Question

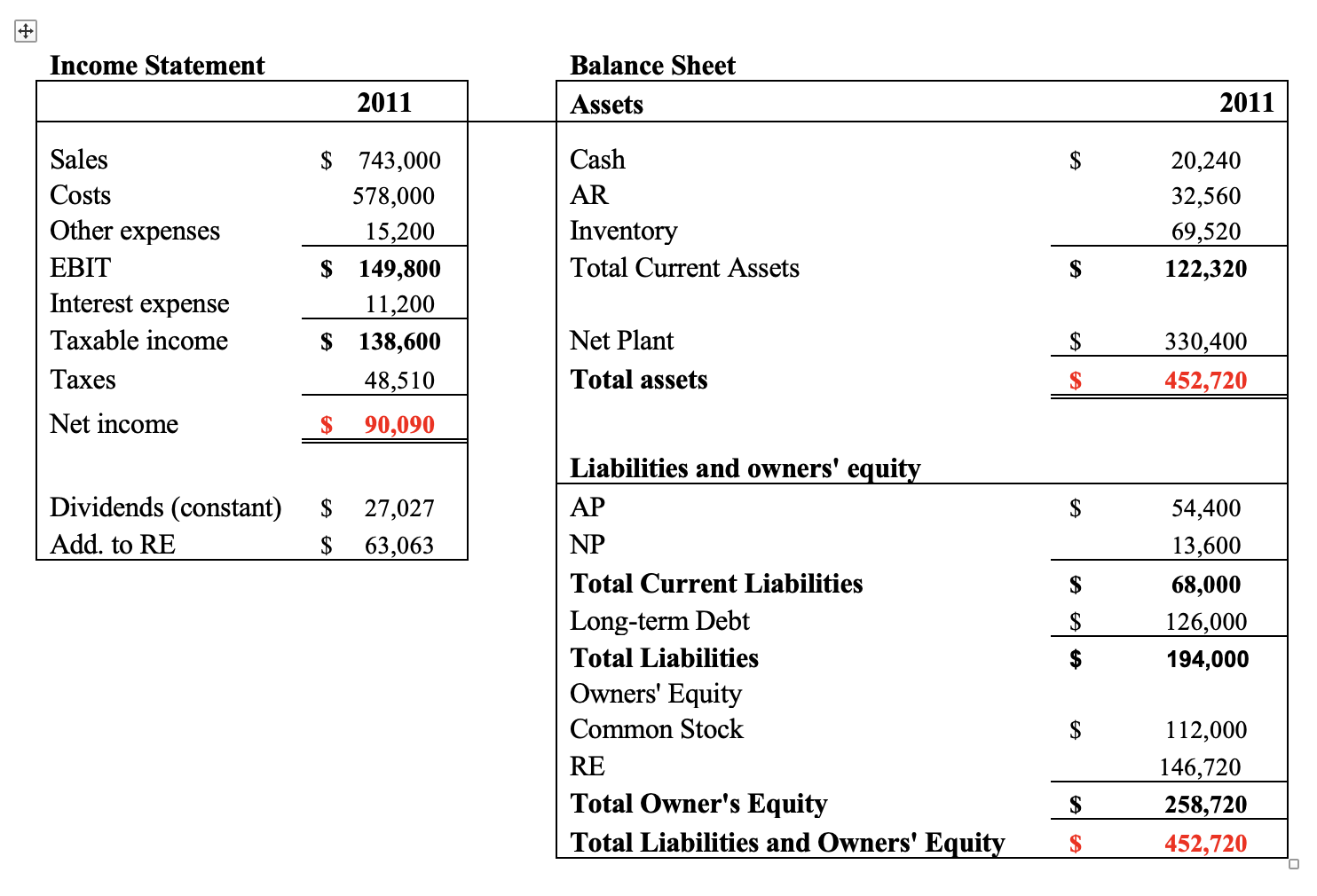

4. Calculating EFN: The most recent financial statements for Fleury, Inc., follow. Sales for 2012 are projected to grow by 20 percent. Interest expense will

4. Calculating EFN: The most recent financial statements for Fleury, Inc., follow. Sales for 2012 are projected to grow by 20 percent. Interest expense will remain constant; the tax rate and the dividend payout rate will also remain constant. Costs, other expenses, current assets, fixed assets, and accounts payable increase spontaneously with sales. If the firm is operating at full capacity and no new debt or equity is issued, what external financing is needed to support the 20 percent growth rate in sales?

5. Capacity Usage and Growth: In the previous problem, suppose the firm was operating at only 80 percent capacity in 2011. What is EFN now?

6. Calculating EFN with multiple conditions: In Problem 4, suppose the firm was operating at only 80 percent capacity in 2011. Also, going into 2012 it expects the following changes to take place: (1) the firm will want to have a minimum cash balance of $30,000 (higher minimum cash balance); (2) its customers will start making payments by day 30, in other words DSO will become 30 or Account Receivable outstanding will be 30 days of sales; (3) they will start paying suppliers every 10 days on average, in other words DPO will become 10; (4) Inventory Turnover will slow down to 6 times a year, in other words DIO will become 61 days and the firm will take longer to turn its inventory over. What is EFN now?

*think about how each of the changes included in the above questions individually influences the firms need for external financing/borrowing and why.

7. Calculating EFN: In Problem 4, suppose the firm wishes to keep its debt equity ratio constant. What is EFN now?

8. EFN and Internal Growth: Redo Problem 4 using sales growth rates of 15 and 25 percent in addition to 20 percent. Illustrate graphically the relationship between EFN and the growth rate, and use this graph to determine the relationship between them. At what growth rate is the EFN equal to zero? (Hint: you need to graph EFN at the Y axis and % growth on the X axis)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started