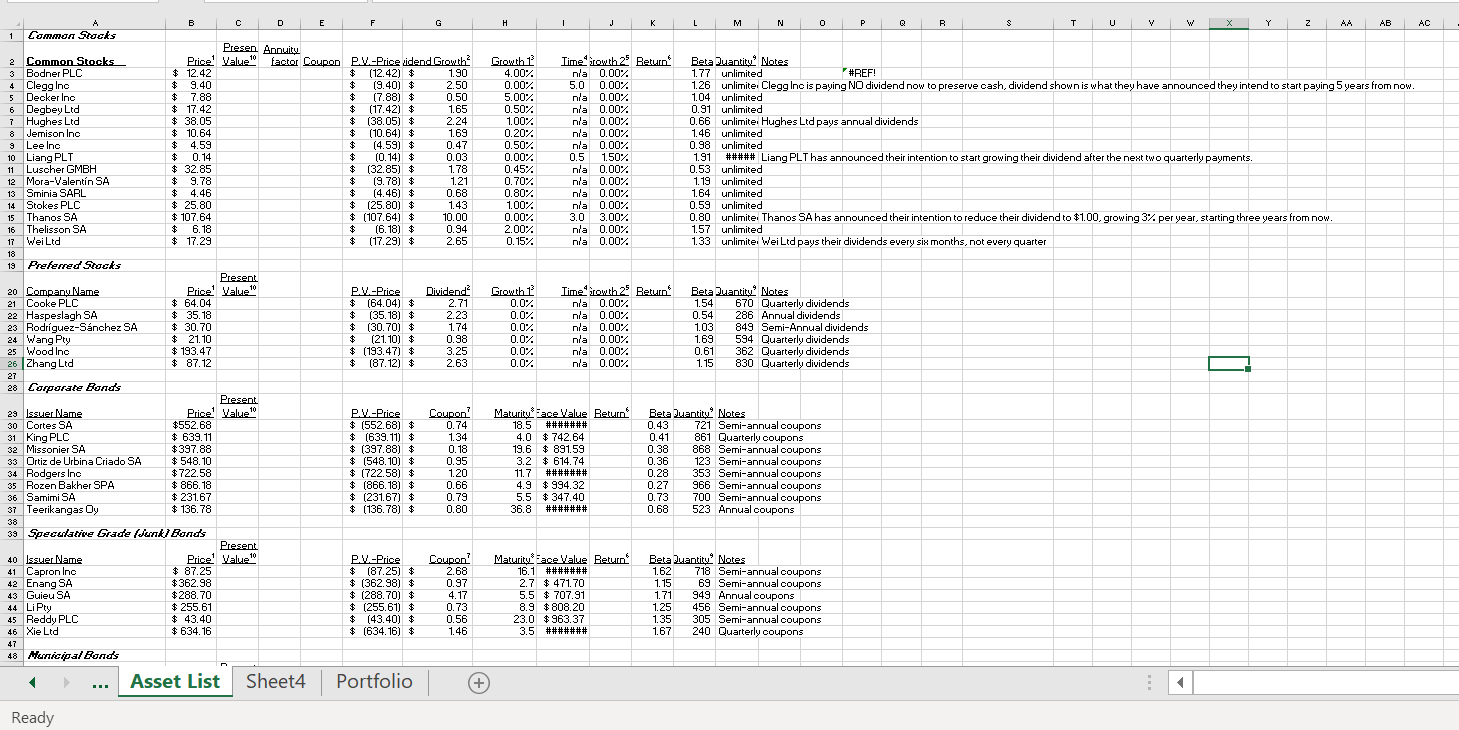

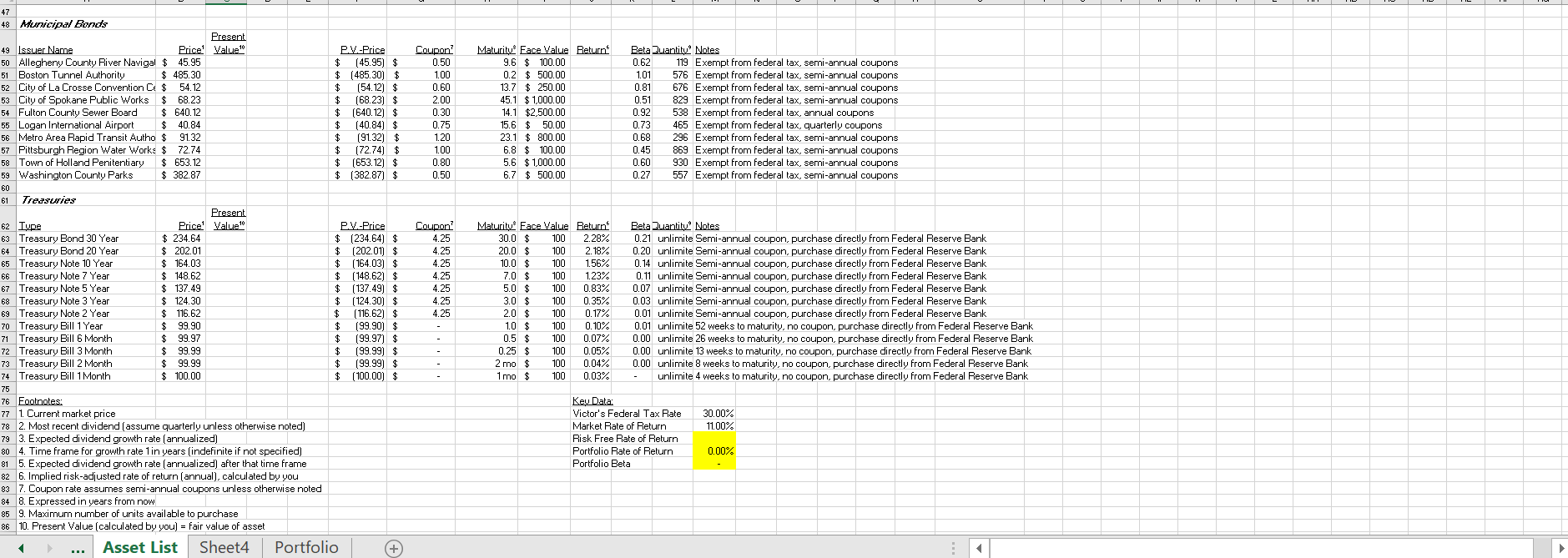

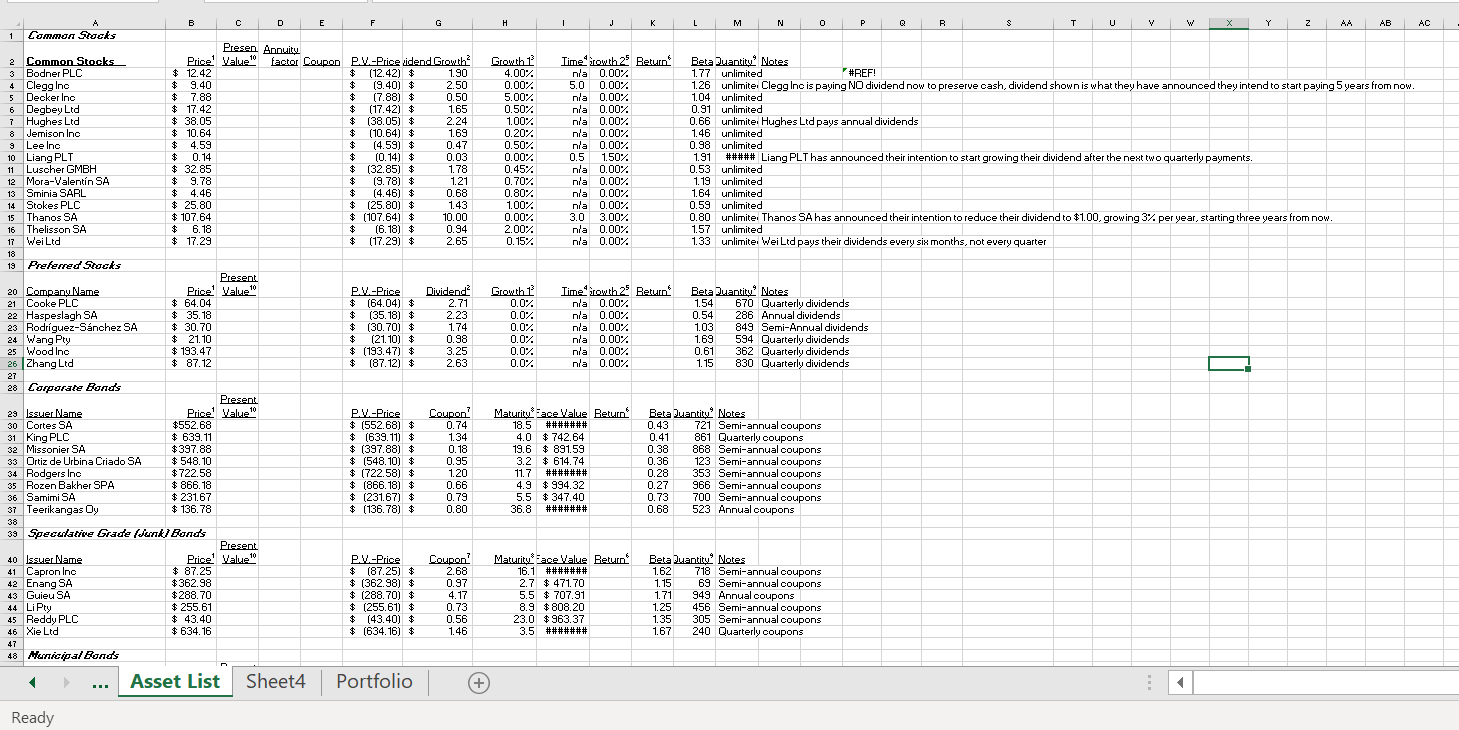

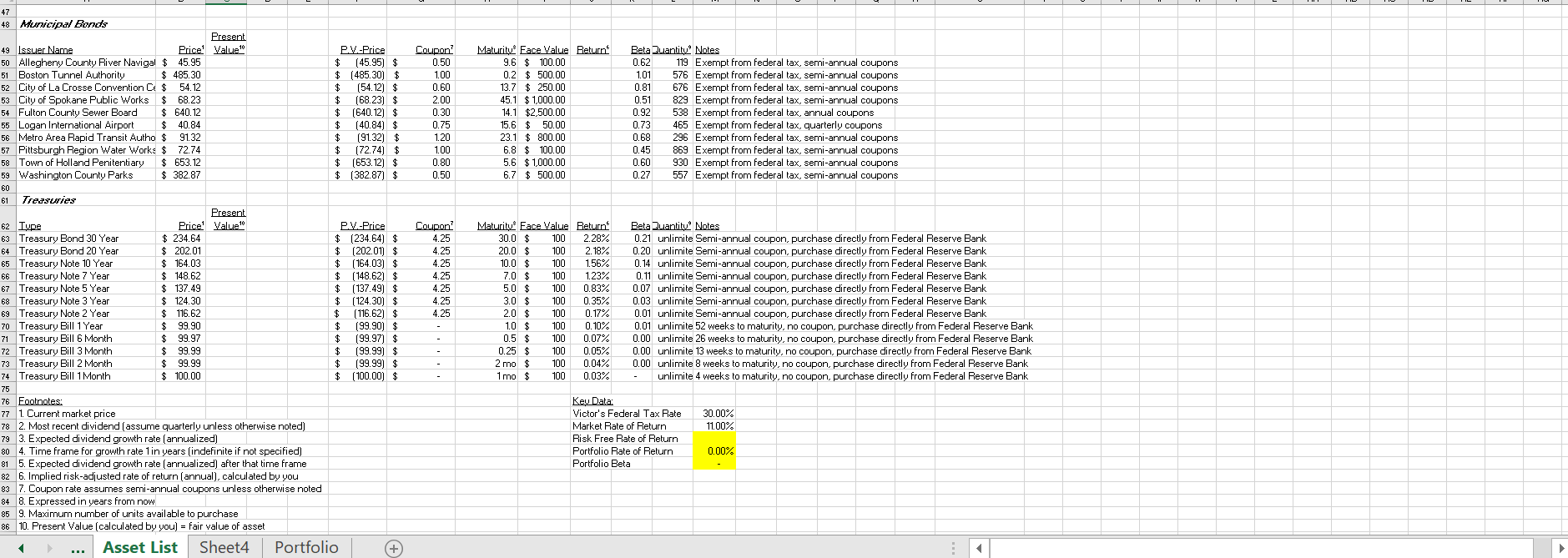

4 Case Description: John Greene has inherited a large sum of money and would like to create an investment portfolio for his future retirement. 5 He is still young but would like to retire early so he is interested in a relatively aggressive portfolio to quadruple his assets within the next 10 years. 6 He believes this will be enough to enable him to enjoy a comfortable retirement for the remainder of his life. 7 John fancies himself to be a savvy investor and has selected a wide range of assets for his portfolio, but he knows you have financial expertise and has 8 asked you to look over his selections and recommend the specific portfolio of assets in which he should invest and the quantities of each he should purchase. 9 Obviously he wants to avoid any assets that are overpriced and buy any bargains available, and he wants to minimize his risk to achieve his target return. 10 11 Your task is to select an investment portfolio from his list of candidates that is expected to achieve his return objectives at the lowest possible risk. 12 Be sure to define: (1) which assets to purchase; (2) how many of each to purchase; (3) the portfolio B; and (4) the expected 10-year return of the portfolio. 13 You will prepare a PowerPoint recommendation for John with your suggestions and why you have selected the asset portfolio you did. 14 15 Excel Grading (80%): 16 1. Price and expected return of each asset is appropriately calculated and filled in on the table in "Asset List" worksheet 17 2. Total portfolio investment holdings = $1 million as shown in the "Portfolio" worksheet and respects the constraints of assets available 18 3. Expected value of portfolio = $4 million in year 10 value based on the required portfolio return as shown in the "Portfolio" worksheet 19 4. Portfolio B and expected return are accurately calculated in the "Portfolio" worksheet 20 5. Best portfolio selected: minimum B, no overpriced assets purchased (over SML), bargain assets selected (if available) 21 6. Good principles of diversification followed: appropriate number of assets and mix of asset types in the recommended portfolio 22 6. Formulas are written out with the source of numbers used in the calculations is clear, no unexplained values 23 7. Excel sheet looks professional 24 8. No spelling/grammar errors B E F H 1 J L M N P Q R T U V Y z AB AC 1 1 Common Stocks 2 Common Stocks Bodner PLC 4 Clegg Ino 5 Decker Ino 6 Degbey Ltd 7 7 Hughes Ltd & Jemison Inc 9 Lee Inc 10 Liang PLT 11 Luscher GMBH 12 Mora-Valentn SA 13 Sminia SARL 14 Stokes PLC 15 Thanos SA 16 Thelisson SA 17 WeiLtd 18 Preferred' Stocks Presen Annuity Price' Value factor Coupon P.V.