4. Bryn Tagovailoa is 29 years old and was born in Cork (Republic of Ireland). Bryn's permanent home is in Dublin (Republic of Ireland).

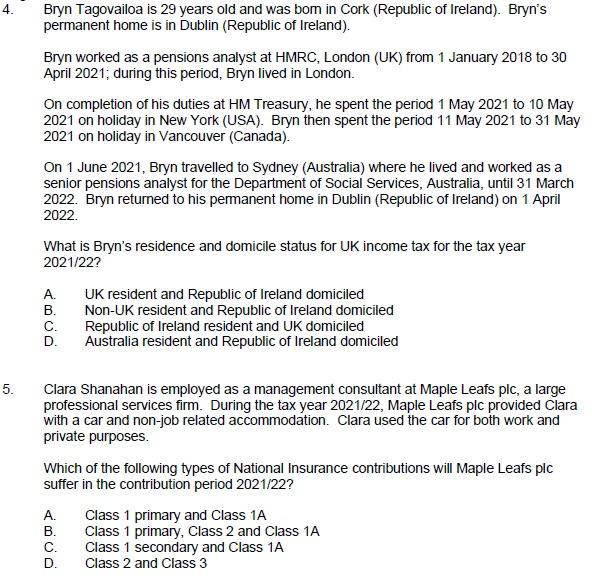

4. Bryn Tagovailoa is 29 years old and was born in Cork (Republic of Ireland). Bryn's permanent home is in Dublin (Republic of Ireland). Bryn worked as a pensions analyst at HMRC, London (UK) from 1 January 2018 to 30 April 2021; during this period, Bryn lived in London. On completion of his duties at HM Treasury, he spent the period 1 May 2021 to 10 May 2021 on holiday in New York (USA). Bryn then spent the period 11 May 2021 to 31 May 2021 on holiday in Vancouver (Canada). On 1 June 2021, Bryn travelled to Sydney (Australia) where he lived and worked as a senior pensions analyst for the Department of Social Services, Australia, until 31 March 2022. Bryn returned to his permanent home in Dublin (Republic of Ireland) on 1 April 2022. What is Bryn's residence and domicile status for UK income tax for the tax year 2021/22? B. ABCD A. UK resident and Republic of Ireland domiciled Non-UK resident and Republic of Ireland domiciled C. Republic of Ireland resident and UK domiciled D. Australia resident and Republic of Ireland domiciled 5. Clara Shanahan is employed as a management consultant at Maple Leafs plc, a large professional services firm. During the tax year 2021/22, Maple Leafs plc provided Clara with a car and non-job related accommodation. Clara used the car for both work and private purposes. Which of the following types of National Insurance contributions will Maple Leafs plc suffer in the contribution period 2021/22? ABCD A. B. C. D. Class 1 primary and Class 1A Class 1 primary, Class 2 and Class 1A Class 1 secondary and Class 1A Class 2 and Class 3

Step by Step Solution

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started