Answered step by step

Verified Expert Solution

Question

1 Approved Answer

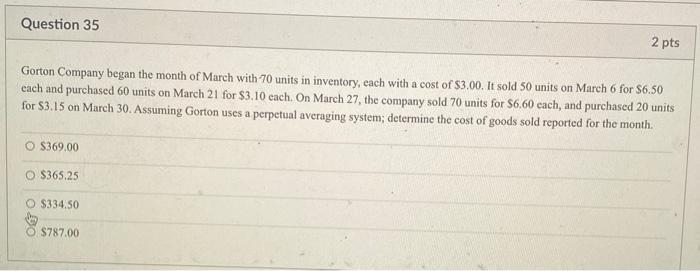

Question 35 2 pts Gorton Company began the month of March with 70 units in inventory, each with a cost of $3.00. It sold

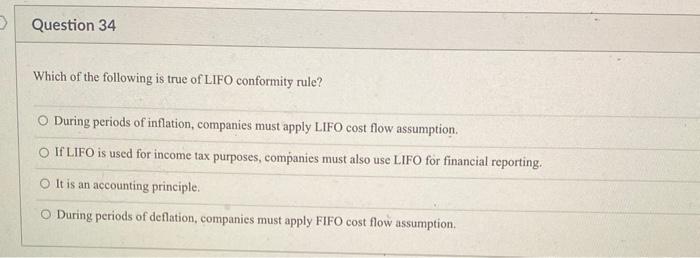

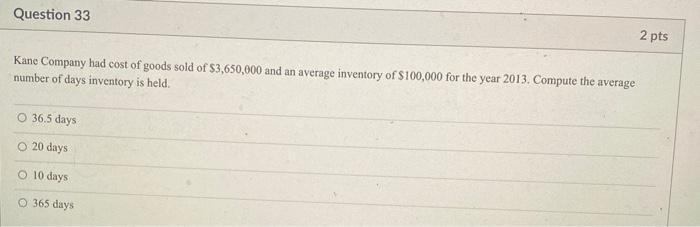

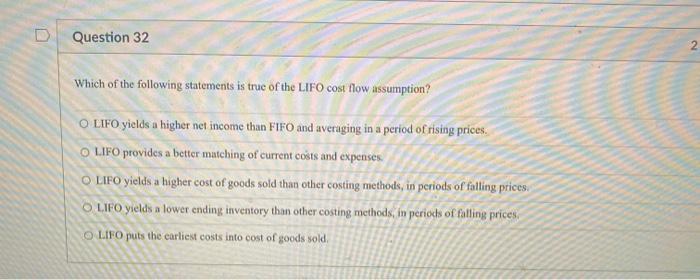

Question 35 2 pts Gorton Company began the month of March with 70 units in inventory, each with a cost of $3.00. It sold 50 units on March 6 for $6.50 each and purchased 60 units on March 21 for $3.10 each. On March 27, the company sold 70 units for $6,60 each, and purchased 20 units for $3.15 on March 30. Assuming Gorton uses a perpetual averaging system; determine the cost of goods sold reported for the month. 55L O $369.00 $365.25 O $334.50 $787.00 Question 34 Which of the following is true of LIFO conformity rule? During periods of inflation, companies must apply LIFO cost flow assumption. If LIFO is used for income tax purposes, companies must also use LIFO for financial reporting. O It is an accounting principle. O During periods of deflation, companies must apply FIFO cost flow assumption. Question 33 Kane Company had cost of goods sold of $3,650,000 and an average inventory of $100,000 for the year 2013. Compute the average number of days inventory is held. O 36.5 days O 20 days O 10 days O 365 days 2 pts Question 32 Which of the following statements is true of the LIFO cost flow assumption? O LIFO yields a higher net income than FIFO and averaging in a period of rising prices. O LIFO provides a better matching of current costs and expenses. O LIFO yields a higher cost of goods sold than other costing methods, in periods of falling prices. OLIFO yields a lower ending inventory than other costing methods, in periods of falling prices. OLIFO puts the earliest costs into cost of goods sold. 2 Question 31 Cost of goods sold will be the same regardless of whether perpetual or periodic FIFO is used. O True O False

Step by Step Solution

★★★★★

3.48 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started