-Price vidend Gowth? $ 12.42 $ (12.42) $ 1.90 9.40 $ (9.40) $ 2.50 $ 7.88 (7.88) $ 0.50 $ 17.42 $ (17.42) $ 1.65 $ 38.05 $ (38.05) $ 2.24 $ 10.64 $ (10.64) $ 1.69 $ 4.59 $ (4.59) $ 0.47 $ 0.14 $ $ (0.14) $ 0.03 $ 32.85 $ (32.85) $ 1.78 $ 9.78 $ (9.78) $ 1.21 $ 4.46 $ (4.46) $ 0.68 $ 25.80 $ (25.80) $ 1.43 $ 107.64 $ (107.64) $ 10.00 $ 6.18 $ (6.18) $ 0.94 $ 17.29 $ (17.29) $ $ 2.65 Growth 1 4.00% 0.00% 5.00% 0.50% 1.00% 0.202 0.50% 0.00% 0.45% 0.70% 0.80% 1.00% 0.00% 2.00% 0.15% Time Lowth 2 Return nla 0.00% 5.0 0.00% nla 0.00% nla 0.00% nla 0.00% nla 0.00% nla 0.00% 0.5 1.50% nla 0.00% nla 0.00% nla 0.00% nla 0.007 3.0 3.00% nla 0.00% nia 0.00% Beta Quantity Notes 1.77 unlimited #REF! 1.26 unlimite. Clegg Inc is paying NO dividend now to preserve cash, dividend shown is what they have announced they intend to start paying 5 years from now. 1.04 unlimited 0.91 unlimited 0.66 unlimite: Hughes Ltd pays annual dividends 1.46 unlimited 0.98 unlimited 1.91 ##### Liang PLT has announced their intention to start growing their dividend after the next two quarterly payments. 0.53 unlimited 1.19 unlimited 1.64 unlimited 0.59 unlimited 0.80 unlimite. Thanos SA has announced their intention to reduce their dividend to $1.00, growing 3% per year, starting three years from now. 1.57 unlimited 1.33 unlimite. WeiLtd pays their dividends every six months, not every quarter 20 Company Name 21 Cooke PLC 22 Haspeslagh SA 23 Rodrguez-Snchez SA 24 Wang Pty 25 Wood Inc 26 Zhang Ltd 27 28 Corporate Bond's Present Price' Value" $ 64.04 $ 35.18 $ 30.70 $ 21.10 $ 193.47 $ 87.12 P.V.-Price $ (64.04) $ $ (35.18) $ $ (30.70) $ (21.10) $ $ (193.47) $ $ (87.12) $ Dividend? 2.71 2.23 1.74 0.98 3.25 2.63 Growth 1 0.0% 0.0% 0.02 0.0% 0.0% 0.0% Time towth 2 Return nla 0.00% nia 0.00% nla 0.00% nia 0.00% nla 0.00% nia 0.00% Beta Quantity Notes 1.54 670 Quarterly dividends 0.54 286 Annual dividends 1.03 849 Semi-Annual dividends 1.69 594 Quarterly dividends 0.61 362 Quarterly dividends 1.15 830 Quarterly dividends ri 29 Issuer Name 30 Cortes SA 31 King PLC 32 Missonier SA 33 Ortiz de Urbina Criado SA 34 Rodgers Inc 35 Rozen Bakher SPA 36 Samimi SA 37 Teerikangas Oy Present Price Value $552.68 $ 639.11 $397.88 $ 548.10 $722.58 $ 866.18 $ 231.67 $ 136.78 P.V.