Answered step by step

Verified Expert Solution

Question

1 Approved Answer

4 (B) On 1st January 2023, an investor has portfolio of Rs 1 Crore with a portfolio beta of 0.8. while the prices of

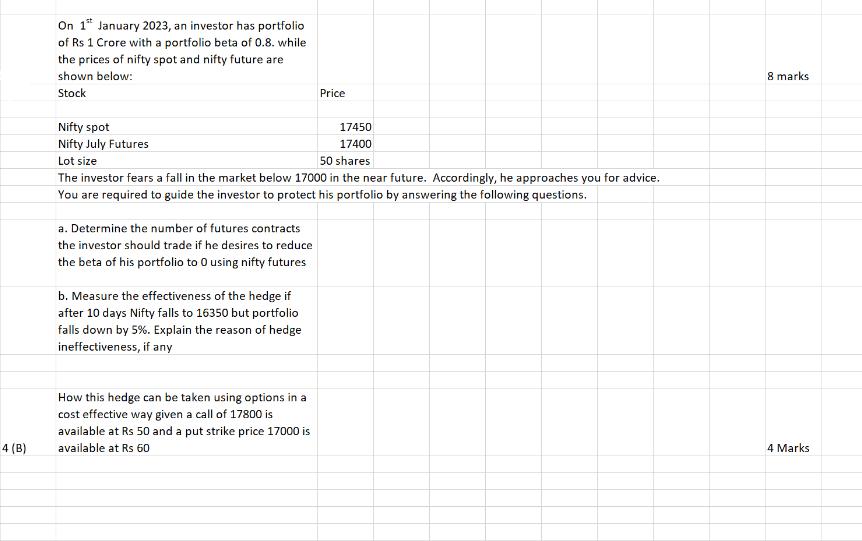

4 (B) On 1st January 2023, an investor has portfolio of Rs 1 Crore with a portfolio beta of 0.8. while the prices of nifty spot and nifty future are shown below: Stock Nifty spot Nifty July Futures Lot size 17450 17400 50 shares The investor fears a fall in the market below 17000 in the near future. Accordingly, he approaches you for advice. You are required to guide the investor to protect his portfolio by answering the following questions. a. Determine the number of futures contracts the investor should trade if he desires to reduce the beta of his portfolio to 0 using nifty futures b. Measure the effectiveness of the hedge if after 10 days Nifty falls to 16350 but portfolio falls down by 5%. Explain the reason of hedge ineffectiveness, if any Price How this hedge can be taken using options in a cost effective way given a call of 17800 is available at Rs 50 and a put strike price 17000 is available at Rs 60 8 marks 4 Marks

Step by Step Solution

★★★★★

3.45 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

a To reduce the beta of the portfolio to 0 the investor needs to take an opposite position in the Nifty futures contracts The formula to calculate the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started