Answered step by step

Verified Expert Solution

Question

1 Approved Answer

4. Bigquiz is experiencing rapid growth. Dividends are expected to grow at 15% per year during the next three years. After that period, dividend will

4. Bigquiz is experiencing rapid growth. Dividends are expected to grow at 15% per year during the next three years. After that period, dividend will grow at 4% forever. Using two stage dividend discount model, how much is the stock price today

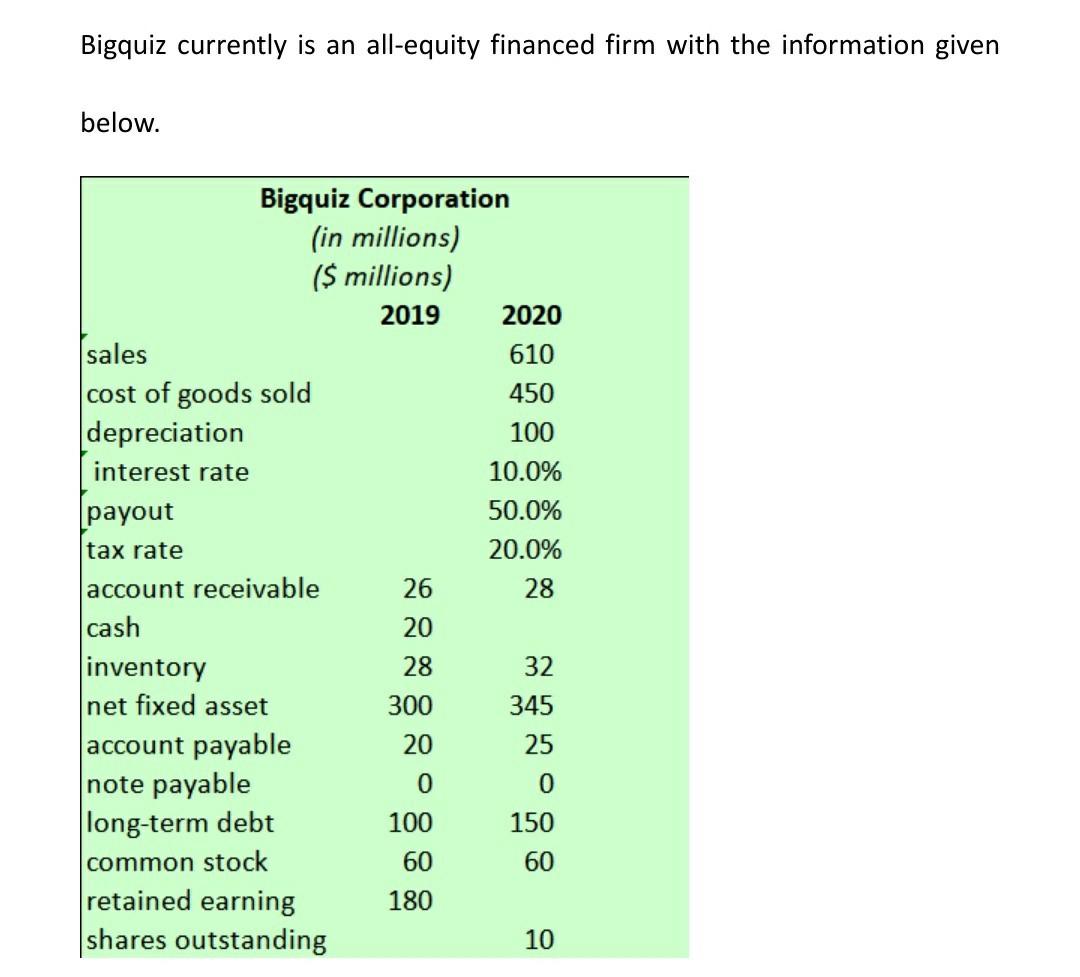

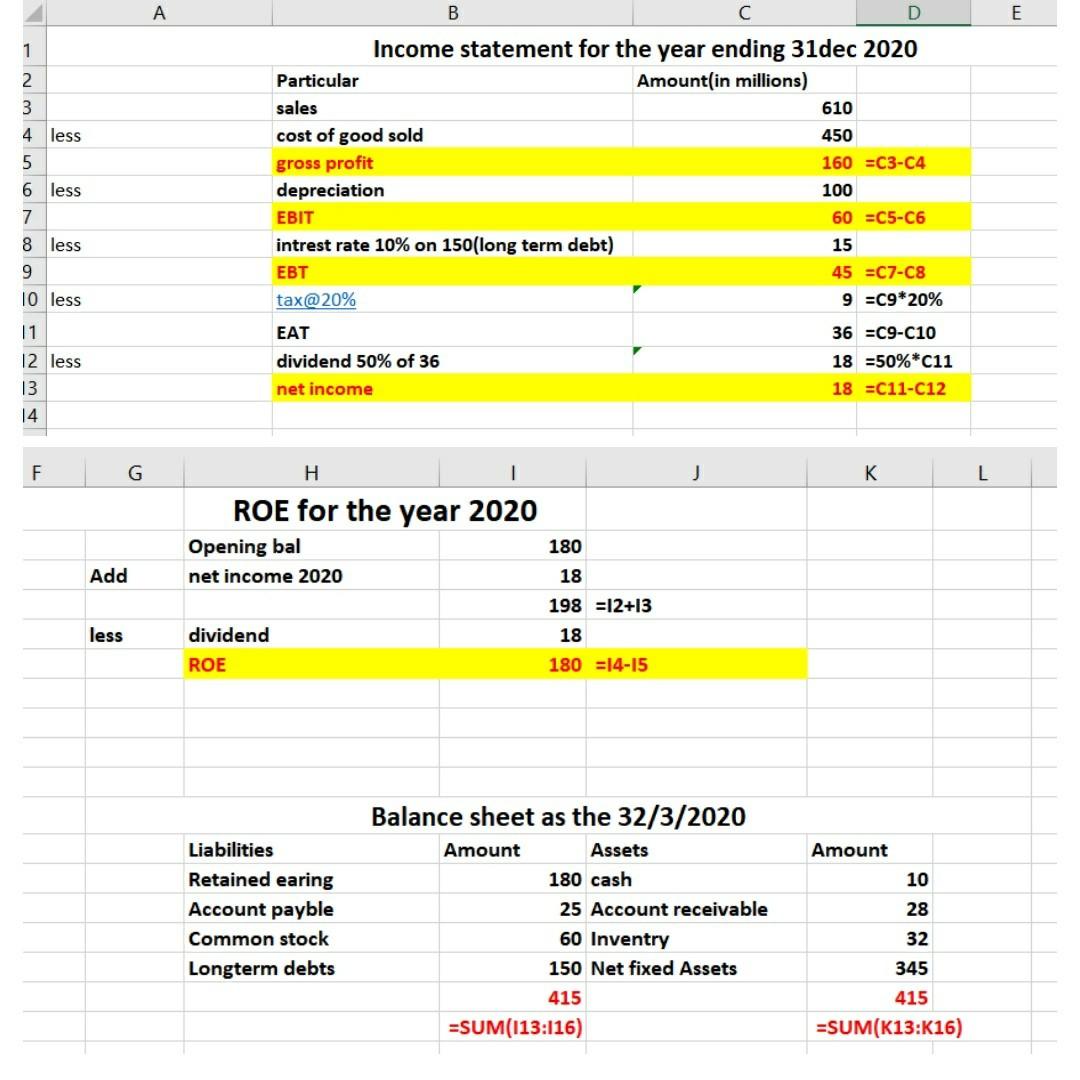

Bigquiz currently is an all-equity financed firm with the information given below. Bigquiz Corporation (in millions) ($ millions) 2019 2020 sales 610 cost of goods sold 450 depreciation 100 interest rate 10.0% payout 50.0% tax rate 20.0% account receivable 26 28 cash 20 inventory 28 32 net fixed asset 300 345 account payable 20 25 note payable 0 0 long-term debt 100 150 common stock 60 60 retained earning 180 shares outstanding 10 A B D E 1 4 less 6 less - Nm too O EN Income statement for the year ending 31dec 2020 Particular Amount(in millions) sales 610 cost of good sold 450 gross profit 160 =C3-C4 depreciation 100 EBIT 60 =C5-C6 intrest rate 10% on 150(long term debt) 15 EBT 45 =C7-C8 tax@20% 9 =C9*20% EAT 36 =C9-C10 dividend 50% of 36 18 =50%*C11 net income 18 =C11-C12 8 less 10 less 12 less F G H 1 J K L Add ROE for the year 2020 Opening bal 180 net income 2020 18 198 = 12+13 dividend 18 ROE 180 =14-15 less Amount 10 Liabilities Retained earing Account payble Common stock Longterm debts 28 Balance sheet as the 32/3/2020 Amount Assets 180 cash 25 Account receivable 60 Inventry 150 Net fixed Assets 415 =SUM(113:116) 32 345 415 =SUM(K13:K16) Bigquiz currently is an all-equity financed firm with the information given below. Bigquiz Corporation (in millions) ($ millions) 2019 2020 sales 610 cost of goods sold 450 depreciation 100 interest rate 10.0% payout 50.0% tax rate 20.0% account receivable 26 28 cash 20 inventory 28 32 net fixed asset 300 345 account payable 20 25 note payable 0 0 long-term debt 100 150 common stock 60 60 retained earning 180 shares outstanding 10 A B D E 1 4 less 6 less - Nm too O EN Income statement for the year ending 31dec 2020 Particular Amount(in millions) sales 610 cost of good sold 450 gross profit 160 =C3-C4 depreciation 100 EBIT 60 =C5-C6 intrest rate 10% on 150(long term debt) 15 EBT 45 =C7-C8 tax@20% 9 =C9*20% EAT 36 =C9-C10 dividend 50% of 36 18 =50%*C11 net income 18 =C11-C12 8 less 10 less 12 less F G H 1 J K L Add ROE for the year 2020 Opening bal 180 net income 2020 18 198 = 12+13 dividend 18 ROE 180 =14-15 less Amount 10 Liabilities Retained earing Account payble Common stock Longterm debts 28 Balance sheet as the 32/3/2020 Amount Assets 180 cash 25 Account receivable 60 Inventry 150 Net fixed Assets 415 =SUM(113:116) 32 345 415 =SUM(K13:K16)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started