-Price $ (552.68) $ $ (639.11) $ $ (397.88) $ $ (548.10) $ $ (722.58) $ $ (866.18) $ $ (231.67) $ $ (136.78) $ Coupon! 0.74 1.34 0.18 0.95 1.20 0.66 0.79 0.80 Maturity Face Value Return 18.5 ####### 4.0 $742.64 19.6 $ 891.59 3.2 $ 614.74 11.7 ####### 4.9 $ 994.32 5.5 $347.40 36.8 ####### Beta Quantity Notes 0.43 721 Semi-annual coupons 0.41 861 Quarterly coupons 0.38 868 Semi-annual coupons 0.36 123 Semi-annual coupons 0.28 353 Semi-annual coupons 0.27 966 Semi-annual coupons 0.73 700 Semi-annual coupons 0.68 523 Annual coupons 39 Speculative Grade (Junk) Bond's Present 40 Issuer Name Price' Value 41 Capron Inc $ 87.25 42 Enang SA $362.98 43 Guieu SA $288.70 44 LiPty $255.61 45 Reddy PLC $ 43.40 46 Xie Ltd $ 634.16 47 48 Municipal Bond's P.V.-Price $ (87.25) $ $ (362.98) $ $ (288.70) $ $ (255.61) $ $ (43.40) $ $ (634.16) $ Coupon? 2.68 0.97 4.17 0.73 0.56 1.46 Maturity Face Value Return 16.1 ####### 2.7 $ 471.70 5.5 $ 707.91 8.9 $ 808.20 23.0 $963.37 3.5 ####### Beta Quantity" Notes 1.62 718 Semi-annual coupons 1.15 69 Semi-annual coupons 1.71 949 Annual coupons 1.25 456 Semi-annual coupons 1.35 305 Semi-annual coupons 1.67 240 Quarterly coupons Asset List Sheet4 Portfolio + Ready 47 Coupon? 0.50 1.00 0.60 2.00 0.30 0.75 1.20 1.00 0.80 0.50 Maturity Eace Value Return 9.6 $ 100.00 0.2 $ 500.00 13.7 $ 250.00 45.1 $1,000.00 14.1 $2,500.00 15.6 $ 50.00 23.1 $ 800.00 6.8 $ 100.00 5.6 $1,000.00 6.7 $ 500.00 Beta Quantity Notes 0.62 119 Exempt from federal tax, semi-annual coupons 1.01 576 Exempt from federal tax, semi-annual coupons 0.81 676 Exempt from federal tax, semi-annual coupons 0.51 829 Exempt from federal tax, semi-annual coupons 0.92 538 Exempt from federal tax, annual coupons 0.73 465 Exempt from federal tax, quarterly coupons 0.68 296 Exempt from federal tax, semi-annual coupons 0.45 869 Exempt from federal tax, semi-annual coupons 0.60 930 Exempt from federal tax, semi-annual coupons 0.27 557 Exempt from federal tax, semi-annual coupons 48 Municipal Bonds Present 49 Issuer Name Price' Value PV-Price 50 Allegheny County River Navigal $ 45.95 $ (45.95) $ 51 Boston Tunnel Authority $ 485.30 $ (485.30) $ 52 City of La Crosse Convention Ce $ 54.12 $ (54.12) $ 53 City of Spokane Public Works $ 68.23 $ (68.23) $ 54 Fulton County Sewer Board $ 640.12 $ (640.12) $ 55 Logan International Airport $ 40.84 $ (40.84) $ 56 Metro Area Rapid Transit Autho $ 91.32 $ 191.32 $ 57 Pittsburgh Region Water Works $ 72.74 $ 172.741 $ 58 Town of Holland Penitentiary $ 653.12 $ (653.12) $ 59 Washington County Parks $ 382.87 $ (382.87) $ 60 61 Tressuries Present 62 Type Price' Value P.V.