Answered step by step

Verified Expert Solution

Question

1 Approved Answer

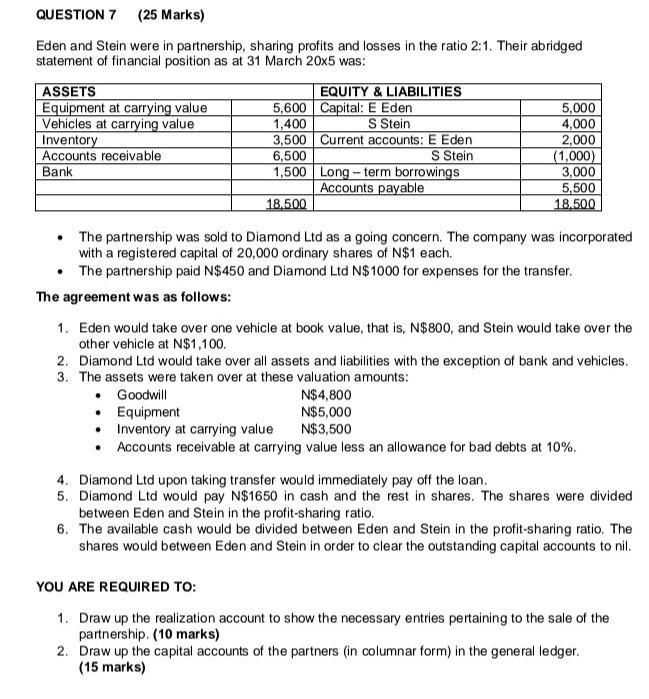

QUESTION 7 (25 Marks) Eden and Stein were in partnership, sharing profits and losses in the ratio 2:1. Their abridged statement of financial position

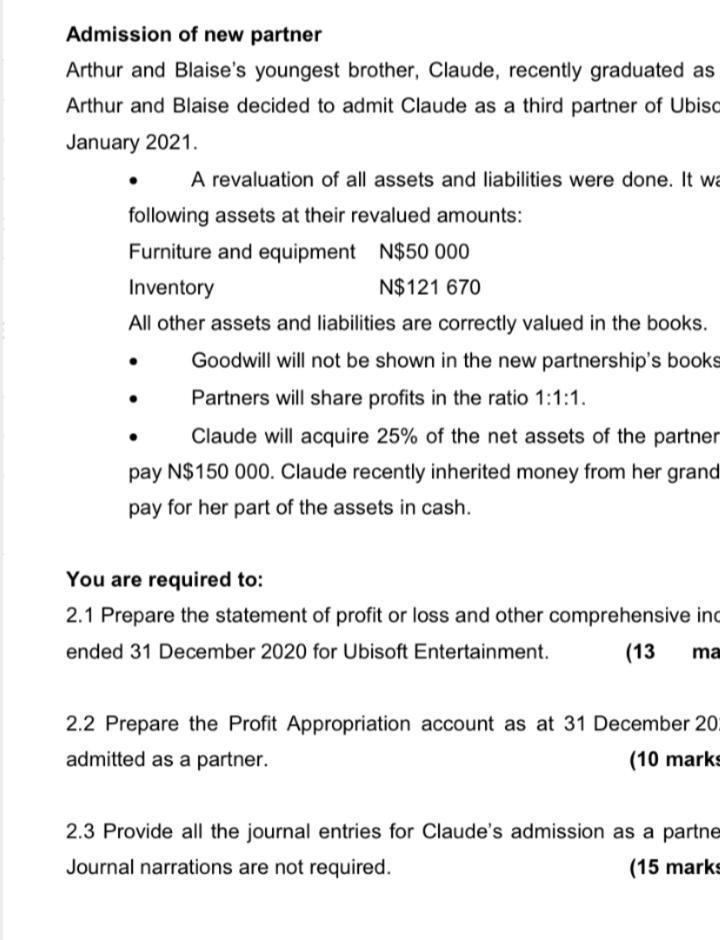

QUESTION 7 (25 Marks) Eden and Stein were in partnership, sharing profits and losses in the ratio 2:1. Their abridged statement of financial position as at 31 March 20x5 was: ASSETS Equipment at carrying value Vehicles at carrying value Inventory Accounts receivable Bank 5,600 EQUITY & LIABILITIES Capital: E Eden S Stein 1,400 3,500 Current accounts: E Eden S Stein 6,500 1,500 18.500 Long-term borrowings Accounts payable 5,000 4,000 2,000 The partnership was sold to Diamond Ltd as a going concern. The company was incorporated with a registered capital of 20,000 ordinary shares of N$1 each. The partnership paid N$450 and Diamond Ltd N$1000 for expenses for the transfer. The agreement was as follows: (1,000) 3,000 5,500 18.500 1. Eden would take over one vehicle at book value, that is, N$800, and Stein would take over the other vehicle at N$1,100. 2. Diamond Ltd would take over all assets and liabilities with the exception of bank and vehicles. 3. The assets were taken over at these valuation amounts: N$4,800 N$5,000 N$3,500 Goodwill Equipment Inventory at carrying value Accounts receivable at carrying value less an allowance for bad debts at 10%. 4. Diamond Ltd upon taking transfer would immediately pay off the loan. 5. Diamond Ltd would pay N$1650 in cash and the rest in shares. The shares were divided between Eden and Stein in the profit-sharing ratio. 6. The available cash would be divided between Eden and Stein in the profit-sharing ratio. The shares would between Eden and Stein in order to clear the outstanding capital accounts to nil. YOU ARE REQUIRED TO: 1. Draw up the realization account to show the necessary entries pertaining to the sale of the partnership. (10 marks) 2. Draw up the capital accounts of the partners (in columnar form) in the general ledger. (15 marks) Admission of new partner Arthur and Blaise's youngest brother, Claude, recently graduated as Arthur and Blaise decided to admit Claude as a third partner of Ubiso January 2021. A revaluation of all assets and liabilities were done. It wa following assets at their revalued amounts: Furniture and equipment N$50 000 Inventory N$121 670 All other assets and liabilities are correctly valued in the books. Goodwill will not be shown in the new partnership's books Partners will share profits in the ratio 1:1:1. Claude will acquire 25% of the net assets of the partner pay N$150 000. Claude recently inherited money from her grand pay for her part of the assets in cash. You are required to: 2.1 Prepare the statement of profit or loss and other comprehensive inc ended 31 December 2020 for Ubisoft Entertainment. (13 ma 2.2 Prepare the Profit Appropriation account as at 31 December 201 admitted as a partner. (10 marks 2.3 Provide all the journal entries for Claude's admission as a partne Journal narrations are not required. (15 marks

Step by Step Solution

★★★★★

3.41 Rating (170 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started