Answered step by step

Verified Expert Solution

Question

1 Approved Answer

4 . ) Babylon Corporation manufactures and sells a special tea called Black - Ceylon Tea ( BCTea ) which includes special teas coming from

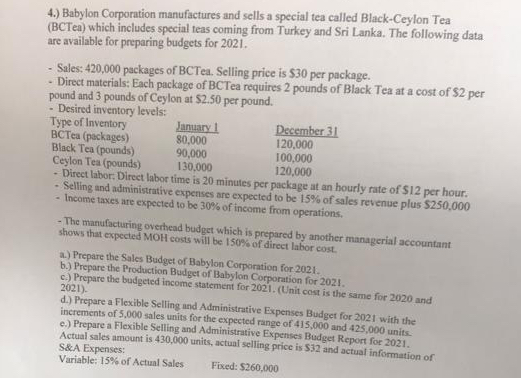

Babylon Corporation manufactures and sells a special tea called BlackCeylon Tea BCTea which includes special teas coming from Turkey and Sri Lanka. The following data are available for preparing budgets for

Sales: packages of BCTea. Selling price is $ per package.

Direct materials: Each package of BCTea requires pounds of Black Tea at a cost of $ per pound and pounds of Ceylon at $ per pound.

Desired inventory levels:

Type of Inventory

BCTea paskages

Black Tea pounds

Ceylon Tea pounds

tableJanuary December

Direct labor. Direct labor time is minutes per package at an hourly rate of $ per hour.

Selling and administrative experises are expected to be of sales revenue plus $

Income taxes are expected to be of income from operations.

The manufacturing overhead budget which is prepared by another manu gerial accountant shows that expected MOH costs will be of difect labor cost.

a Prepare the Sales Budget of Babylon Corporation for

b Prepare the Production Budger of Babylon Corporation for

c Prepare the budeled income statement for Unit cost is the same for and

d Prepare a Flexible Selling und Administrative Expenses Budget for with the increments of sales unis for the expected range of and units.

c Prepare a Flexible Selling and Administrative Expenses Budget Report for

Actual sales amount is units, actiul selling price is $ and actual information of S&A Expenses:

Variable: of Actual Sales

Fixed: $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started