Answered step by step

Verified Expert Solution

Question

1 Approved Answer

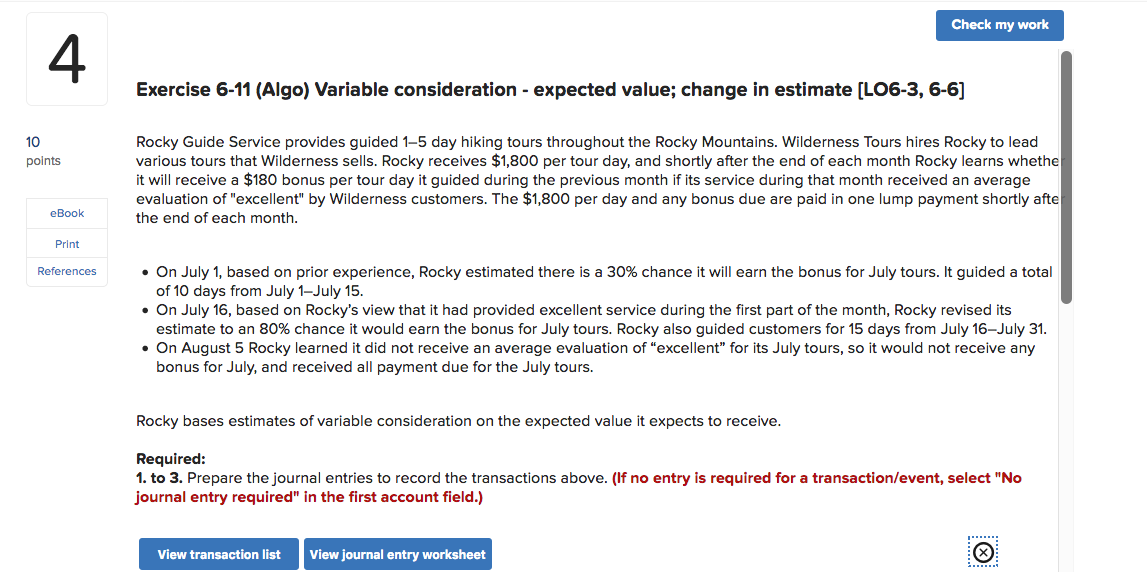

4 Check my work 10 points eBook Print References Exercise 6-11 (Algo) Variable consideration - expected value; change in estimate [LO6-3, 6-6] Rocky Guide

4 Check my work 10 points eBook Print References Exercise 6-11 (Algo) Variable consideration - expected value; change in estimate [LO6-3, 6-6] Rocky Guide Service provides guided 1-5 day hiking tours throughout the Rocky Mountains. Wilderness Tours hires Rocky to lead various tours that Wilderness sells. Rocky receives $1,800 per tour day, and shortly after the end of each month Rocky learns whethe it will receive a $180 bonus per tour day it guided during the previous month if its service during that month received an average evaluation of "excellent" by Wilderness customers. The $1,800 per day and any bonus due are paid in one lump payment shortly afte the end of each month. On July 1, based on prior experience, Rocky estimated there is a 30% chance it will earn the bonus for July tours. It guided a total of 10 days from July 1-July 15. On July 16, based on Rocky's view that it had provided excellent service during the first part of the month, Rocky revised its estimate to an 80% chance it would earn the bonus for July tours. Rocky also guided customers for 15 days from July 16-July 31. On August 5 Rocky learned it did not receive an average evaluation of "excellent" for its July tours, so it would not receive any bonus for July, and received all payment due for the July tours. Rocky bases estimates of variable consideration on the expected value it expects to receive. Required: 1. to 3. Prepare the journal entries to record the transactions above. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list View journal entry worksheet

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started