Answered step by step

Verified Expert Solution

Question

1 Approved Answer

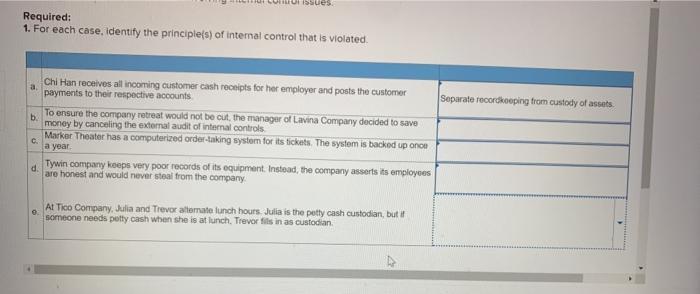

COMO Issues Required: 1. For each case, identify the principle(s) of internal control that is violated. a. Chi Han receives all incoming customer cash

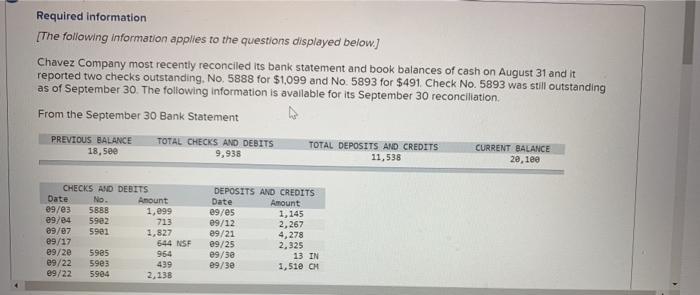

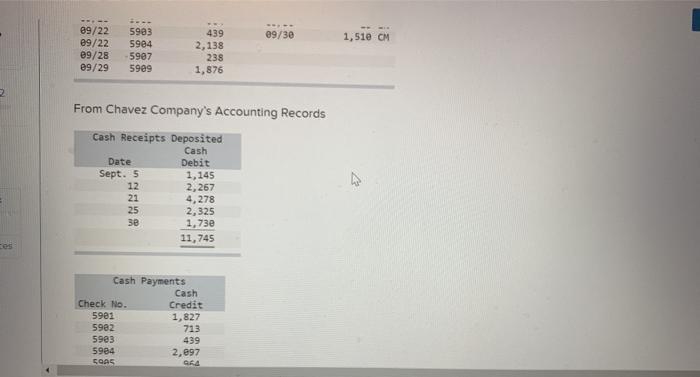

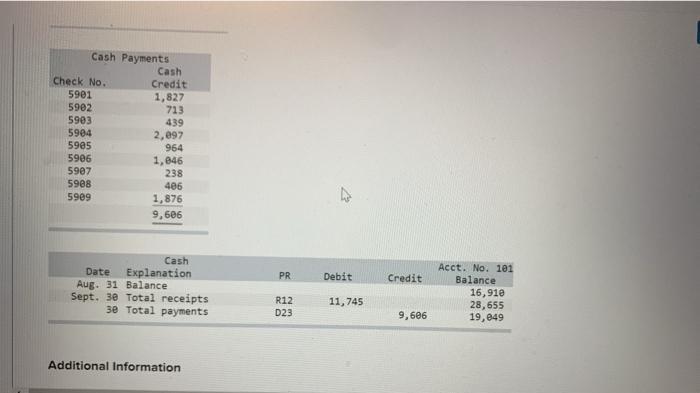

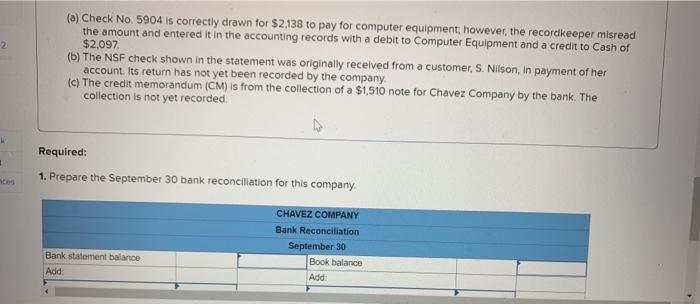

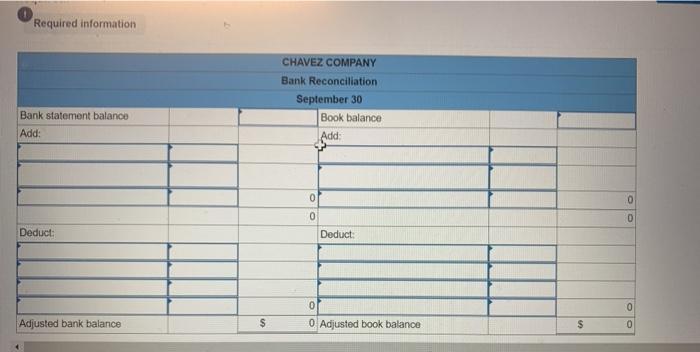

COMO Issues Required: 1. For each case, identify the principle(s) of internal control that is violated. a. Chi Han receives all incoming customer cash receipts for her employer and posts the customer payments to their respective accounts. b. To ensure the company retreat would not be cut, the manager of Lavina Company decided to save money by canceling the external audit of internal controls. C. Marker Theater has a computerized order-taking system for its tickets. The system is backed up once a year. d. Tywin company keeps very poor records of its equipment. Instead, the company asserts its employees are honest and would never steal from the company. At Tico Company, Julia and Trevor alternate lunch hours. Julia is the petty cash custodian, but if 0. someone needs petty cash when she is at lunch, Trevor fils in as custodian Separate recordkeeping from custody of assets. Required information [The following information applies to the questions displayed below.] Chavez Company most recently reconciled its bank statement and book balances of cash on August 31 and it reported two checks outstanding, No. 5888 for $1,099 and No. 5893 for $491. Check No. 5893 was still outstanding as of September 30. The following information is available for its September 30 reconciliation. From the September 30 Bank Statement PREVIOUS BALANCE 18,500 CHECKS AND DEBITS No. Date 09/03 5888 09/04 5902 09/07 5901 09/17 09/20 5985 09/22 5903 09/22 5904 TOTAL CHECKS AND DEBITS 9,938 Amount 1,099 713 1,827 644 NSF 964 439 2,138 DEPOSITS AND CREDITS Date 