Answered step by step

Verified Expert Solution

Question

1 Approved Answer

4 . Assume the partnership of Erin, Evan and Josh has been in existence for a number of years. Erin decides to withdraw from the

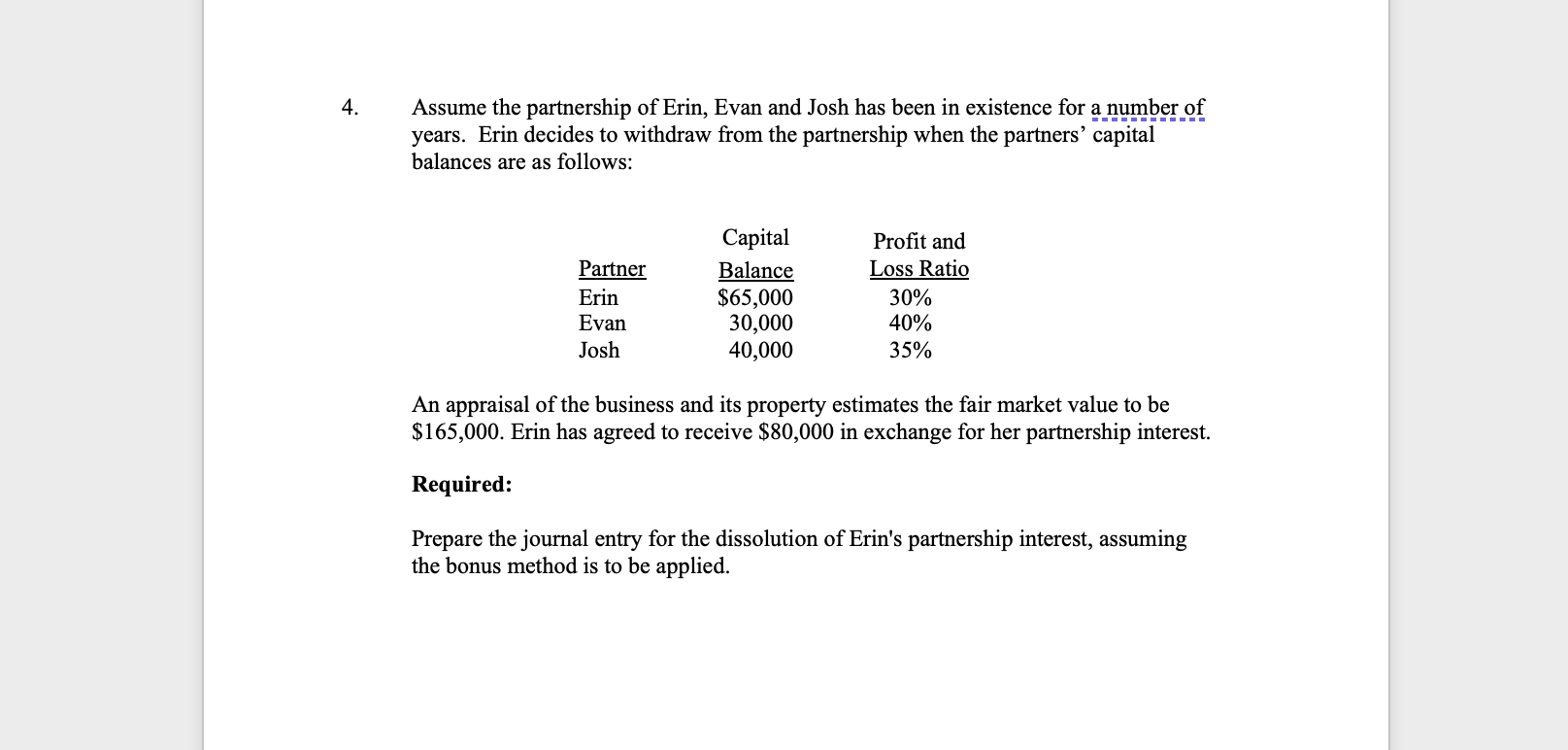

Assume the partnership of Erin, Evan and Josh has been in existence for a number of years. Erin decides to withdraw from the partnership when the partners capital balances are as follows:

Partner Capital

Balance Profit and

Loss Ratio

Erin $

Evan

Josh

An appraisal of the business and its property estimates the fair market value to be $ Erin has agreed to receive $ in exchange for her partnership interest.

Required:

Prepare the journal entry for the dissolution of Erin's partnership interest, assuming the bonus method is to be applied.Assume the partnership of Erin, Evan and Josh has been in existence for a number of

years. Erin decides to withdraw from the partnership when the partners' capital

balances are as follows:

An appraisal of the business and its property estimates the fair market value to be

$ Erin has agreed to receive $ in exchange for her partnership interest.

Required:

Prepare the journal entry for the dissolution of Erin's partnership interest, assuming

the bonus method is to be applied.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started