-Price 63 Treasury Bond 30 Year $ 234.64 $ (234.64) $ 64 Treasury Bond 20 Year $ 202.01 $ (202.01) $ 65 Treasury Note 10 Year $ 164.03 $ (164.03) $ 66 Treasury Note 7 Year $ 148,62 $ (148.62) $ 67 Treasury Note 5 Year $ 137.49 $ (137.49) $ 68 Treasury Note 3 Year $ 124.30 $ (124.30) $ 69 Treasury Note 2 Year $ 116.62 $ ( 116.62) $ 70 Treasury Bill 1 Year $ 99.90 $ (99.90) $ 71 Treasury Bill 6 Month $ 99.97 $ (99.97) $ 72 Treasury Bill 3 Month $ 99.99 $ (99.99) $ 73 Treasury Bill 2 Month $ 99.99 $ (99.99) $ 74 Treasury Bill 1 Month $ 100.00 $ (100.000 $ 75 76 Footnotes: 77 1. Current market price 78 2. Most recent dividend (assume quarterly unless otherwise noted) 79 3. Expected dividend growth rate (annualized) 80 4. Time frame for growth rate 1in years (indefinite if not specified) 81 5. Expected dividend growth rate (annualized) after that time frame 82 6. Implied risk-adjusted rate of return (annual), calculated by you 83 7. Coupon rate assumes semi-annual coupons unless otherwise noted 84 8. Expressed in years from now 85 9. Maximum number of units available to purchase 86 10. Present Value (calculated by you) = fair value of asset Asset List Sheet4 Portfolio Coupon? 4.25 4.25 4.25 4.25 4.25 4.25 4.25 Maturity Face Value Return 30.0 $ 100 2.28% 20.0 $ 100 2.18% 10.0 $ 100 1.56% 7.0 $ 100 1.23% 5.0 $ 100 0.83% 3.0 $ 100 0.35% 2.0 $ 100 0.17% 10 $ 100 0.10% 0.5 $ 100 0.07% 0.25 $ 100 0.05% 2 mo $ 100 0.04% 1 mo $ 100 0.03% Reta Quantity Notes 0.21 unlimite Semi-annual coupon, purchase directly from Federal Reserve Bank 0.20 unlimite Semi-annual coupon, purchase directly from Federal Reserve Bank 0.14 unlimite Semi-annual coupon, purchase directly from Federal Reserve Bank 0.11 unlimite Semi-annual coupon, purchase directly from Federal Reserve Bank 0.07 unlimite Semi-annual coupon, purchase directly from Federal Reserve Bank 0.03 unlimite Semi-annual coupon, purchase directly from Federal Reserve Bank 0.01 unlimite Semi-annual coupon, purchase directly from Federal Reserve Bank 0.01 unlimite 52 weeks to maturity, no coupon, purchase directly from Federal Reserve Bank 0.00 unlimite 26 weeks to maturity, no coupon, purchase directly from Federal Reserve Bank 0.00 unlimite 13 weeks to maturity, no coupon, purchase directly from Federal Reserve Bank 0.00 unlimite 8 weeks to maturity, no coupon, purchase directly from Federal Reserve Bank unlimite 4 weeks to maturity, no coupon, purchase directly from Federal Reserve Bank 30.00% 11.00% Key Data: Victor's Federal Tax Rate Market Rate of Return Risk Free Rate of Return Portfolio Rate of Return Portfolio Beta 0.00% II. 4 Case Description: John Greene has inherited a large sum of money and would like to create an investment portfolio for his future retirement. 