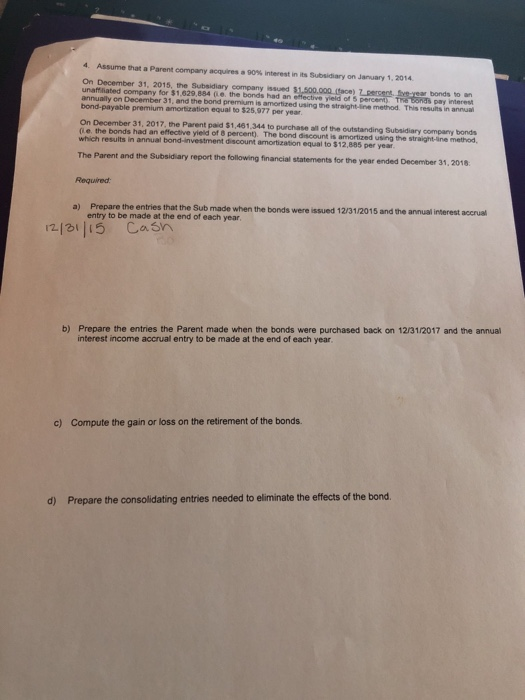

4. Assume that a Parent company acquires a 90% interest in its Subsidiary on January 1, 2014 On December 31, 2015, the Subsidiary company issued $1,500,000 face) unaffliated company for $1,629,884 e the bonds had an effective yield of 5 percent) T annually on December 31, and the bond premium is amortized using the straight-ine method. This results in anna T recent bonds to a bond-payable premium amortization equal to $25,977 per year On December 31, 2017, the Parent paid $1,461,344 to purchase all of the outstanding Subsidiary company bonds bonds had an effective yield of 8 percent). The bond discount is amortized using the straight-line method which resuits in annual bond-investment discount amortization equal to $12,885 per year The Parent and the Subsidiary report the following financial statements for the year ended December 31, 2018 Required Prepare the entries that the Sub made when the bonds were issued 12/31/2015 and the annual interest entry to be made at the end of each year a) accrual 213115 Casn b) Prepare the entries the Parent made when the bonds were purchased back on 12/31/2017 and the annual interest income accrual entry to be made at the end of each year c) Compute the gain or loss on the retirement of the bonds. d) Prepare the consolidating entries needed to eliminate the effects of the bond. 4. Assume that a Parent company acquires a 90% interest in its Subsidiary on January 1, 2014 On December 31, 2015, the Subsidiary company issued $1,500,000 face) unaffliated company for $1,629,884 e the bonds had an effective yield of 5 percent) T annually on December 31, and the bond premium is amortized using the straight-ine method. This results in anna T recent bonds to a bond-payable premium amortization equal to $25,977 per year On December 31, 2017, the Parent paid $1,461,344 to purchase all of the outstanding Subsidiary company bonds bonds had an effective yield of 8 percent). The bond discount is amortized using the straight-line method which resuits in annual bond-investment discount amortization equal to $12,885 per year The Parent and the Subsidiary report the following financial statements for the year ended December 31, 2018 Required Prepare the entries that the Sub made when the bonds were issued 12/31/2015 and the annual interest entry to be made at the end of each year a) accrual 213115 Casn b) Prepare the entries the Parent made when the bonds were purchased back on 12/31/2017 and the annual interest income accrual entry to be made at the end of each year c) Compute the gain or loss on the retirement of the bonds. d) Prepare the consolidating entries needed to eliminate the effects of the bond