09/05 09/12 09/21 09/25 09/30 09/30 TOTAL DEPOSITS AND CREDITS 11,538 Amount 1,145 2,267 4,278 2,325 13 IN 1,510 CH CURRENT BALANCE 20,100 2 ces 09/22 5903 09/22 5984 09/28 5907 09/29 5909 Date Sept. 5 12 21 25 38 From Chavez Company's Accounting Records Cash Receipts Deposited Cash Debit Cash Payments Check No. 5901 5982 439 2,138 238 1,876 5903 5984 5945 1,145 2,267 4,278 2,325 1,730 11,745 09/30 Cash Credit 1,827 713 439 2,897 964 1,510 CM Cash Payments Check No. 5901 5902 5903 5904 5985 5906 5907 5908 5909 Cash Credit 1,827 713 439 2,097 964 1,046 238 406 1,876 9,606 Cash Explanation Date Aug. 31 Balance Sept. 38 Total receipts 30 Total payments Additional Information. PR R12 D23 Debit 11,745 Credit 9,606 Acct. No. 101 Balance 16,910 28,655 19,049 2 k 1 (a) Check No. 5904 is correctly drawn for $2.138 to pay for computer equipment, however, the recordkeeper misread the amount and entered it in the accounting records with a debit to Computer Equipment and a credit to Cash of $2,097, (b) The NSF check shown in the statement was originally received from a customer, S. Nilson, in payment of her account. Its return has not yet been recorded by the company. (c) The credit memorandum (CM) is from the collection of a $1,510 note for Chavez Company by the bank. The collection is not yet recorded. Required: 1. Prepare the September 30 bank reconciliation for this company. Bank statement balance Add: CHAVEZ COMPANY Bank Reconciliation September 30 Book balance Add: Required information Bank statement balance Add: Deduct: Adjusted bank balance $ CHAVEZ COMPANY Bank Reconciliation September 30 0 0 Book balance Add: Deduct: 0 0 Adjusted book balance 50 $ 0 0 0 0

Step by Step Solution

★★★★★

3.43 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

2 Bank Reconciliation Statement Bank Balance September 30 21 282 Add Deposit in Transit 1747 Less Outstanding Check 496 Adjusted Bank Balance September 30 22533 Ending Book Balance September 30 21500 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started