5 He is still young but would like to retire early so he is interested in a relatively aggressive portfolio to quadruple his assets within the next 10 years. 6 He believes this will be enough to enable him to enjoy a comfortable retirement for the remainder of his life. 7 John fancies himself to be a savvy investor and has selected a wide range of assets for his portfolio, but he knows you have financial expertise and has 8 asked you to look over his selections and recommend the specific portfolio of assets in which he should invest and the quantities of each he should purchase. 9 Obviously he wants to avoid any assets that are overpriced and buy any bargains available, and he wants to minimize his risk to achieve his target return. 10 11 Your task is to select an investment portfolio from his list of candidates that is expected to achieve his return objectives at the lowest possible risk. 12 Be sure to define: (1) which assets to purchase; (2) how many of each to purchase; (3) the portfolio B; and (4) the expected 10-year return of the portfolio. 13 You will prepare a PowerPoint recommendation for John with your suggestions and why you have selected the asset portfolio you did. 14 15 Excel Grading (80%): 16 1. Price and expected return of each asset is appropriately calculated and filled in on the table in "Asset List" worksheet 17 2. Total portfolio investment holdings = $1 million as shown in the "Portfolio" worksheet and respects the constraints of assets available 18 3. Expected value of portfolio = $4 million in year 10 value based on the required portfolio return as shown in the "Portfolio" worksheet 19 4. Portfolio B and expected return are accurately calculated in the "Portfolio" worksheet 20 5. Best portfolio selected: minimum B, no overpriced assets purchased (over SML), bargain assets selected (if available) 21 6. Good principles of diversification followed: appropriate number of assets and mix of asset types in the recommended portfolio 22 6. Formulas are written out with the source of numbers used in the calculations is clear, no unexplained values 23 7. Excel sheet looks professional 24 8. No spelling/grammar errors B E F H 1 J L M N P Q R T U V Y z AB AC 1 1 Common Stocks 2 Common Stocks Bodner PLC 4 Clegg Ino 5 Decker Ino 6 Degbey Ltd 7 7 Hughes Ltd & Jemison Inc 9 Lee Inc 10 Liang PLT 11 Luscher GMBH 12 Mora-Valentn SA 13 Sminia SARL 14 Stokes PLC 15 Thanos SA 16 Thelisson SA 17 WeiLtd 18 Preferred' Stocks Presen Annuity Price' Value factor Coupon P.V.-Price vidend Gowth? $ 12.42 $ (12.42) $ 1.90 9.40 $ (9.40) $ 2.50 $ 7.88 (7.88) $ 0.50 $ 17.42 $ (17.42) $ 1.65 $ 38.05 $ (38.05) $ 2.24 $ 10.64 $ (10.64) $ 1.69 $ 4.59 $ (4.59) $ 0.47 $ 0.14 $ $ (0.14) $ 0.03 $ 32.85 $ (32.85) $ 1.78 $ 9.78 $ (9.78) $ 1.21 $ 4.46 $ (4.46) $ 0.68 $ 25.80 $ (25.80) $ 1.43 $ 107.64 $ (107.64) $ 10.00 $ 6.18 $ (6.18) $ 0.94 $ 17.29 $ (17.29) $ $ 2.65 Growth 1 4.00% 0.00% 5.00% 0.50% 1.00% 0.202 0.50% 0.00% 0.45% 0.70% 0.80% 1.00% 0.00% 2.00% 0.15% Time Lowth 2 Return nla 0.00% 5.0 0.00% nla 0.00% nla 0.00% nla 0.00% nla 0.00% nla 0.00% 0.5 1.50% nla 0.00% nla 0.00% nla 0.00% nla 0.007 3.0 3.00% nla 0.00% nia 0.00% Beta Quantity Notes 1.77 unlimited #REF! 1.26 unlimite. Clegg Inc is paying NO dividend now to preserve cash, dividend shown is what they have announced they intend to start paying 5 years from now. 1.04 unlimited 0.91 unlimited 0.66 unlimite: Hughes Ltd pays annual dividends 1.46 unlimited 0.98 unlimited 1.91 ##### Liang PLT has announced their intention to start growing their dividend after the next two quarterly payments. 0.53 unlimited 1.19 unlimited 1.64 unlimited 0.59 unlimited 0.80 unlimite. Thanos SA has announced their intention to reduce their dividend to $1.00, growing 3% per year, starting three years from now. 1.57 unlimited 1.33 unlimite. WeiLtd pays their dividends every six months, not every quarter 20 Company Name 21 Cooke PLC 22 Haspeslagh SA 23 Rodrguez-Snchez SA 24 Wang Pty 25 Wood Inc 26 Zhang Ltd 27 28 Corporate Bond's Present Price' Value" $ 64.04 $ 35.18 $ 30.70 $ 21.10 $ 193.47 $ 87.12 P.V.-Price $ (64.04) $ $ (35.18) $ $ (30.70) $ (21.10) $ $ (193.47) $ $ (87.12) $ Dividend? 2.71 2.23 1.74 0.98 3.25 2.63 Growth 1 0.0% 0.0% 0.02 0.0% 0.0% 0.0% Time towth 2 Return nla 0.00% nia 0.00% nla 0.00% nia 0.00% nla 0.00% nia 0.00% Beta Quantity Notes 1.54 670 Quarterly dividends 0.54 286 Annual dividends 1.03 849 Semi-Annual dividends 1.69 594 Quarterly dividends 0.61 362 Quarterly dividends 1.15 830 Quarterly dividends ri 29 Issuer Name 30 Cortes SA 31 King PLC 32 Missonier SA 33 Ortiz de Urbina Criado SA 34 Rodgers Inc 35 Rozen Bakher SPA 36 Samimi SA 37 Teerikangas Oy Present Price Value $552.68 $ 639.11 $397.88 $ 548.10 $722.58 $ 866.18 $ 231.67 $ 136.78 P.V.-Price $ (552.68) $ $ (639.11) $ $ (397.88) $ $ (548.10) $ $ (722.58) $ $ (866.18) $ $ (231.67) $ $ (136.78) $ Coupon! 0.74 1.34 0.18 0.95 1.20 0.66 0.79 0.80 Maturity Face Value Return 18.5 ####### 4.0 $742.64 19.6 $ 891.59 3.2 $ 614.74 11.7 ####### 4.9 $ 994.32 5.5 $347.40 36.8 ####### Beta Quantity Notes 0.43 721 Semi-annual coupons 0.41 861 Quarterly coupons 0.38 868 Semi-annual coupons 0.36 123 Semi-annual coupons 0.28 353 Semi-annual coupons 0.27 966 Semi-annual coupons 0.73 700 Semi-annual coupons 0.68 523 Annual coupons 39 Speculative Grade (Junk) Bond's Present 40 Issuer Name Price' Value 41 Capron Inc $ 87.25 42 Enang SA $362.98 43 Guieu SA $288.70 44 LiPty $255.61 45 Reddy PLC $ 43.40 46 Xie Ltd $ 634.16 47 48 Municipal Bond's P.V.-Price $ (87.25) $ $ (362.98) $ $ (288.70) $ $ (255.61) $ $ (43.40) $ $ (634.16) $ Coupon? 2.68 0.97 4.17 0.73 0.56 1.46 Maturity Face Value Return 16.1 ####### 2.7 $ 471.70 5.5 $ 707.91 8.9 $ 808.20 23.0 $963.37 3.5 ####### Beta Quantity" Notes 1.62 718 Semi-annual coupons 1.15 69 Semi-annual coupons 1.71 949 Annual coupons 1.25 456 Semi-annual coupons 1.35 305 Semi-annual coupons 1.67 240 Quarterly coupons Asset List Sheet4 Portfolio + Ready 47 Coupon? 0.50 1.00 0.60 2.00 0.30 0.75 1.20 1.00 0.80 0.50 Maturity Eace Value Return 9.6 $ 100.00 0.2 $ 500.00 13.7 $ 250.00 45.1 $1,000.00 14.1 $2,500.00 15.6 $ 50.00 23.1 $ 800.00 6.8 $ 100.00 5.6 $1,000.00 6.7 $ 500.00 Beta Quantity Notes 0.62 119 Exempt from federal tax, semi-annual coupons 1.01 576 Exempt from federal tax, semi-annual coupons 0.81 676 Exempt from federal tax, semi-annual coupons 0.51 829 Exempt from federal tax, semi-annual coupons 0.92 538 Exempt from federal tax, annual coupons 0.73 465 Exempt from federal tax, quarterly coupons 0.68 296 Exempt from federal tax, semi-annual coupons 0.45 869 Exempt from federal tax, semi-annual coupons 0.60 930 Exempt from federal tax, semi-annual coupons 0.27 557 Exempt from federal tax, semi-annual coupons 48 Municipal Bonds Present 49 Issuer Name Price' Value PV-Price 50 Allegheny County River Navigal $ 45.95 $ (45.95) $ 51 Boston Tunnel Authority $ 485.30 $ (485.30) $ 52 City of La Crosse Convention Ce $ 54.12 $ (54.12) $ 53 City of Spokane Public Works $ 68.23 $ (68.23) $ 54 Fulton County Sewer Board $ 640.12 $ (640.12) $ 55 Logan International Airport $ 40.84 $ (40.84) $ 56 Metro Area Rapid Transit Autho $ 91.32 $ 191.32 $ 57 Pittsburgh Region Water Works $ 72.74 $ 172.741 $ 58 Town of Holland Penitentiary $ 653.12 $ (653.12) $ 59 Washington County Parks $ 382.87 $ (382.87) $ 60 61 Tressuries Present 62 Type Price' Value P.V.