Answered step by step

Verified Expert Solution

Question

1 Approved Answer

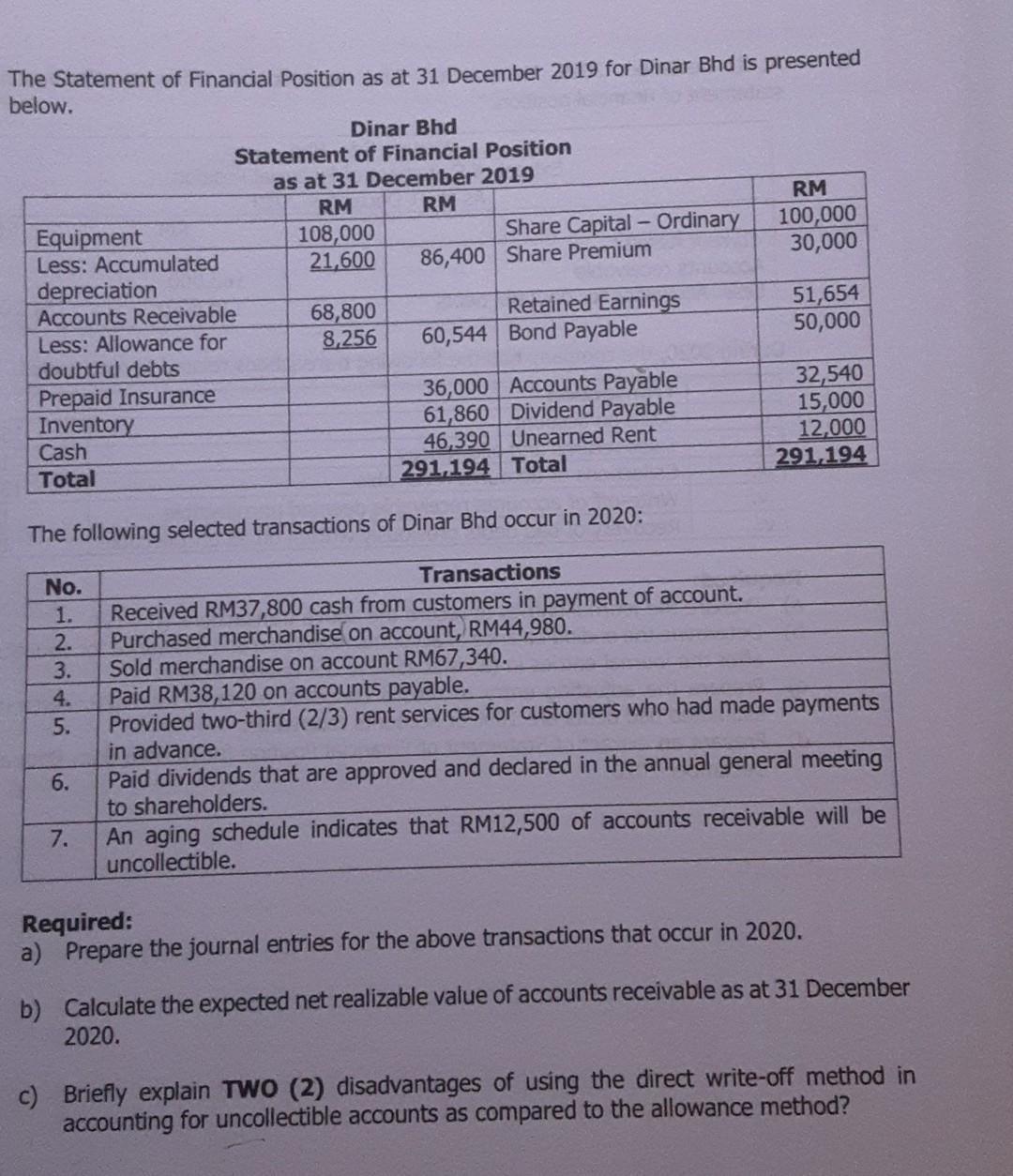

The Statement of Financial Position as at 31 December 2019 for Dinar Bhd is presented below. Equipment Less: Accumulated depreciation Accounts Receivable Less: Allowance

The Statement of Financial Position as at 31 December 2019 for Dinar Bhd is presented below. Equipment Less: Accumulated depreciation Accounts Receivable Less: Allowance for doubtful debts Prepaid Insurance Inventory Cash Total No. 1. 2. 3. 4. 5. Dinar Bhd Statement of Financial Position as at 31 December 2019 RM 6. 7. RM 108,000 21,600 36,000 Accounts Payable 61,860 Dividend Payable 46,390 Unearned Rent 291,194 Total The following selected transactions of Dinar Bhd occur in 2020: 68,800 8,256 Share Capital - Ordinary 86,400 Share Premium Retained Earnings 60,544 Bond Payable Transactions Received RM37,800 cash from customers in payment of account. Purchased merchandise on account, RM44,980. Sold merchandise on account RM67,340. RM 100,000 30,000 51,654 50,000 32,540 15,000 12,000 291,194 Paid RM38,120 on accounts payable. Provided two-third (2/3) rent services for customers who had made payments in advance. Paid dividends that are approved and declared in the annual general meeting to shareholders. An aging schedule indicates that RM12,500 of accounts receivable will be uncollectible. Required: a) Prepare the journal entries for the above transactions that occur in 2020. b) Calculate the expected net realizable value of accounts receivable as at 31 December 2020. c) Briefly explain TWO (2) disadvantages of using the direct write-off method in accounting for uncollectible accounts as compared to the allowance method?

Step by Step Solution

★★★★★

3.55 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

SNo Particulars 1 2 3 4 5 Cash Ac Dr To Accounts Receivable Ac Being cash received from debtor...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started