Question: 4. Case study A tech industries Inc. has initial resources equal to $150 million. Because management estimates that optimal operation requires an investment of $200

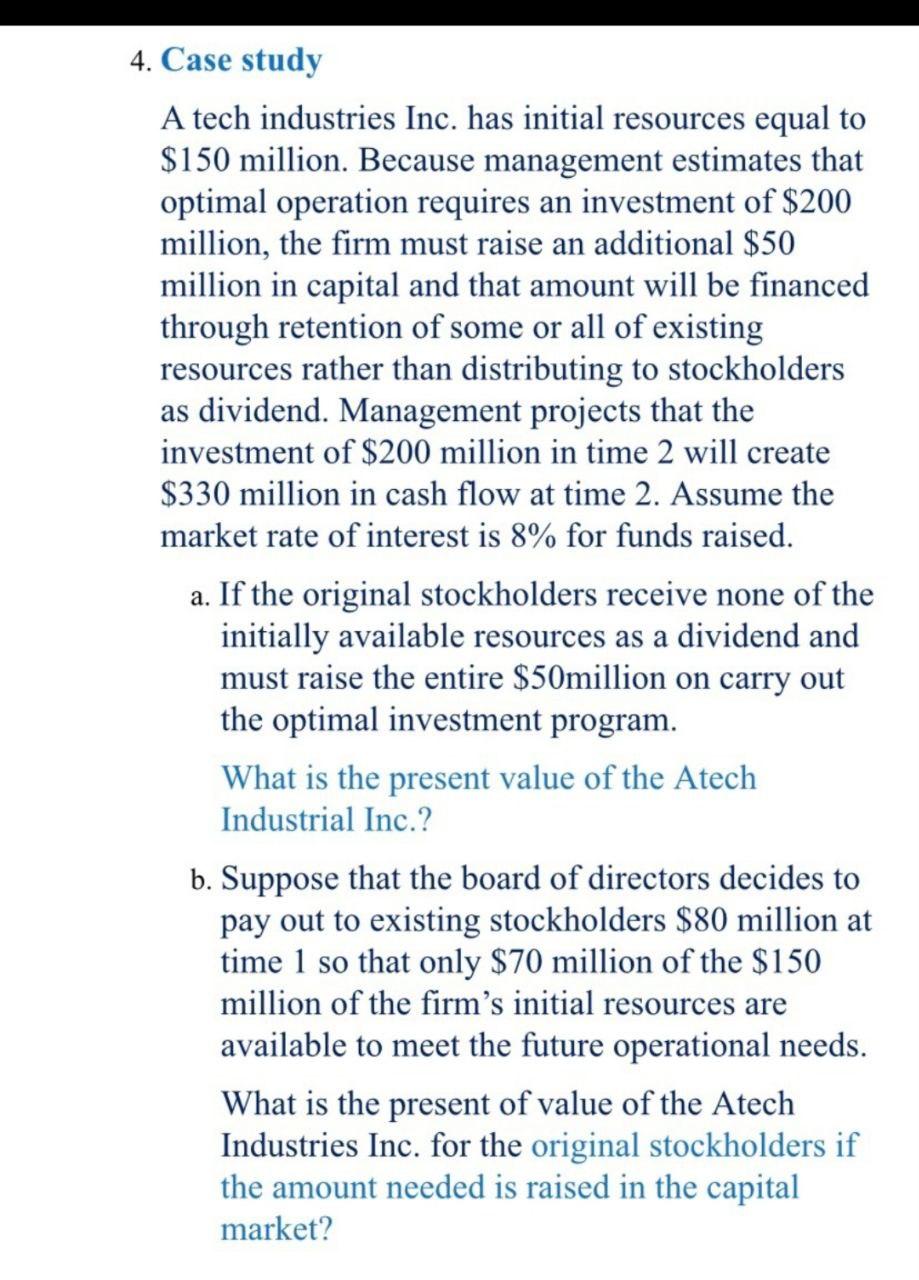

4. Case study A tech industries Inc. has initial resources equal to $150 million. Because management estimates that optimal operation requires an investment of $200 million, the firm must raise an additional $50 million in capital and that amount will be financed through retention of some or all of existing resources rather than distributing to stockholders as dividend. Management projects that the investment of $200 million in time 2 will create $330 million in cash flow at time 2. Assume the market rate of interest is 8% for funds raised. a. If the original stockholders receive none of the initially available resources as a dividend and must raise the entire $50million on carry out the optimal investment program. What is the present value of the Atech Industrial Inc.? b. Suppose that the board of directors decides to pay out to existing stockholders $80 million at time 1 so that only $70 million of the $150 million of the firm's initial resources are available to meet the future operational needs. What is the present of value of the Atech Industries Inc. for the original stockholders if the amount needed is raised in the capital market

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts