Given the following mortgage collateral and PAC: Mortgage collateral = $100,000,000 Weighted average coupon rate (WAC) =

Question:

Given the following mortgage collateral and PAC:

Mortgage collateral = $100,000,000

Weighted average coupon rate (WAC) = 7%

Weighted average maturity (WAM) = 350 months

Seasoning = 10 months

Estimated prepayment speed = 150 PSA MBS pass-through rate = PT rate = 6.5%

PAC formed from the collateral with a lower collar of 100 and upper collar of 300 Support bond receiving the residual principal

a. Using the MBSpac Excel program, create an Excel table for the CMO.

In your table, hide many of the rows and hide all columns except for the following: period, the balance, interest, and principal for the collateral, the interest, lower collar principal, upper collar principal, PAC principal, and cash flow for the PAC bond, and principal, interest, and cash flow for the support bond.

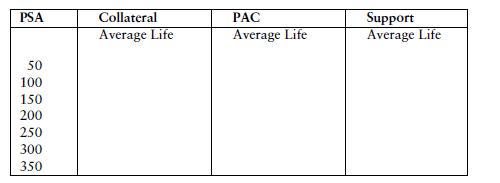

b. Using the MBSpac Excel program, determine the average life for collateral, PAC bond, and support bond given the PSA speeds shown in the table:

c. Comment on the PAC’s average life given the different PSA speeds.

Step by Step Answer: