Question

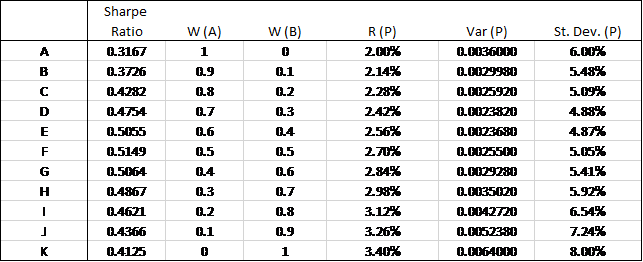

4. Based on the table above, which combination represents the Optimal Risky Portfolio: A. B. C. D. E. F. G H. I. J. K. 5.

4. Based on the table above, which combination represents the Optimal Risky Portfolio:

A.

B.

C.

D.

E.

F.

G

H.

I.

J.

K.

5. Based on the table above, which combination represents the Minimum Variance Portfolio:

A.

B.

C.

D.

E.

F.

G

H.

I.

J.

K.

6. Based on the table above, Rf = 0.1%, and your clients risk aversion factor A = 30, what should be the suggested allocation into the ORP and into Rf security for your client?

a. 0.15 and 0.85

b. 0.28 and 0.72

c. 0.34 and 0.66

d. 0.45 and 0.55

e. 0.63 and 0.37

7. If your client decides to invest 65% of their money into ORP and 35% into Rf security, what would be the expected return of that combination (Rf = 0.1%)?

a. 2.70%

b. 2.56%

c. 1.79%

d. 1.76%

e. 1.23%

8. If your client decides to invest 65% of their money into ORP and 35% into Rf security, what would be the standard deviation of that combination (Rf = 0.1%)?

a. 7.24%

b. 5.05%

c. 4.87%

d. 4.28%

e. 3.28%

9. If your client decides to invest 65% of their money into ORP and 35% into Rf security, what would be the variance of that combination (Rf = 0.1%)?

a. 0.01755

b. 0.00255

c. 0.00166

d. 0.00108

e. 0.00101

2 2 2 2 2 2 2 2. 1 56789 11 0.3 0.3 0.3 0.5 0.5 0A 0.3 0.2 0.1 1 98765 321 ABCDEFGHI-KStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started