-Price 63 Treasury Bond 30 Year $ 234.64 $ (234.64) $ 64 Treasury Bond 20 Year $ 202.01 $ (202.01) $ 65 Treasury Note 10 Year $ 164.03 $ (164.03) $ 66 Treasury Note 7 Year $ 148,62 $ (148.62) $ 67 Treasury Note 5 Year $ 137.49 $ (137.49) $ 68 Treasury Note 3 Year $ 124.30 $ (124.30) $ 69 Treasury Note 2 Year $ 116.62 $ ( 116.62) $ 70 Treasury Bill 1 Year $ 99.90 $ (99.90) $ 71 Treasury Bill 6 Month $ 99.97 $ (99.97) $ 72 Treasury Bill 3 Month $ 99.99 $ (99.99) $ 73 Treasury Bill 2 Month $ 99.99 $ (99.99) $ 74 Treasury Bill 1 Month $ 100.00 $ (100.000 $ 75 76 Footnotes: 77 1. Current market price 78 2. Most recent dividend (assume quarterly unless otherwise noted) 79 3. Expected dividend growth rate (annualized) 80 4. Time frame for growth rate 1in years (indefinite if not specified) 81 5. Expected dividend growth rate (annualized) after that time frame 82 6. Implied risk-adjusted rate of return (annual), calculated by you 83 7. Coupon rate assumes semi-annual coupons unless otherwise noted 84 8. Expressed in years from now 85 9. Maximum number of units available to purchase 86 10. Present Value (calculated by you) = fair value of asset Asset List Sheet4 Portfolio Coupon? 4.25 4.25 4.25 4.25 4.25 4.25 4.25 Maturity Face Value Return 30.0 $ 100 2.28% 20.0 $ 100 2.18% 10.0 $ 100 1.56% 7.0 $ 100 1.23% 5.0 $ 100 0.83% 3.0 $ 100 0.35% 2.0 $ 100 0.17% 10 $ 100 0.10% 0.5 $ 100 0.07% 0.25 $ 100 0.05% 2 mo $ 100 0.04% 1 mo $ 100 0.03% Reta Quantity Notes 0.21 unlimite Semi-annual coupon, purchase directly from Federal Reserve Bank 0.20 unlimite Semi-annual coupon, purchase directly from Federal Reserve Bank 0.14 unlimite Semi-annual coupon, purchase directly from Federal Reserve Bank 0.11 unlimite Semi-annual coupon, purchase directly from Federal Reserve Bank 0.07 unlimite Semi-annual coupon, purchase directly from Federal Reserve Bank 0.03 unlimite Semi-annual coupon, purchase directly from Federal Reserve Bank 0.01 unlimite Semi-annual coupon, purchase directly from Federal Reserve Bank 0.01 unlimite 52 weeks to maturity, no coupon, purchase directly from Federal Reserve Bank 0.00 unlimite 26 weeks to maturity, no coupon, purchase directly from Federal Reserve Bank 0.00 unlimite 13 weeks to maturity, no coupon, purchase directly from Federal Reserve Bank 0.00 unlimite 8 weeks to maturity, no coupon, purchase directly from Federal Reserve Bank unlimite 4 weeks to maturity, no coupon, purchase directly from Federal Reserve Bank 30.00% 11.00% Key Data: Victor's Federal Tax Rate Market Rate of Return Risk Free Rate of Return Portfolio Rate of Return Portfolio Beta 0.00%