Answered step by step

Verified Expert Solution

Question

1 Approved Answer

4. Bell Bottom is considering a project which will require the purchase of BDT 1.4 million in new equipment. The equipment will be depreciated

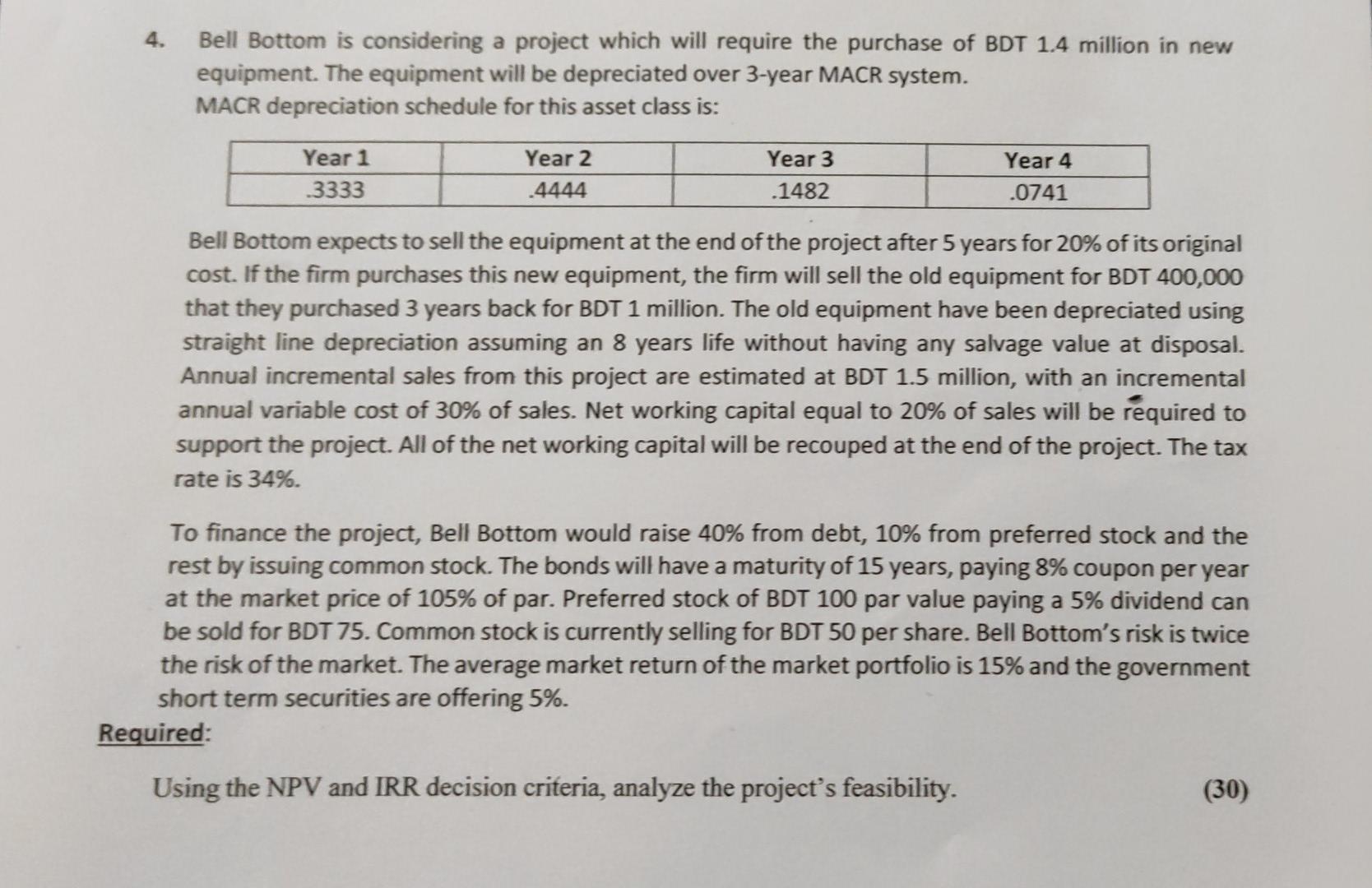

4. Bell Bottom is considering a project which will require the purchase of BDT 1.4 million in new equipment. The equipment will be depreciated over 3-year MACR system. MACR depreciation schedule for this asset class is: Year 1 3333 Year 2 .4444 Year 3 .1482 Year 4 .0741 Bell Bottom expects to sell the equipment at the end of the project after 5 years for 20% of its original cost. If the firm purchases this new equipment, the firm will sell the old equipment for BDT 400,000 that they purchased 3 years back for BDT 1 million. The old equipment have been depreciated using straight line depreciation assuming an 8 years life without having any salvage value at disposal. Annual incremental sales from this project are estimated at BDT 1.5 million, with an incremental annual variable cost of 30% of sales. Net working capital equal to 20% of sales will be required to support the project. All of the net working capital will be recouped at the end of the project. The tax rate is 34%. To finance the project, Bell Bottom would raise 40% from debt, 10% from preferred stock and the rest by issuing common stock. The bonds will have a maturity of 15 years, paying 8% coupon per year at the market price of 105% of par. Preferred stock of BDT 100 par value paying a 5% dividend can be sold for BDT 75. Common stock is currently selling for BDT 50 per share. Bell Bottom's risk is twice the risk of the market. The average market return of the market portfolio is 15% and the government short term securities are offering 5%. Required: Using the NPV and IRR decision criteria, analyze the project's feasibility. (30)

Step by Step Solution

★★★★★

3.43 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

To analyze the feasibility of the project using the Net Present Value NPV and Internal Rate of Return IRR decision criteria we need to calculate the c...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started