call 460 and sell call 450 credit call spread) and SPY is at 450 at expiration, what is your profit or loss? 2. You don't know if SPY will go up or down, so you buy both call 440 and put 140. If SPY goes sideways around 440, what is your estimated loss each day? - If SPY goes to 445 at expiration, what your profit or loss? if SPY goes down strongly to 430 at expiration, what is your profit or loss? 4. Assume SPY is currently at 440 and you predict that it is most likely at 450 on the expiration Apr 29. We have the following option table: Option Call 440 Call 445 Call 450 Call 455 Call 460 Put 440 Put 435 Put 430 Nolo Price 3.0 2.0 1.0 0.5 0.2 3.0 2.0 1.0 Delta 0.5 0.4 0.3 0.2 0.1 -0.5 -0.4 -0.3 Theta -0.3 -0.25 -0.2 -0.15 -0.1 -0.3 -0.25 -0.2 a. If you buy call 440 and SPY goes up to 442, what is your profit and ROI? b. If you buy call 440 and Spy goes up to 445 at expiration, what is your profit or loss? | c. If you buy call 450 and SPY goes up to 450 at expiration, what is your profit or loss? d. If SPY will be at 451 at expiration, what is the profit for each of the following trades? - Buy call 450 Buy debit spread: buy call 445, sell call 450 Buy butterfly: buy 1 call 440, sell 2 call 450, buy 1 call 460 Buy butterfly: buy 1 call 445, sell 2 call 450, buy 1 call 455 e. If you buy put 430 and sell put 440 (credit put spread) and SPY is at 439 at expiration; what is your profit or loss? 1. If you buy call 460 and sell call 450 credit call spread) and SPY is at 450 at expiration, what is your profit or loss? 2. You don't know if SPY will go up or down, so you buy both call 440 and put 140. If SPY goes sideways around 440, what is your estimated loss each day? - If SPY goes to 445 at expiration, what your profit or loss? if SPY goes down strongly to 430 at expiration, what is your profit or loss